Are you ready to dive into the Splinterlands liquidity pools?

The Splinterlands ecosystem is one that transcends the "Blockchain game" tag because it is a lot more than that. There are opportunities for everyone with a computer that's willing to do a few clicks.

For a long time, people have looked at Splinterlands as just a game and because of their lack of ranked battle brawling skills, they've not really participated in the game's activities.

If you take a closer look, you'll find that Splinterlands is more than just a game. It is a game with a variety of investment opportunities that don't require skill in ranked battles.

To put it slightly differently, Splinterlands offers traditional crypto investors an opportunity to get involved in the action through a variety of assets that are constantly generating value.

You can buy assets like packs, monsters, land and a variety of tradable in-game assets that you don't necessarily have to even use for the game. These assets can then be flipped in the way day traders do or just hold long-term and flip in the future when their prices rise.

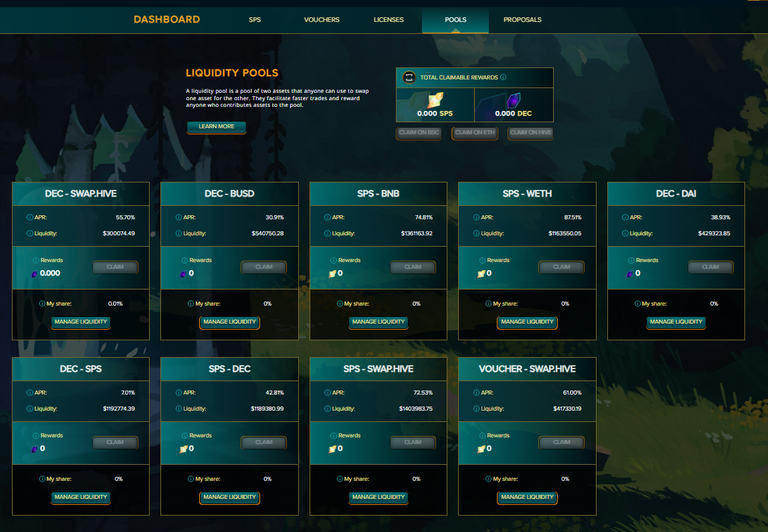

As the title depicts, there are also a number of liquidity pools that we'll be getting into in a bit. These liquidity pools offer different APRs and are all based on Splinterlands tokens.

Yesterday I announced the end of my ranked battle playing partnership with SEED project. This was not an easy decision but it also effectively halted my participation in ranked battle.

For what it's worth, I have a personal deck of approximately 90K collection power that I currently delegate to my friend. However, I've decided that I'd like to take a long break from battling and look at the other aspects of Splinterlands.

This is why I decided to explore the available liquidity pools in Splinterlands. My funds are very limited but I reckon I should still be able to participate in a couple of the pools.

Dive into the pool

At the time of writing, there are a total of 9 pools affiliated with Splinterlands. To find the pools, you simply;

- Visit Splinterlands

- Go to SPS management portal

- Click on Pools at the top right of your screen.

You'll notice that the assets you pool are broadly divided into two categories: Assets on Hive and Assets outside Hive.

For me, pooling assets on Hive will always be easier than pooling outside Hive. In any case, I'll break down the process of investing in all the Splinterlands liquidity pools.

DEC-Swap.Hive

The DEC-Swap.Hive pool is exclusively on Hive and you earn DEC rewards at 55.7% APR. To invest in this pool you;

- Transfer DEC and Hive into your Hive-engine wallet

- Visit Tribaldex

- Select the two pairs of tokens in the spaces available

- Stake equivalent amount of each token

- Claim your rewards inside Splinterlands Liquidity pool section

DEC-BUSD

This pool is staked outside of Hive and it offers 30.9% APR that is paid in DEC token. To invest in this pool;

- Connect your Binance Smart Chain wallet address to your SPlinterlands account

- Send DEC and BUSD to the wallet address

- Go to Pancakeswap to stake equivalent amount of the two tokens

SPS-BNB

This is also another pool that you find outside of Hive and it offers an astonishing 74.8% APR that is paid in SPS token. To invest in this pool;

- Connect your Binance Smart Chain wallet address to your SPlinterlands account

- Send DEC and BUSD to the wallet address

- Go to Pancakeswap to stake equivalent amount of the two tokens

SPS-WETH

This is also another pool that you find outside of Hive and it offers an astonishing 87.5% APR that is paid in SPS token. To invest in this pool;

- Connect your Binance Smart Chain wallet address to your SPlinterlands account

- Send DEC and BUSD to the wallet address

- Go to Sushiswap to stake equivalent amount of the two tokens

DEC-DAI

This is also another pool that you find outside of Hive and it offers 38.95% APR that is paid in DEC token. To invest in this pool;

- Connect your Ethereum wallet address to your SPlinterlands account

- Send DEC and BUSD to the wallet address

- Go to Uniswap to stake equivalent amount of the two tokens

DEC-SPS

The DEC-SPS pool is exclusively on Hive and you earn DEC rewards at 7.01% APR. To invest in this pool you;

- Transfer DEC and SPS into your Hive-engine wallet

- Visit Tribaldex

- Select the two pairs of tokens in the spaces available

- Stake equivalent amount of each token

- Claim your rewards inside Splinterlands Liquidity pool section

SPS-DEC

The SPS-DEC pool is exclusively on Hive and you earn SPS rewards at 42% APR. To invest in this pool you;

- Transfer DEC and SPS into your Hive-engine wallet

- Visit Tribaldex

- Select the two pairs of tokens in the spaces available

- Stake equivalent amount of each token

- Claim your rewards inside Splinterlands Liquidity pool section

SPS-Swap.Hive

The SPS-Swap.hive pool is exclusively on Hive and you earn SPS rewards at 72.53% APR. To invest in this pool you;

- Transfer Hive and SPS into your Hive-engine wallet

- Visit Tribaldex

- Select the two pairs of tokens in the spaces available

- Stake equivalent amount of each token

- Claim your rewards inside Splinterlands Liquidity pool section

Voucher-Swap.Hive

The Voucher-Swap.hive pool is exclusively on Hive and you earn SPS rewards at 61% APR. To invest in this pool you;

- Transfer Voucher and Hive into your Hive-engine wallet

- Visit Tribaldex

- Select the two pairs of tokens in the spaces available

- Stake equivalent amount of each token

- Claim your rewards inside Splinterlands Liquidity pool section

In Summary

I generally feel more comfortable with using Hive applications so I'll be investing in only the Hive-based pools. Others might see things differently though. I also like the fact that there are minimal transaction fees on hive as compared to Binance Smart Chain and Ethereum.

So, what about you frens? WIll you be investing in any of these pools?

Posted Using LeoFinance Beta

https://twitter.com/belemo__/status/1566738930187358208

https://twitter.com/PhantomofOper14/status/1566751174858051585

The rewards earned on this comment will go directly to the people( @belemo, @crazyphantombr ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I have had my Dec tokens for a while now and I had no idea what to do with it. Now, you have given me the answer.

All I have to do is stake my available deck right?

Do I need to vote or do anything else?

Uhmm... Wait do I need to have Hive tokens to get into the pool too?

I currently have 4000 Dec, how many Hive would I need to successfully get into the pool?

Posted Using LeoFinance Beta

You will need an equivalent amount of Hive to stake it. Alternatively, you can just sell half of your DEC for Hive and then pool them against each other

Now, I am sad I can't get in.. cos even though I wanted an equivalent amount of Hive that would mean seeling a huge number of my DEC.

For instance I checked leodex and 2000 DEC can get me 2 Hive only. I am not seeing a balance anywhere. 🥺

Thank you for this. I never really looked into Splinterlands because I don't play the game. The good thing is we can still buy assets and pool them.

Posted Using LeoFinance Beta

Yup. It's an opportunity

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Do you know if these pools overlap with the ones at BeeSwap or are they maintained separately? thx!

!PIZZA

Posted Using LeoFinance Beta

I think they're the same

PIZZA Holders sent $PIZZA tips in this post's comments:

@pregosauce(2/5) tipped @belemo (x1)

Join us in Discord!

What os the difference between DEC-SPS and SPS-DEC, I could not find the second one on Tribaldex.

Posted using Splintertalk

Idk but that's how it is on the lp page.

hey Eddie, so here is what I found out from the pool.

There is only one pool DEC-SPS, however, when you invest in this particular pool, you earn dividend from both DEC-SPS and SPS-DEC pool.

So that this means in essence is that you will be earning both SPS and DEC for investing in this pool

Awesome! Thank you!

After I commented I decided to try it and I've been earning both DEC and SPS.

I already claimed a couple of times. Not bad rewards!

As someone who wants to build my HIVE stake faster, I haven't been able to say not to that (now) 70% in the SWAP.HIVE:SPS pool.

Long may those heavy yields continue!

Posted Using LeoFinance Beta

Bigger yields I pray 🫡

This is an eye-opener to leverage on.