Panic Seller are Buying Again

In every dip we have seen a lot of people do sell their holding even if they are on loss, just to cut off the major loss which they might incur. Now there are two types of investors who sell, one who sells for loss and never buy again to remain in loss forever and others who sell and when they see that market is improving they buy again to get the profit again.

Now we should not be the first type where if we sell, we should not buy again. But again we cannot time the market so people will not know when to enter the market again. Like if they sell and buy again lower and what if it goes even lower, they will remain in loss even though the loss is less. Again if they sell and by the time the market reverses and it is again a loss for them. So, actually, as a trader, we should be very careful with the trade and because of that a lot of people suffer heavy losses as they do not manage their trades well.

Only traders do not do panic selling, but again people who are for long term also panic sells when they see the market is going down 10% to 20% because again they wanted to cut off their losses and do not have any idea when to buy again. But what should we actually do is to Buy the Dip if you are a long term investor so that your average amount should be lesser. The Buy the Dip should not be done with all your money but you should only buy from some amount so that if the market fell again you can again buy the dip.

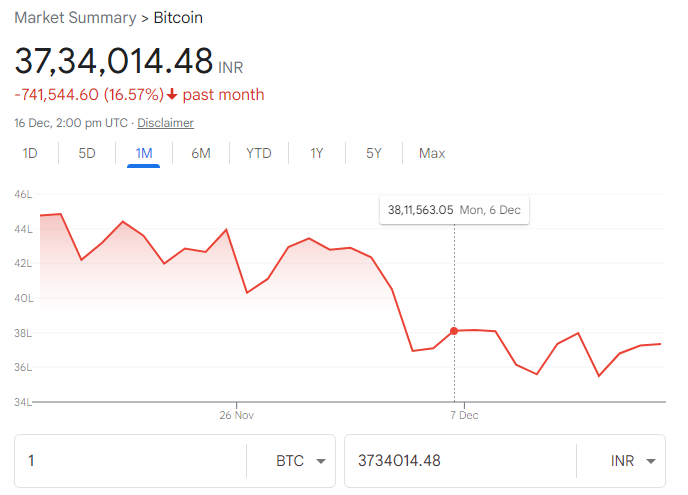

PC: Google.com

Bitcoin dipped by more than 17% in the last month and thus a lot of people have panicked and sold their holdings and there are a lot of people who have bought, but since it's going down that means there are more sellers than buyers. And since the last 3-4 days, when the market is improving people are actually buying more than the sellers because those who have sold their holdings at the top are actually taking the trade again.

Panic selling often happens and those who dump actually might regret later about their decision. Only thing is that their question is when to enter the market again. There was also a study that many investors who panic-sold assets never get back into the market because they think that there is only a loss in the market. Actually what we should do is to cut off the loss but again we have to be right when to enter the market again which is again a difficult question to ask.

The best thing is to do dollar cost averaging where you should put money in the market at regular intervals even if they dip. But if it dips further people should use their lump sum to buy the asset. The only thing is universal truth is that if you remain invested in the market your money will grow, only if your asset selection is good.

Posted using LeoFinance Mobile

While retail investors are panic selling, the whales are panic buying

Posted Using LeoFinance Beta

I wish I to have more fiat to buy the Dip and become the whale 🐋

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

How'd I wish I have some spare to buy some coins in the market with this period.

I have this mindset always, and I know it is bad for me but can't help it.

Posted Using LeoFinance Beta