Where does HBD’s 20% interest come from? - HBD FAQs

Direct from the desk of Dane Williams.

Continuing to address your most common questions about Hive's algorithmic stablecoin, HBD.

One of the most common questions surrounding Hive Backed Dollars (HBD), is where does the 20% interest come from?

We’re all taught from a young age that if something sounds too good to be true then it probably is.

But is that really the case here?

In answering today’s question, I went straight to LeoFinance’s resident HBD expert - @dalz.

Hopefully I’ve done his answers justice.

Seeing them remain technically accurate even after I’ve reworded them into something more… normie friendly.

(If not, no doubt you guys will jump into the comments section and set me straight! :D)

With that out of the way, let’s take a look at today’s batch of HBD FAQs.

Where does HBD’s 20% interest come from?

HBD’s 20% interest comes from the Hive blockchain’s inflation.

That being, freshly printed tokens.

This inflation used to pay interest on HBD in savings, is actually in addition to HIVE’s regular rate of new tokens being minted per block.

Keep reading! 👇

Is HBD’s 20% interest sustainable?

Yes, HBD’s 20% interest rate is sustainable.

While many consider inflation to be a dirty word, the reality is that the rate new tokens are created to pay interest on HBD savings is actually less than 0.5% on a yearly basis.

When you consider just how small our market cap is, this is an inflation rate that is more than sustainable.

Remember, for HBD to take its place at the table amongst the major stablecoins, it needs to increase its size 100x from here…

…and then some!

So I’d encourage you not to get caught up in interest payments being paid via inflation.

Furthermore, paying HBD interest via inflation in this manner can't increase inflation too much because for that to happen, Hive needs more HBD to be created.

More HBD created means that the price of HIVE should go up.

Then when that occurs, we would begin to see Hive’s inflation drop.

A phenomenon we saw play out in real time throughout 2021 when HIVE actually ended the year as a deflationary asset.

The bottom line is that the haircut rule and ultimately the amount of debt that the blockchain takes on is what regulates HBD.

As such, the APR paid out on top is actually insignificant to the sustainability of HBD.

What HIVE price will the haircut rule kick in?

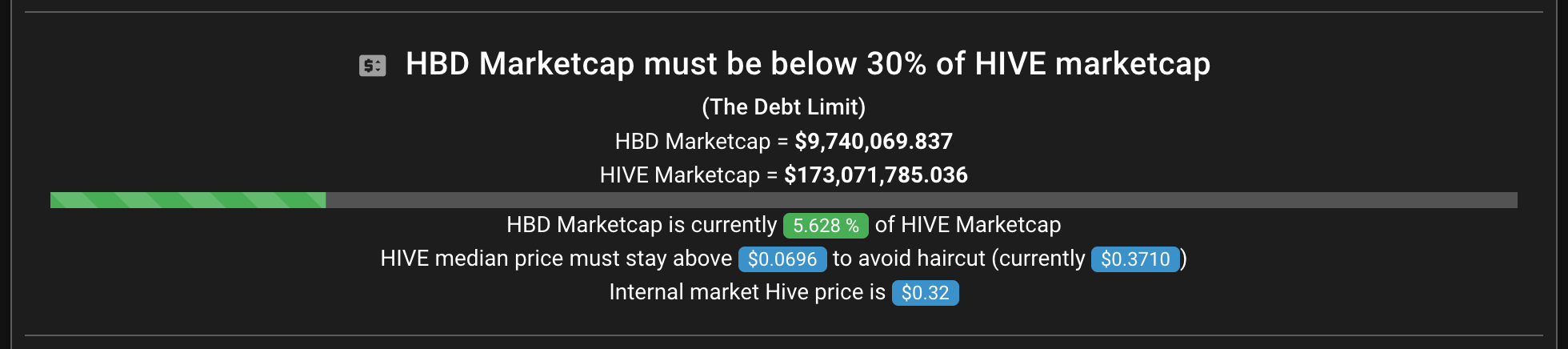

For the haircut to kick in, the HBD market cap must rise above 30% of HIVE’s market cap.

You can check the live HIVE price that the haircut would kick in on @ausbitbank’s Hive Backed Dollars Monitor.

But at the time of writing that price is 6.9c:

The acceptable debt limit is dynamic depending on the amount of HBD in circulation.

If HBD in circulation drops through conversions or buying from the stabiliser, so will this price.

For example at the beginning of 2022 we had 14M HBD and a floor price of around 17 cents.

Now we are at 9.7M HBD and a floor price at sub-7 cents.

Before compiling all of these together into the original Hive Backed Dollars (HBD) FAQs page, I’m just giving Google some more time to properly index all of this supporting content and links.

While these questions and answers seem fractured right now, please bear with me and just give Google a little more time before downvoting the shit out of these.

The end result of having HBD’s frequently asked questions showing up on Google will add immense value to the network.

Cheers and…

…best of probabilities to you.

Posted Using LeoFinance Beta

Great job at compiling this!

Thanks mate.

I've just updated the original FAQs here.

You're our resident technical voice, so if you're sharing them and find any glaring errors or something that you think should be worded better, let me know! :)

Posted Using LeoFinance Beta

I appreciate this!

You did Justice with this... Simply explained things nicely!

Awesome mate.

Isn't it bad that the HBD is dropping? If we want HBD to be used more, there needs to be a lot more HBD out there and I think the floor price depends on the price of Hive too much. However, I don't think the haircut rule matters as much as people would just get HP instead in author rewards. So people would just have to spend time powering down and moving it to HBD.

Posted Using LeoFinance Beta

HBD is just Hive blockchain debt and the haircut rule is designed to stop it taking on too much.

So when it is hit, there are mechanisms in place to get us down, such as no longer guaranteeing conversions (which is essentially stopping new HBD - or debt - being created).

Also during this time, people who select 50/50 payouts on author (and curator) rewards will receive liquid HIVE instead of HBD.

Something that will continue until the debt ratio drops below the haircut level.

But ultimately, I agree that we need more HBD.

The only way we are going to grow and compete with the stablecoin big boys is if we take on more debt (create more HBD) and provide liquidity for swaps via DEXs.

But we need to remain sustainable!

If we blow up like UST, then it will have all been for nothing.

Sustainability is key.

Posted Using LeoFinance Beta

These are actually important factors to know as this has direct implications on the Hive price.

Posted Using LeoFinance Beta

I believe HBD is the most sustainable stablecoin among all

It is really nice to know about this and thanks for sharing.

After reading this normie-friendly answer, I am not a normie anymore. 🔥

Posted Using LeoFinance Beta

Awesome because to be honest this always confused me as to how 20% is sustainable. 20% APR is freakin massive and is one of the best ways to really stack value and earn passive income compared to just about any other method.

Posted Using LeoFinance Beta

I haven't understood it yet, but now I can start reading about it in a meaningful way

I also haven't fully understood it yet but reading your article sheds some light about about the mysteries of the 20% interest. 😊

!1UP

I'm saving HBD (1800, so far) and this is giving me hope. I have asked a few people about this before if the 20% apr will gonna be the same because it never sounds like a sustainable strategy.

Your post explains everything beautifully.

This is what we need to hear. Thanks.

Amazing .

I knew a bit about this here and there while gathering data for reports but now it makes more sense.

Posted Using LeoFinance Beta

Wonderful explanation and finally i got answer of my question. I thought about it many time that from where 20% interest come.

As you said Sustainability is key and that is what HBD is.

Posted Using LeoFinance Beta

Very informative :) I have to say, this made me understand what the heck a haircut rule is! (It's not just going to the barber regularly 🤣) An interesting tidbit in the comments from you too: if/when this comes into play, we will get liquid Hive instead of HBD in 50/50- VERY IMPORTANT to know! I have been converting all my HBD to Hive to power up/ invest in tokens, I'm going to stop doing so much of that now, and stick some in savings. I knew HBD was precious, but I didn't realize that someday I may not get some with my daily payout!

Posted Using LeoFinance Beta

This post has been manually curated by @finguru from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

https://twitter.com/494429019/status/1591062787714850822

The rewards earned on this comment will go directly to the people( @successforall ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

You have received a 1UP from @thecuriousfool!

@leo-curator, @ctp-curator, @bee-curator, @neoxag-curator, @cent-curator

And they will bring !PIZZA 🍕.

Learn more about our delegation service to earn daily rewards. Join the Cartel on Discord.

I gifted $PIZZA slices here:

@curation-cartel(2/20) tipped @forexbrokr (x1)

Send $PIZZA tips in Discord via tip.cc!