Whales are buying Bitcoin after prices fell

The current decline in the price of Bitcoin represents an opportunity for whales, which do not hesitate to seize any decline to strengthen their positions and collect more Bitcoin.

This is what actually happened, as many wallets containing more than 0.1% of the total currency supply bought approximately 55 thousand bitcoins.

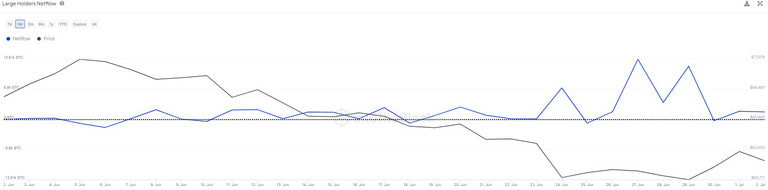

The chart below shows the netflow of wallets holding more than 0.1% of the Bitcoin supply.

This data shows that over the past 30 days, large Bitcoin whales had a positive netflow of more than 55k $BTC, signaling accumulation.

The peak in this accumulation was strongest when Bitcoin recently dipped to $60k, suggesting substantial buying pressure from these large holders at this price level.

The analyst told ALI that early signs of Bitcoin accumulation have already begun to appear.

Another analyst from CryptoQuant said that the consolidation of the Bitcoin price contributed to providing a good opportunity for investors to buy and choose good positions.

A large percentage of analysts still believe that Bitcoin is still in an upward trend despite the recent decline in price below $60,000.