CRYPTO MARKET DOWNTIME: CAN DCA BE THE SOLUTION?

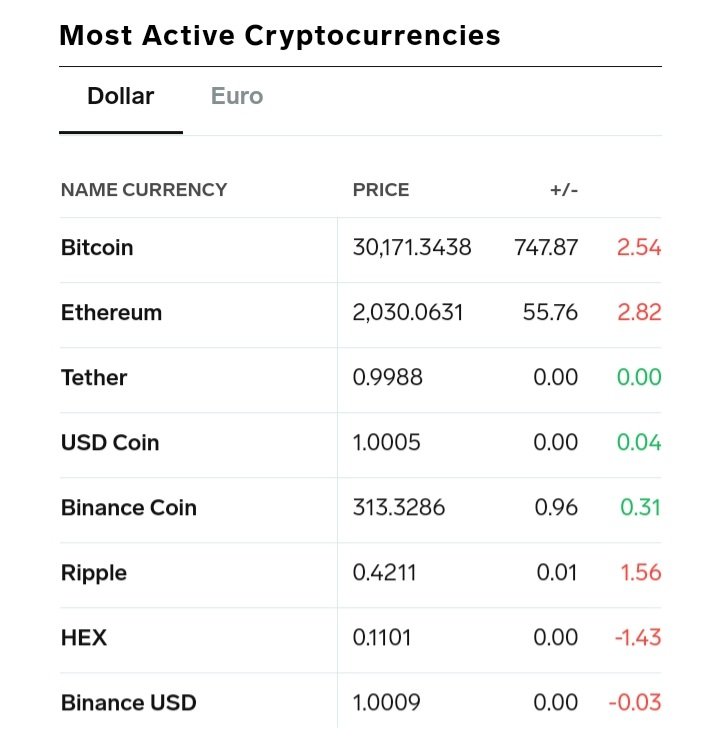

CRYPTOCURRENCIES including Bitcoin, Ethereum, BNB, Cardano and XRP have faced a tough year, with fluctuating values and more. The price of Bitcoin and Ethereum has gone down by about 2.5% and 2.8% respectively for example, in just the past 24 hours. Only a few coins have managed to barely rise this past week taking Binance coin which managed to rise by 0.31% for example.

Source

Cryptocurrencies are highly volatile, meaning their values often make large swings with no notice, as the latest plunge shows, when this swings happens even the experts look like novices.

Investing in cryptocurrency is a very risky business, you can be left with less money than you put in, and could even lose it all, even if you spend on what appears to be a safe bet.

Therefore it is always advised that every trader be alert and vigilant for the right time to buy and sell their coins.

In an ideal world, it’s simple: buy low, sell high. In reality, this is easier said than done, even for experts. Instead of trying to “time the market,” many investors use a strategy called dollar-cost averaging (or “DCA”) to reduce the impact of market volatility by investing a smaller amount into an asset ( like cryptocurrency, stocks, or gold) on a regular schedule.

DCA might be the answer to cryptocurrency investors' worry, as DCA is ideal when someone believes their investments will appreciate (or increase in value) in the long term and experience price volatility on the way there.

What is DCA?

DCA is a long-term strategy, where an investor regularly buys smaller amounts of an asset over a period of time, no matter the price (for example, investing $100 in Bitcoin every month for a year, instead of $1,200 at once). Of course they can decide to increase or reduce the amount of monthly imput or even pause or suspend the input depending on the market value of their investment.

What are the advantages of DCA?

DCA can be an effective way to own crypto without the notoriously difficult work of timing the market or the risk of unnecessarily using all of your funds to invest a huge amount at a peak of a coin.

The key is choosing an amount that’s affordable and investing regularly, no matter the price of an asset. This has the potential to “average” out the cost of purchases over time and reduce the overall impact of a sudden drop in prices on any given purchase. And if prices do fall, DCA investors can continue to buy, as scheduled, with the potential to earn returns as prices recover.

When is DCA more effective than Huge-sum investing?

DCA can help an investor safely enter a market, start benefiting from long-term price appreciation, and average out the risk of dip movements in the short-term. And in situations like the current cryptocurrency dip, it may offer more predictable returns than investing a lot of cash at once.

• Buy a cryptocurrency asset during this downtime/dip period using the "DCA", as the prices are ultimately going down, they are likely to recover in the long run as the coin may increase in value, If you're right, you'll benefit from picking up assets at a lower price. But even if you're wrong, you'll ’ll have investments in the market as the price increases.

Thanks a lot for taking out time to checkout my blog, I'd appreciate your comments. Until the next time. Much love from @ponmile22222

References

https://www.google.com/amp/s/www.thesun.co.uk/money/14704689/why-is-the-crypto-market-down/amp/

https://markets.businessinsider.com/cryptocurrencies

https://www.coinbase.com/learn/tips-and-tutorials/dollar-cost-averaging

When it comes to any type of investment, DCA is always a good idea to spread the risk. Hedge funds, stocks, crypto…

Definitely yes. Thanks for your comment.