How Much are Crypto Transaction Fees?

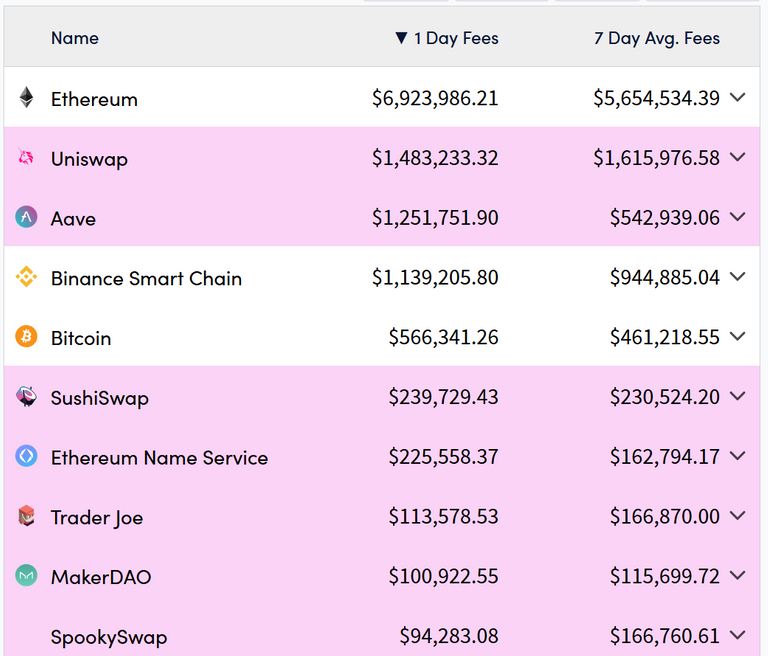

Today we are taking a brief review of an interesting site I stumbled to called cryptofees.info. The site lists out the transaction fees of the chain for 1 day and 7 day averages. The chains are listed be default from most fees to the least.

Not surprising ETH takes the lead with close to $7 million in fees earned just in one day. BTC is in fifth with over $0.55 million per a day. Just by reading this one would assume transferring in BTC is much cheaper than on ETH.

One of the more surprising ones on the list is FTM. With the token formerly reached as high as $3 it is now hovering over $0.3 making FTM dropping peak to through somewhere around 90%. Demand for FTM is still high but knowing that transaction rats are low compared to other chains it seems.

Conclusions

A site that list total amount of fees collected helps in many ways. For one identify which chain has the most fee earned corresponding to more profits shared amount chain native token staking.

In addition investors who are cautious about over spending on gas fees can see which chains to avoid as day fees of chains at the top likely cost at present moment.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

I don't think Uniswap is it's own chain right? It feels like the applications and the blockchains got all mixed up together on their chart.

Posted Using LeoFinance Beta

My bad on using the incorrect terminology. It more like protocol fees than chain fees. Uniswap has its UNI token which will earn some of those daily fees for its holders. So yeah put in protocol in lieu of every time I mention chain. Thanks for catching that.

Don't worry about the mistakes. It just kind of stood out to me and it makes more sense if I think about it in protocol terms.

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

I was not aware of that website and I am glad it exists.

Thanks for sharing it

This is an useful site. What's is surprising is pancake swap is not on there. I have a few cake tokens and also in liquidity pools !

!PIZZA

!LOLZ

Posted using LeoFinance Mobile

lolztoken.com

No one, it happens Autumnatically.

Credit: reddit

@mawit07, I sent you an $LOLZ on behalf of @olympicdragon

Use the !LOL or !LOLZ command to share a joke and an $LOLZ.

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

(1/2)

PIZZA Holders sent $PIZZA tips in this post's comments:

@olympicdragon(2/5) tipped @mawit07 (x1)

You can now send $PIZZA tips in Discord via tip.cc!

Fascinating info - thank you for posting this ! It would be lovely to see the volume or value of transactions next to these figures, so we could get an idea of the cost per transaction or BTC-worth of coins moved.

Another way to look at these figures is that it gives an idea of how much is available to be mined, given out in airdrops or (possibly for BSC) taken by the exchange owners as profit.

That's a lot of fees indeed! Very interesting information. There's huge money in crypto :)

Posted Using LeoFinance Beta

I always wonder why Ethereum fees is so high. Yet people transact on it. Most times I swap my Ethereum for Bitcoin before transferring.

Ethereum gas fees discouraged me from engaging in NFT. Only the big guys plays there as I am still an up coming