Coefficient of correlation between BITCOIN and ETHEREUM prices

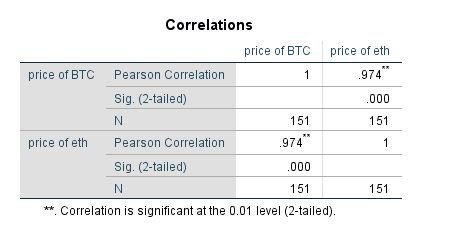

Correlation result

In my previous post about HIVE and BNB correlation contains detailed summary as regards the types of correlation.

Here is the link:Source

The analysis of correlation will be tested against the hypothesis of bivariate relationship.

The hypothesis

The hypothesis of correlation analysis states that there is no relationship between the variables in question. The level of relationship of relationship could either be positive, negative or zero. Details of this is been explained in the link above.

When the significance level of the calculation is less than 0.05, the hypothesis is expected to be rejected. Otherwise the hypothesis is been accepted.

The calculated significance

The calculated significance value is 0.00 which means the hypothesis has to be rejected. In order words there is a relationship between the price of ETHEREUM and BITCOIN. To what extent can the relationship be measured? This is answered using correlation coefficient.

Correlation coefficient

This section determines if the correlation between both assets is high or low.

The coefficient of correlation between ETHEREUM and BITCOIN is used to define the level to which when there is a rise in the price of BTC, will result to an increase in the price of ETHEREUM.

From the table above, the coefficient is 0.974. Considering the fact that a positive correlation ranges from 0 to +1, the above coefficient indicates a very high positive correlation for BITCOIN and ETHEREUM price within the month of December 2022 and February, 2023.

Literally this means as the price of BITCOIN indicates a pump, there is also close to similar pump in the price of ETHEREUM as well with respect to their price levels.

The validity of the result covers for the period stated above.

Number of data

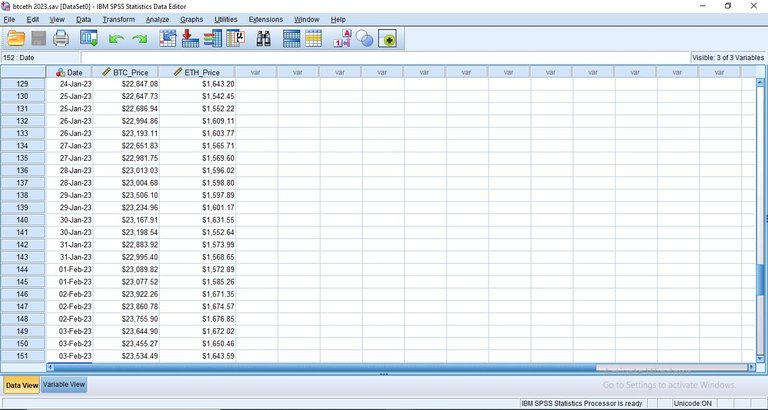

The third row contains the number of data that provides the information. From my analysis, I used 151 entries of BITCOIN and ETHEREUM prices gotten from coingecko.com.

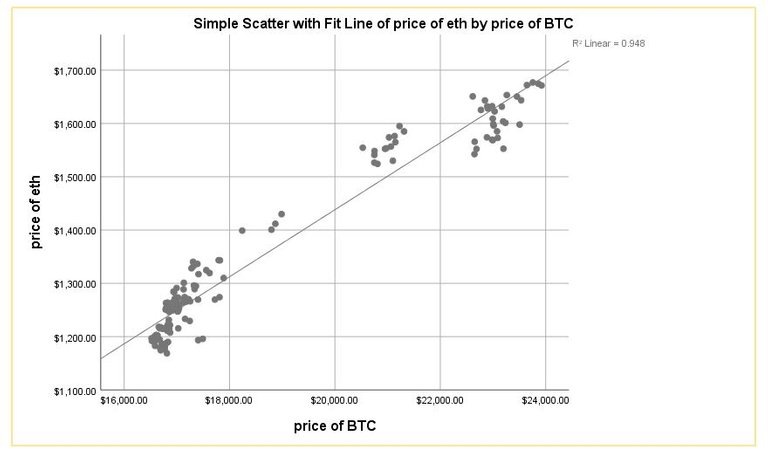

Scatter dot diagram

The scatter dot diagram helps to visualize the direction of correlation.

It could be on the positive side which means for every high price of BITCOIN will result to an increased price of ETHEREUM.

The diagonal line of best fit explains that better as it relates to both axes of the assets.

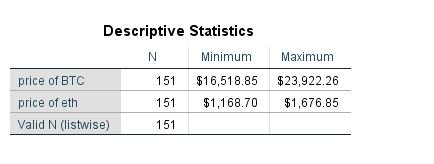

The maximum and minimum prices of both assets

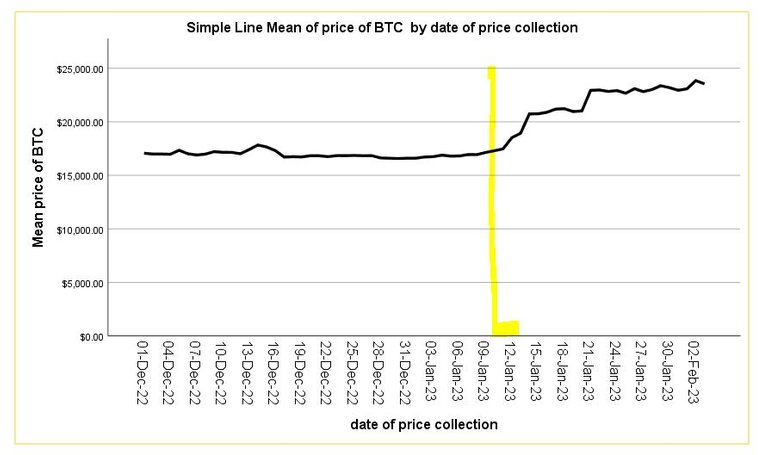

For BITCOIN, its highest price during the given period was $23,922.26.

On the line graph below it is seen that BITCOIN is on the track to estimate $25,000 which can be achieved within a short time frame.

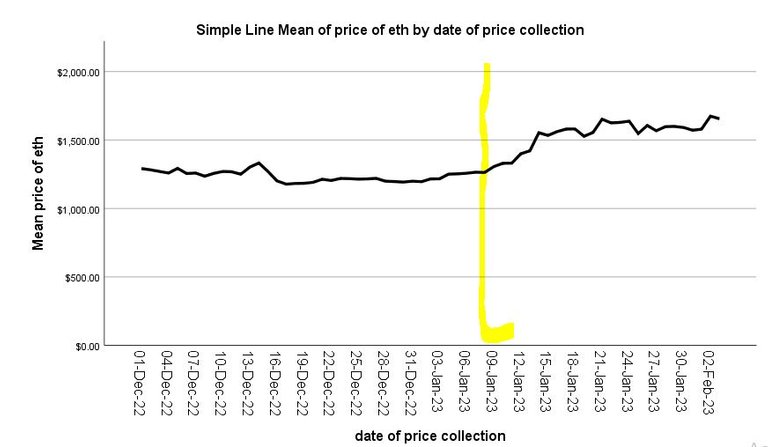

For ETHEREUM, the highest price during the stated period is $1,676.85.

However, it can be seen from its line graph below that it’s attempted to make its way up above the midpoint between $1500 to $2000.

Conclusively

The analysis presents the coefficient of correlation between BITCOIN and ETHEREUM to be positive and highly correlated in the crypto market.

Posted Using LeoFinance Beta