Comparison of HIVE and EOS

Correlation is a crucial test for crypto assets. It gauges how well cryptocurrency pairs with other assets can support investments. I tested the price of HIVE and the price of EOS for correlation in this article.

EOS is hosted on the EOSIO block chain, same like HIVE is on the hive block chain.

The correlation coefficient is covered in this analysis.

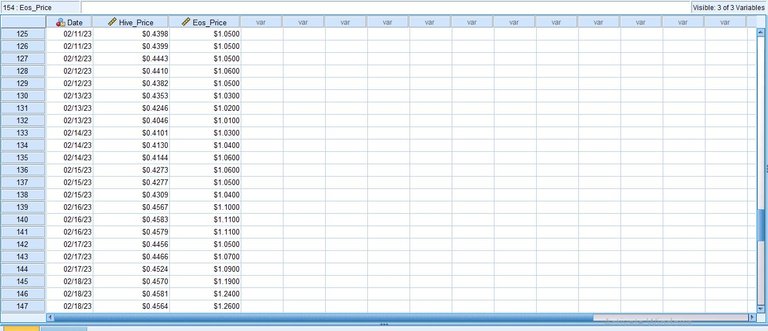

The information gathered for this investigation was gathered during January and February of 2023.

The correlation's outcome

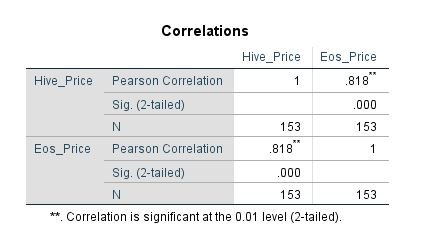

This is what the correlation coefficient result means, which is displayed below.

The table above contains three rows with the names Pearson correlation, sig, and N.

The Pearson correlation coefficient is 0.818. This suggests that HIVE and EOS have a very strong positive association in the cryptocurrency market. The likelihood that the price of EOS increases will be same for the likelihood of the price of HIVE as well. Given this fact, decrease in the price of HIVE will reflect the opposite of it.

Sig: Referred to as a measure of statistical significance, sig tests the null hypothesis that there is no correlation between the prices of EOS and HIVE. In other words, if the estimated significance value is less than 0.05, the null hypothesis can be rejected and the correlation fact between the two assets is accepted.

N: The number of entries that verified the outcome is indicated by the letter N. Taking the months of January and February into account, there are 153 entries total, with a minimum of three submissions for each price per day.

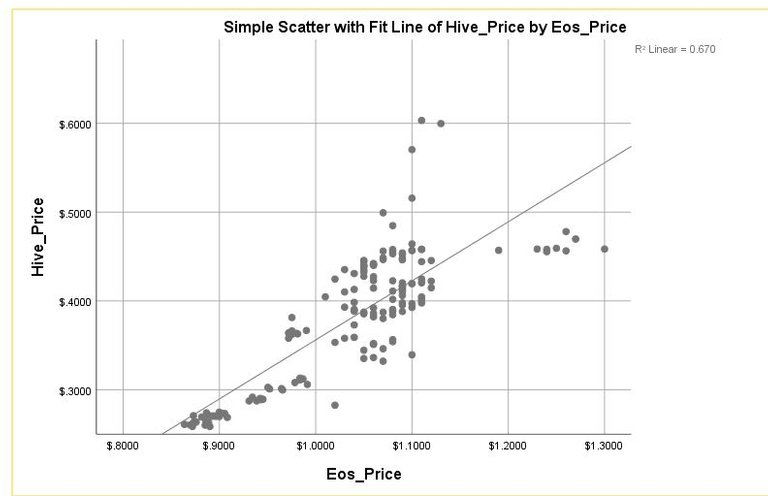

Scatter dot diagram

To visualize the degree of correlation, which may also be necessary in prediction analysis when taking into account the line of best fit, a scatter dot diagram is required. It means we can create an equation to anticipate HIVE prices using the price of EOS as input. If the available information is adequate, the conclusion of this statement will be true.

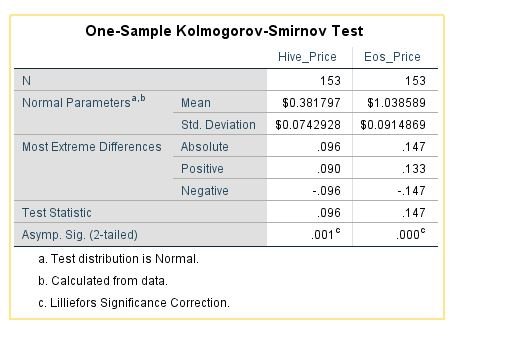

Test For Normality

Cryptography's normality test establishes whether the data came from a sample population.

Population-based data is adequate to produce reliable, accurate, or relevant information.

A normality test between EOS and HIVE was performed using the aforementioned table. It was determined that both assets were important, thus they were taken from the same population and were sufficient to produce findings.

The data are taken from the same population, according to the hypothesis for the normality test. In order for this to be accurate, the significance level's value must not be lower than 0.05.

Given that the test's significance value is less than 0.05, we can declare the claim to be untrue in general because both samples are normal and taken from the same population.

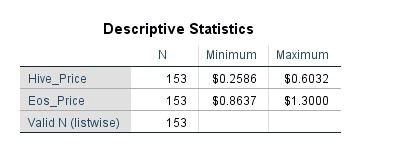

Highest and minimum asset prices

The table shows the highest and lowest prices for both assets for the specified time period;

EOS's lowest price was $0.8637 and HIVE's was $0.2586.

Both are most expensive at $1.3 for EOS and $0.6 for HIVE

Data

SPSS was used to examine the data.

Conclusion

HIVE has exhibited a high and favorable correlation with important assets like bitcoin and other alternative currencies like EOS and BNB. We can add EOS to our investment portfolio if this relationship remains solid.

Thanks a million for visiting my blog, if you find this content interesting or not please leave a feedback. I will gladly receive

Posted Using LeoFinance Beta

https://twitter.com/1455313948425732098/status/1627876078810284032

The rewards earned on this comment will go directly to the people sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Congratulations @iniobong3emm! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts:

Support the HiveBuzz project. Vote for our proposal!