LeoStrategy Has Generated 195% LEO Yield This Week

LeoStrategy is a permanent-capital vehicle that builds products & services to generate accretive revenue in order to purchase and permanently stake LEO on our balance sheet.

This week, LeoStrategy generated a 195% LEO Yield for LSTR investors. In this post, we'll dive into the numbers this week.

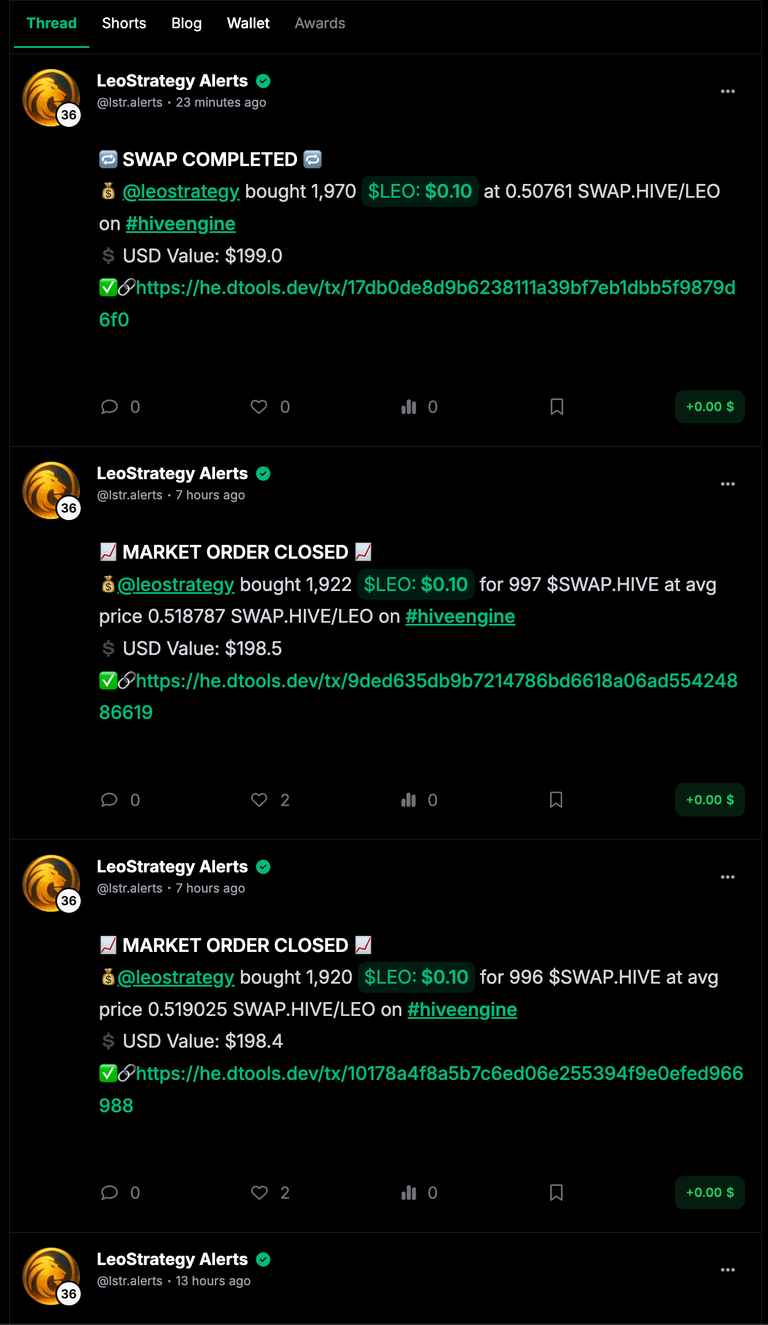

To track our buying of LEO, you can use INLEO Threads. On Threads, our AI Agent @lstr.alerts publishes real-time threads showcasing our buys within minutes of them happening on the market. You can also engage with our other agents for crtitical stats and management related to LeoStrategy products/services (@lstr.alerts, @lstr.voter, @surge.yield).

LeoStrategy Has Generated 195% LEO Yield This Week

This week, LeoStrategy acquired an additional 78,241.18 LEO for ~$8,281.14 at $0.1058 per #leo.

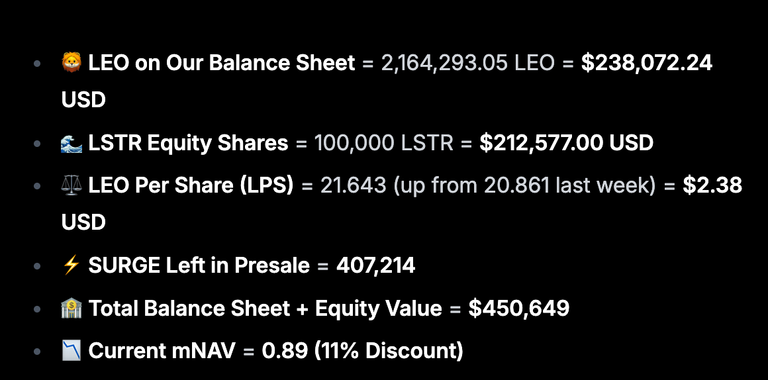

This raises the fund's total holdings to 2,164,293.05 LEO on our balance sheet.

LEO Per Share (LPS) is the best Key Performance Indicator (KPI) for tracking LeoStrategy's velocity and growth. The LPS last week was 20.861 LEO per Share of LSTR outstanding. This week, the LPS rose to 21.643. This is a 3.75% increase week-over-week. Annualized, this is a 195% growth rate in the total size of the LeoStrategy fund.

If we maintain this pace of growth, LeoStrategy will acquire an additional ~12M LEO over the course of 52 weeks and hold approximately 14,679,036.31 $LEO by September 1st, 2026. This would be nearly half of the entire LEO supply.

Obviously, LEO will get more expensive as LeoStrategy (as well as POL and SIRP and investors in general) continue to accumulate the scarce LEO that is out there. We will continue to find ways to generate capital and revenue to acquire more LEO as quickly as we can. We believe there is a sprint to acquire LEO and we are ahead of the curve. Maintaining a rapid pace of LEO Per Share growth is vital.

Our goal is to acquire 10M LEO by the end of 2025. We are at 2.164M LEO today and if we maintain the current pace of growth, we will have ~4.1M LEO by the end of 2025. This signals to us that we need to accelerate the velocity of LeoStrategy's growth. We believe the combination of our new Market Maker protocols (which should be highly profitable) along with accelerating SURGE sales by integrating and partnering with the Base blockchain should spur us toward our goal even faster. This week, we will target a much higher LEO Yield than 195%.

3 Key Metrics in Valuing LeoStrategy

To value LeoStrategy, you should look at 3 key metrics:

- mNav

- LPS

- LEO Yield

mNav stands for market cap to net asset value. In simpler terms, this means the market cap of LSTR tokens divided by the value of LEO on our balance sheet. Right now, LeoStrategy owns 2.164M LEO and there are 100,000 LSTR tokens outstanding.

With a LEO price of $0.11 and LSTR price of $2.12, the mNav = 0.89 (or an 11% discount of the LSTR market cap versus the total value of LEO holdings).

mNAV = LSTR Market Cap / LEO Value on Our Balance Sheet

0.89 = $212,577 / $238,072

LPS stands for LEO Per Share of LSTR. In other words, how much LEO is on LeoStrategy's balance sheet relative to the outstanding shares of LSTR.

Right now, LeoStrategy owns 2.164M LEO and there are 100,000 LSTR shares outstanding. The LPS therefore = 21.64 LEO per share of LeoStrategy. Since LEO is trading at $0.11, this means there are $2.38 worth of LEO per share of LeoStrategy. The fair market value of LeoStrategy is therefore $2.38 at a minimum.

LPS = LEO on the Balance Sheet / LSTR Shares Outstanding

21.64 = 2.164M / 100,000

LEO Yield is the velocity of LEO accumulation by LeoStrategy. In other words, this is the pace at which new LEO is added to the LSTR balance sheet relative to outstanding LSTR shares.

Since the outstanding shares of LSTR haven't increased at all but LeoStrategy is finding ways to access capital and purchase more LEO, the LPS is rising at an incredible pace. This is how LEO yield is measured.

Last week, the LPS was 20.861. This week, the LPS is 21.643. This represents a 3.75% increase. Annualized, this is a 195% increase per year.

LEO Yield = (current LPS / last week LPS - 1) * 52

195% = (21.643 / 20.861 - 1) * 52

SURGing to Base

We're accelerating our pace of LEO accumulation and with this, we must acclerate the pace of SURGE sales. Our Market Makers are going live this week. First for Hive-Engine pools and second for LEO cross-chain pools.

Following that, we will release it for LSTR and SURGE cross-chain pools on Base <> Hive.

The coalition of these 3 parts of our Market Maker will result in LeoStrategy generating consistent revenues from our market making moat. The moat is built via whitelisting on the bridges for LeoStrategy to have cheaper fees than everyone else. This allows LeoStrategy to be the sole Arbitrager of LEO / LSTR / SURGE across blockchains. With this moat, we can scale volume and volatility in order to generate profits. Those profits purchase LEO and add it to our balance sheet.

To support this growth, get some SURGE. The faster it sells out, the faster we can launch LSTR and SURGE on Base.

- SURGE on TribalDEX: https://tribaldex.com/trade/SURGE

- SURGE on Beeswap: https://beeswap.dcity.io/tokens/SURGE

Posted Using INLEO

Nice! I have to admit that i was somewhat skeptical of Leostrategy at first and impatient, but it really starting to come along nicely! Kudos!

Keep pushing!

It is the incredible level of building that converted me. I used to think of it as more like a curation project combined with the other types of funds we had seen on HIVE so far. Initially, LSTR was that, but over time we have had all these new ventures one after the other.

Anyone can speculate and make promises. Even hype can be astroturfed. Building great this cannot be faked like that.

Initially I was growing my account faster than they were and did not invest. Had bought none right up into the last days.

It became quickly clear that they were coming on fast and whipping my ass, so I aped in.

Glad that I did. They have been killing it!

Thank you Makishima!

We've got so much in store. It is cheesy to say, but this is truly just the beginning. LPS growth at 195% annualized is nothing compared to what is on the horizon

View more

Thank you for the words of encouragement! With a Strategy company, skepticism is definitely to be expected. Our performance and development is the only thing that can change hearts & minds. We're so happy to hear that his changed your mind about us

The LPS accretion to LSTR holders will only accelerate from here. Growth is what begets more growth when it comes to a Strategy company. We will aim to surpass your expectations and drive that LPS through the roof!

Foot on the floor and both hands on the wheel. It's gonna be a fun, wild ride!

Nice report, thanks. There are plans to accumulate stablecoins in the treasury? As #LSTR grows higher the valuation will depend 100% on the price of $LEO so diversification on stables would help to cement a minimum value on the Holding Company? Hope it makes sense.

LeoStrategy will only ever accumulate $LEO on our balance sheet. We believe LEO is the most pristine asset you could own

LeoStrategy is simple: we acquire as much LEO as possible, permanently stake it as sLEO and utilize that balance sheet of sLEO to acquire more LEO in the future

LEO will be worth $1,000+ in the next decade. We do not want to handicap our success by owning a stablecoin which would drag our profits down as they will:

Even owning BTC in the treasury would be outperformed by LEO. We believe LEO will outperform every single asset class on the planet in the coming decade

Damn, ok, message received loud and clear 🚀

Congratulations @leostrategy! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 25000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Hello leostrategy!

It's nice to let you know that your article will take 7th place.

Your post is among 15 Best articles voted 7 days ago by the @hive-lu | King Lucoin Curator by deepresearch

You receive 🎖 0.4 unique LUBEST tokens as a reward. You can support Lu world and your curator, then he and you will receive 10x more of the winning token. There is a buyout offer waiting for him on the stock exchange. All you need to do is reblog Daily Report 774 with your winnings.

Buy Lu on the Hive-Engine exchange | World of Lu created by szejq

STOPor to resume write a wordSTART