A Look At Hive’s L2 Hive Engine | Data On HIVE Deposits And Withdrawals

Hive Engine has been around for quite some time now and slowly but suelry it has been growing in the period, powering Hive’s second layer applications. Splinterlands is heavily dependent on Hive Engine since a lot of the in game assets are only tradable on it.

Apart from Splinterlands we have seen other projects like the second layer tribe tokens, LEO, POB to mention a few. Other games have been also built on top it, and since recently we have NFTs like Hive Punks. BeeSwap is also building on top of Hive Engine with it BXT defi token.

All the projects that we have mentioned above have contributed to increase the overall traffic, deposits and withdrawals from Hive Engine.

Here we will be looking at the volume that Hive Engine does in terms of deposits and withdrawals on the platform. It is a nice indicator of the state of the platform.

At the moment there are three major gateways for deposits and withdrawals on Hive Engine:

- Hive Engine (@honey-swap)

- LeoDex (@leodex)

- BeeSwap (@hiveswap)

The fee for deposits and withdrawals are 1% on Hive Engine and 0.25% on LeoDex and BeeSwap.

All the projects build on top of Hive are made possible by the custom_json data and Hive Engine.

The period that we will be looking at here is the current year of 2021.

Deposits

For deposits we will be looking at the transfers to the Hive Engine @honey-swap account, @leodex and @hiveswap for BeeSwap.

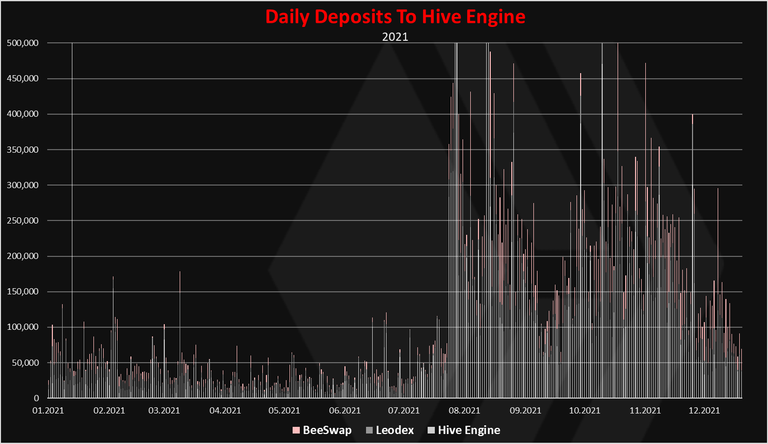

Here is the chart.

The daily chart is a bit messy with a lot of spikes and ups and downs.

Prior to August 2021, the deposits were under 50k per day. Then it August they spiked a lot reaching more then 500k a day. Since then the volume has been much higher with a slow decline. On average there is around 150k daily deposits in the last 30 days.

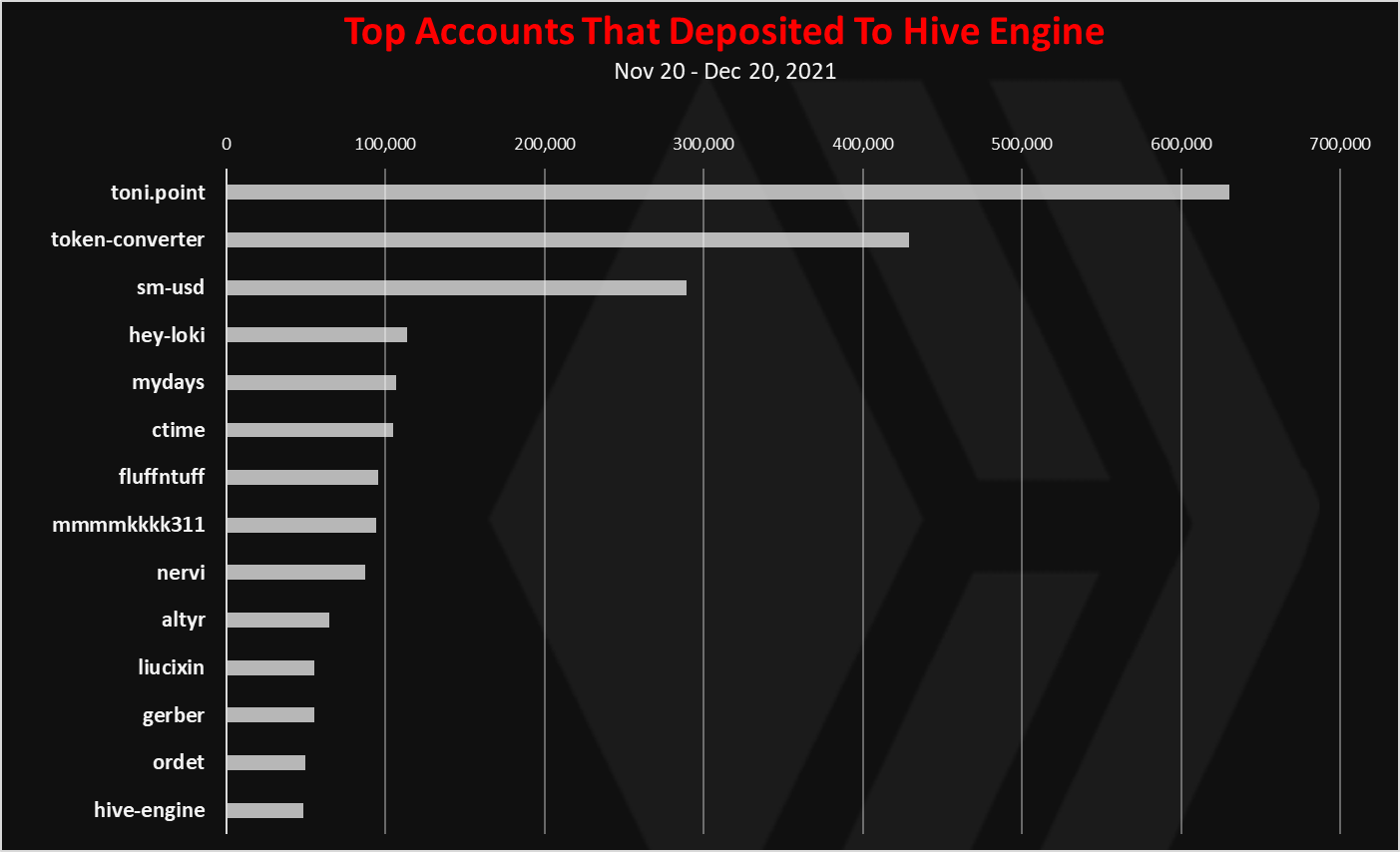

Who has deposited the most?

Here is the chart for the top accounts that deposited in the last 30 days.

The @toni.point is on the top here with more then 600k HIVE deposited, followed by the @token-converter account. These are most likely arbitrage accounts.

Withdrawals

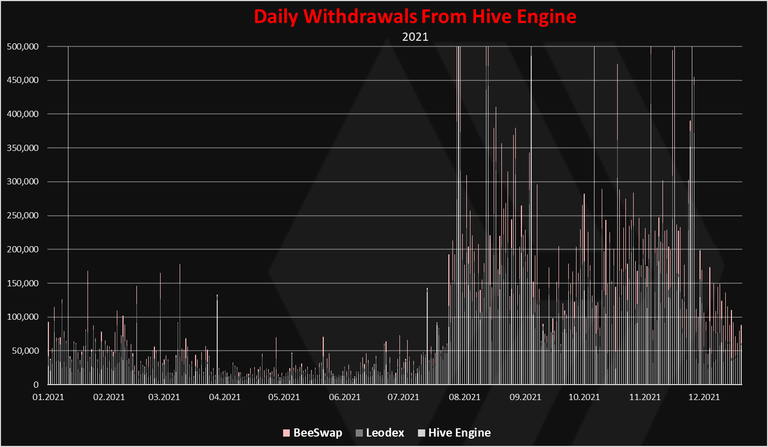

Next the withdrawals. Here is the chart for the daily withdrawals.

This chart seems to be following the deposits, just with smaller intensity.

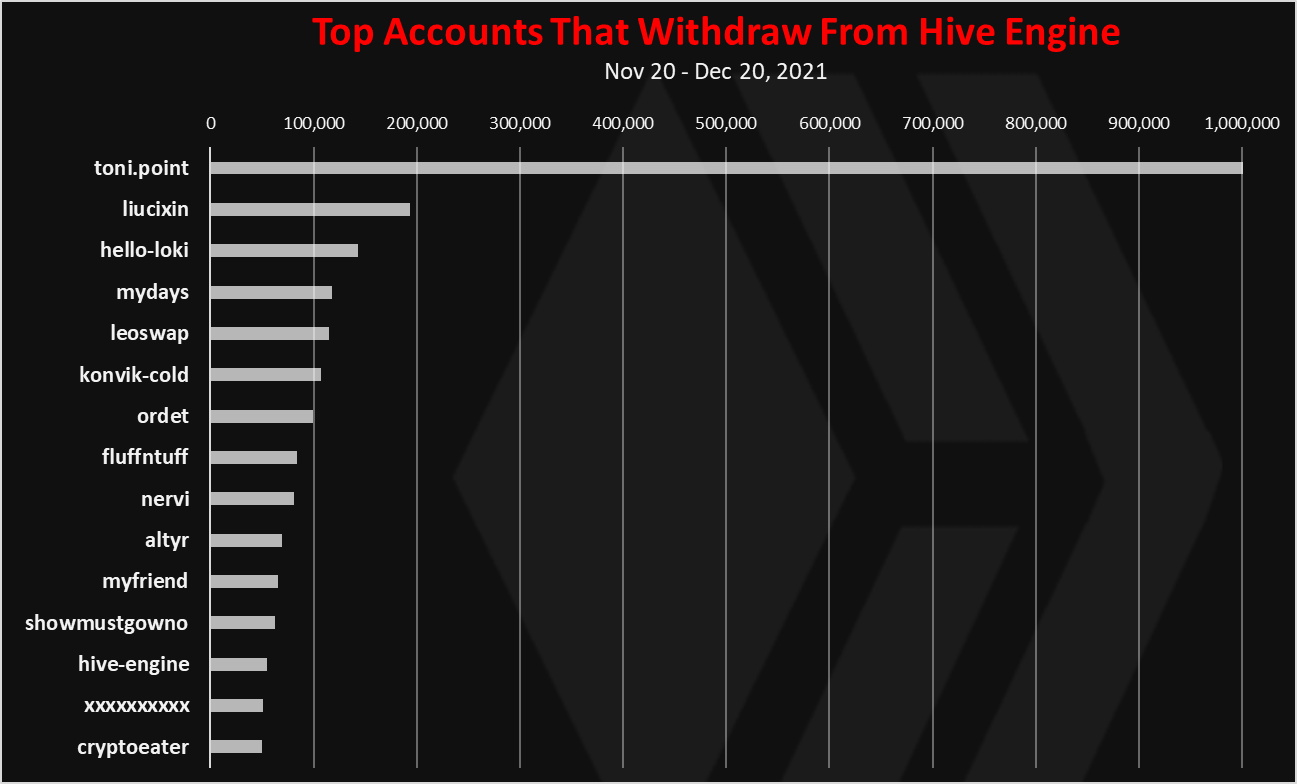

Who has withdrawn the most?

Here is the chart for the top accounts that withdrew in the period.

@toni.point is on the top with more then 1M HIVE withdrawn in the period, followed by @liucixin.

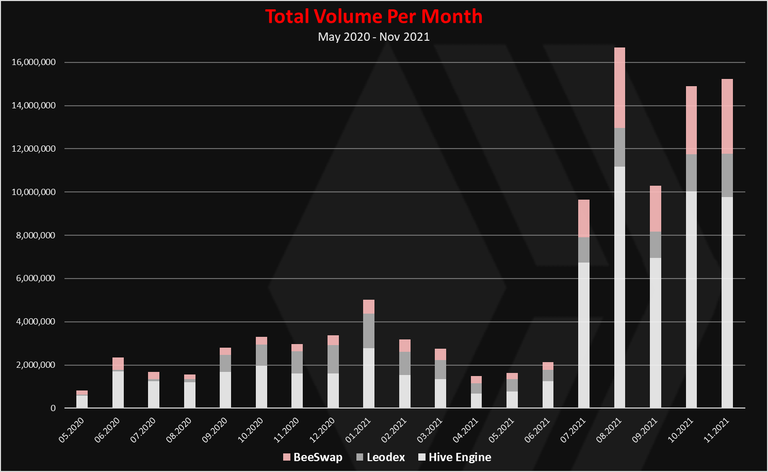

Total Volume Per Month

If we take both the deposits and withdrawals and sum them up on a monthly level we get this.

This is a bit clearer representation.

In the last five months the volume on Hive Engine has grown a lot. Going from around 2M per month to more then 10M per month. Again, we can see that the volume increased a lot from August, or it has been following the growth from Splinterlands.

BeeSwap seems to be gaining more traction, increasing it share in the last months.

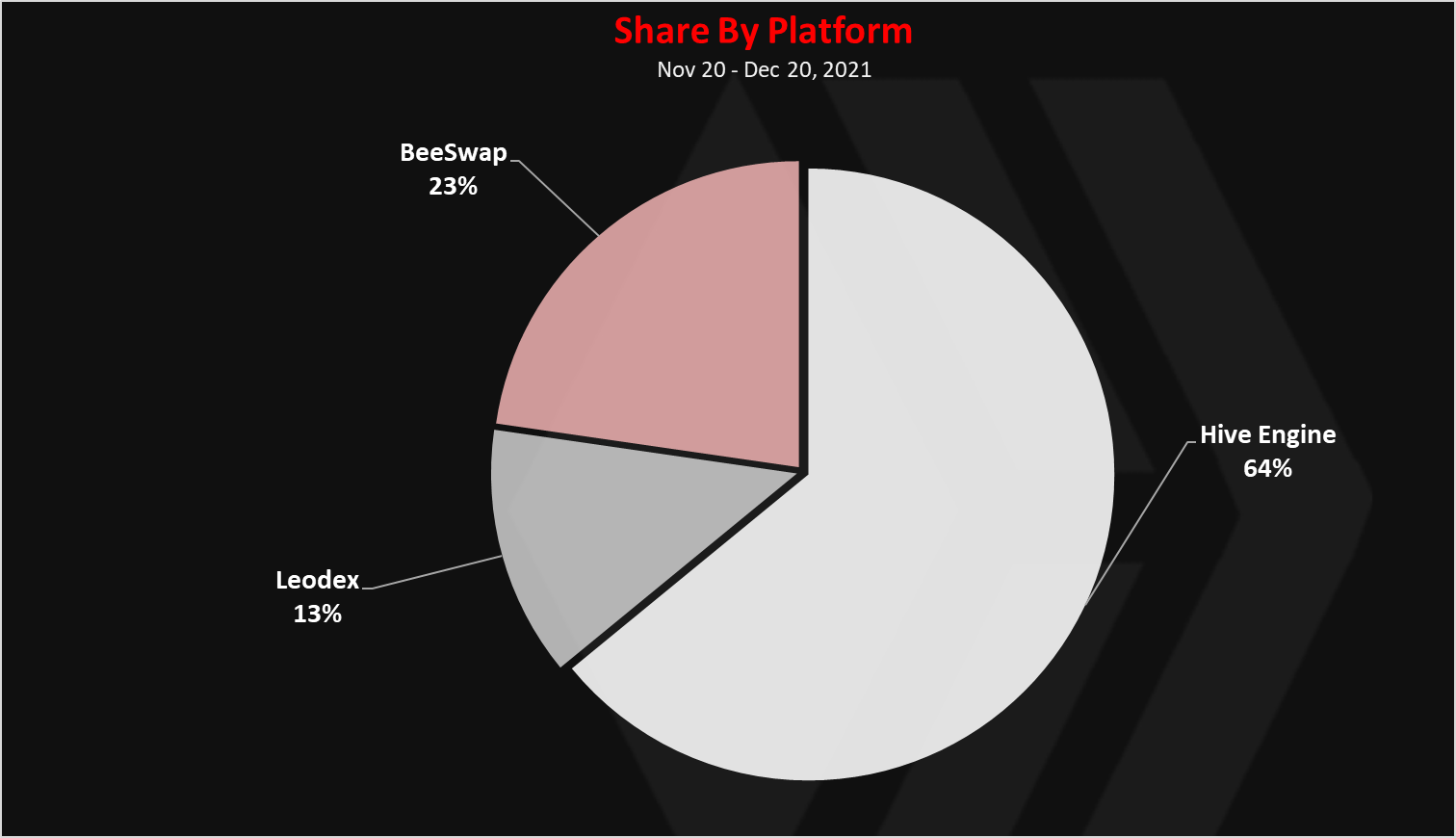

Individual platforms share

Here is the chart for the share of the deposits of Hive Engine, LeoDex and BeeSwap.

The Hive Engine account @honey-swap has 64% share of the cumulative volume (deposits and withdrawals). BeeSwap is on the second spot with 23%, followed by Leodex with 13% in the period.

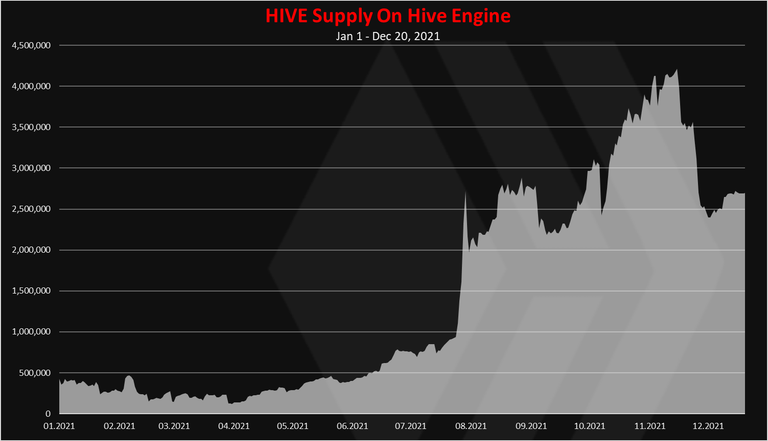

Historical Supply On Hive Engine

Here is the chart for the HIVE stored on Hive Engine in 2021.

Note: This is a sort of reverse engineered data, from the current HIVE balances and then net the deposits and withdrawals over time. There might be errors.

As we can see prior to June there was under 500k HIVE started on Hive Engine. Then it started to pick up reaching 2.5M in August and an ATH in November with more than 4M HIVE. A drop since then back to around 2.5M where it is now.

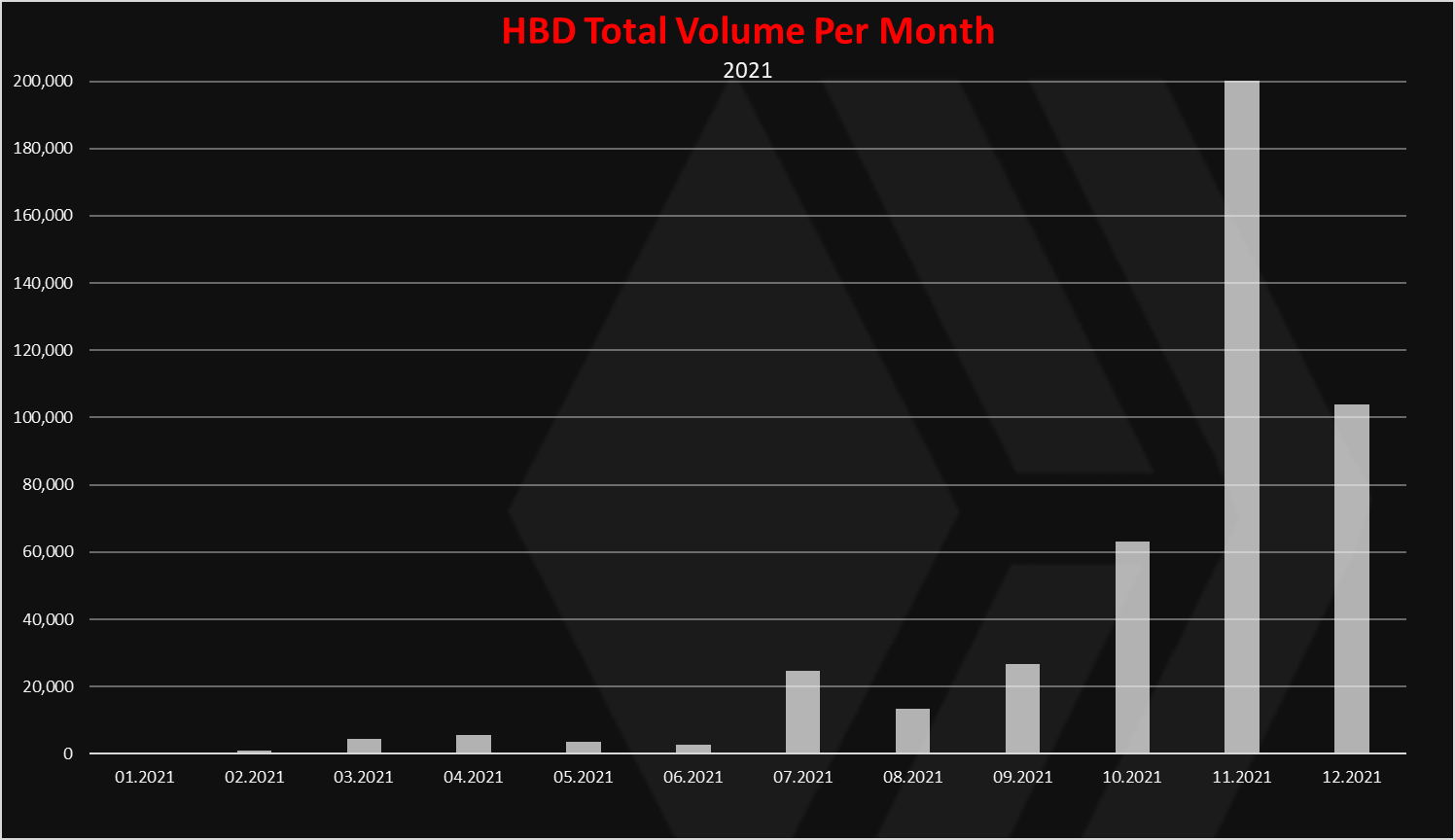

HBD

What about HBD? HBD has been growing in adoption recently. How is the volume for HBD?

Here is the monthly chart for 2021.

As we can see the HBD transactions to Hive Engine have been growing as well. They reached more then 200k HBD in November and are more then 100k in December, although the month is not over yet. If we compare this with HIVE where there is more then 10M HIVE volume, the HBD volume is obviously lower, but still the trend has been up, showing the increased usability of HBD. BeeSwap added the HBD:BUSD pair recently, that has been grown to around 150k. The HIVE:HBD pair has similar liquidity as well.

All the best

@dalz

Posted Using LeoFinance Beta

Thanks for the statistics. HBD is trending on hive. I think the 12% interest is the reason. For the hive engine, it's slow and frustrating, sometimes on peakd it doesn't come up. I think leodex is much more stronger.

Posted using LeoFinance Mobile

Leodex, tribaldex, beeswap ... you choose :)

Thanks buddy for the stats.

One thing I had noticed in Hive Engine is that it has been sort of slow for me. I checked Tribaldex and liked it alot. It was fast and understandable :)

Haven’t used tribaldex though, but people seem to like it more

Yes, it can be confusing a bit, hive engine in general is the baco end, then you have the old hive engine UI, the new tribaldex, leodex and and beeswap :).... four UI, one backend

LeoDex is staying strong on the Hive-Engine exchanges, but I think it can do better by developing more DeFi features as TribalDex and BeeSwap. I know there are many projects done in parallel, but there is an immense opportunity within Hive itself as well.

Posted Using LeoFinance Beta

Yes leodex is doing quite well having in mind that it has been left on the side for a while

Can you explain me a bit that if HBL volume increases, how it will be beneficial for Hive platform. I think it will make it stable and people can store their investment in HBD as well to use it later for different purposes?

Your expert opinion on it would be appreciated.

Where does HBD comes in the first place?

From inflation as authors rewards, but that is just a small amount, the majority of it comes from HIVE to HBD conversions. If users start accumulating hbd it will means more hive converted to hbd transfering demand to hive

Ahh, I got it, so eventually it will lead to Hive demand which will push the Hive Price Up. Higher Hive price means more rewards for everyone and a better hive ecosystem.

Thanks for enlightening me on it.

Interesting stats, my favourite is beeswap, I like the simplicity and also BXT "tokenomics"! The project is pretty fresh. But I am planning to stay in it long term (pools) 🙂👍

https://twitter.com/Dalz19631657/status/1473319769747111942

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

I'm happy to see all this chart, that's to show how Hive is growing. HBD is pushing up per day

Posted Using LeoFinance Beta

gm

Still learning about how all this works but day by day I am gaining more knowledge.

Thanks for the updated report. @beeswap share increased by 2% since last report.

@toni.point is definitely an arbitrage account while @token-converter is a service that is used to buy DEC for users for other cryptos. It is powered by Simple Swap.

I really wish hbd could grow also like the way hive has been growing but how how are you able to trace this?? I hope before the end of the year the transaction of hbd might still rise beyond the normal stage it is now.