Hive-Engine Tokens With High Liquidity

Liquidity is one of the very important aspects when you want to invest in a token. Why is liquidity important? An asset that has high liquidity, will not affect the market when you sell it in a short time to get cash. When you invest your money in Hive-Engine tokens, you may end up selling a large amount. You have no trouble because a rational price is available in the market.

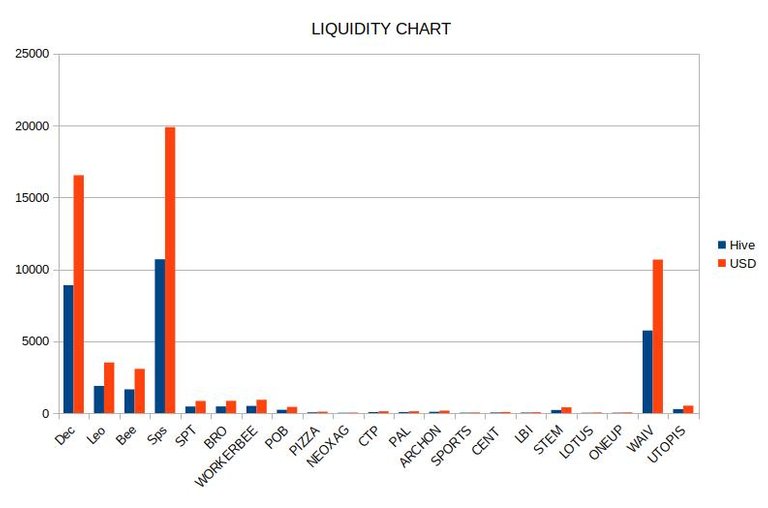

Liquidity chart in the hive-engine market. I took the data from the leodex marketplace. The liquidity of the HE tokens is based on buy orders' value in the marketplace.

| HE TOKEN | Hive | In USD |

|---|---|---|

| DEC | 8,898 | 16,545.7 |

| LEO | 1,888 | 3,511.7 |

| BEE | 1,653 | 3,074.6 |

| SPS | 10,964 | 19,890.6 |

| SPT | 454 | 844.4 |

| BETA | 772 | 1,435.9 |

| ALPHA | 1333 | 2,479.4 |

| UNTAMED | 686 | 1,275.9 |

| BRO | 458 | 851.9 |

| WORKERBEE | 496 | 922.6 |

| POB | 228 | 424 |

| PIZZA | 52 | 96.7 |

| NEOXAG | 18 | 33.5 |

| CTP | 66 | 122.8 |

| PAL | 67 | 124.6 |

| ARCHON | 89 | 165.54 |

| SPORTS | 23 | 42.78 |

| CENT | 40 | 74.4 |

| LBI | 31 | 57.7 |

| STEM | 213 | 396 |

| LOTUS | 22 | 40.9 |

| ONEUP | 24 | 24.7 |

| WAIV | 5739 | 10,674.5 |

| UTOPIS | 276 | 513 |

From the data, you will know which are the most liquid Hive Engine tokens in the Hive-Engine market. Besides that, the diesel pool also provides liquidity for Hive-Engine tokens.

Let's check the liquidity tokens in the diesel pool.

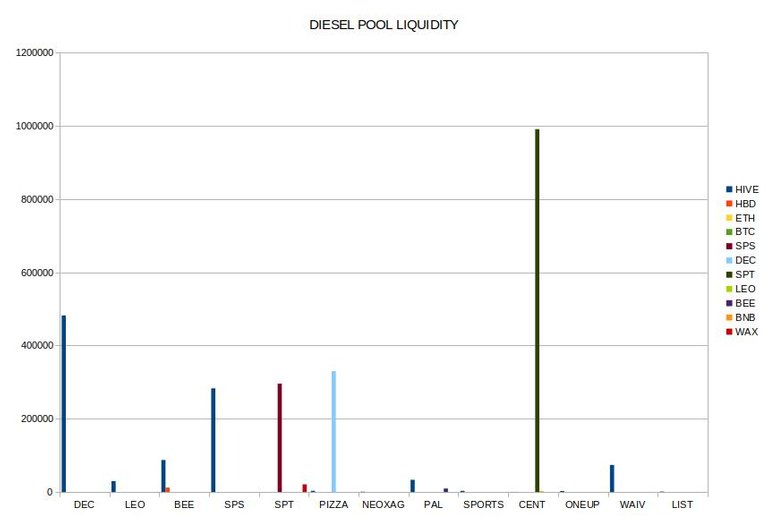

This is the data on the liquidity of Hive Engine tokens in the diesel pool.

| HE TOKEN | HIVE | HBD | BTC | ETH | WAX | BNB | SPS | DEC | BEE | LEO | SPT |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DEC | 482,134 | ||||||||||

| LEO | 30,000 | ||||||||||

| BEE | 87,509 | 12127 | 1 | 16 | |||||||

| SPS | 283,181 | 1 | 66 | ||||||||

| SPT | 21,069 | 42 | 295,848 | ||||||||

| PIZZA | 3,282 | 330152 | |||||||||

| NEOXAG | 992 | ||||||||||

| PAL | 33,331 | 9,677 | |||||||||

| SPORTS | 3,150 | ||||||||||

| CENT | 282 | 399 | 2,770 | ||||||||

| ONEUP | 2746 | 991,045 | |||||||||

| WAIV | 74,032 | ||||||||||

| LIST | 1,234 |

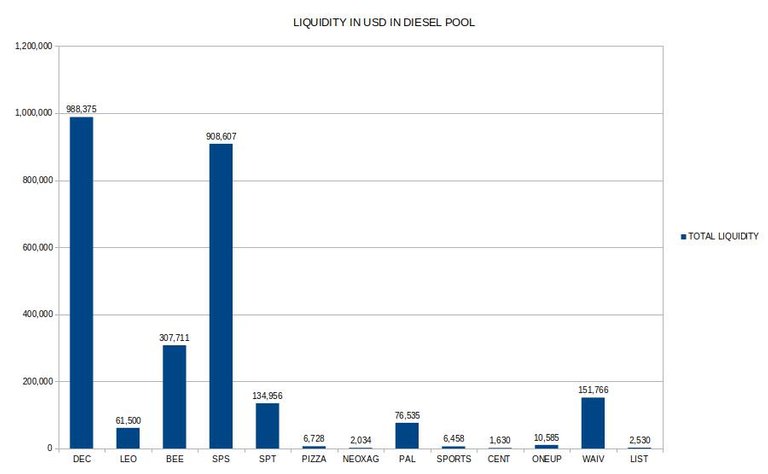

LIQUIDITY OF HE TOKEN IN USD IN DIESEL POOL

| HE | LIQUIDITY IN USD |

|---|---|

| DEC | 988,375 |

| LEO | 61,500 |

| BEE | 307,711 |

| SPS | 908,607 |

| SPT | 134,956 |

| PIZZA | 6,728 |

| NEOXAG | 2,034 |

| PAL | 76,535 |

| SPORTS | 6,458 |

| CENT | 1,630 |

| ONEUP | 10,585 |

| WAIV | 151,766 |

| LIST | 2,530 |

Liquidity is one proof that the token is in demand by investors. But you also have to be careful with manipulation of the liquidity in the hive-engine and diesel pool. Tokens with a liquidity value of below 100,000 USD can still be manipulated by rogue developers to attract investors' attention. Please find out how liquidity and trading volume are manipulated.

Leo token has moderate liquidity in the diesel pool, but it has high liquidity outside of hive platforms like ETH, BNB, and others.

Thanks for doing this research.

you are welcome

https://twitter.com/ahmadfz1/status/1467415108020105216

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Wow, this is amazing. In the last couple of months, I have been reading a lot about liquidity. Have never understood why liquidity is important.

Thank you for teaching me the importance of liquidity :-)

thanks, i also learn from my experience when i bought and invest a token in he that i should not mention, the token is not liquid because the demand value is lower than my asset value. after that i always check the liquidity of the token if i want to invest in it

Going forward I will also do the same in fact I am going to check the liquidity of the tokens I currently hold. Thank you for expanding my knowledge 😀

Congratulations @lebah! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: