Is Insurance Really Worth It? A Nigerian Perspective

In Nigeria, insurance is a topic that many find important; yet, I haven’t seen people around me purchasing any insurance policy. I do not currently have any form of insurance policy. No car insurance, no health insurance, no life insurance, no insurance. And honestly, I never really thought deeply about it per se.

To me, I see insurance policies as something meant for the rich, corporate workers, or people living overseas, where their systems are more predictable.

Growing up, I always heard adverts either on the radio or saw posters in banks about the importance of owning an insurance plan, but in everyday conversations, nobody around me was excitedly discussing their insurance plans.

The one I could remember was when my big sister explained to us last year about health insurance. If not for her explanation, I wouldn’t understand much about that and I could feel it’s something one should try out.

According to her, she was ready to get the plan for us, as there is a discount when she pays for a family of 4-5, and since we are siblings, she was ready, but I haven’t heard her talk about it again.

Just like I said above, such discussions don't come up around me except for the typical Nigerians who rely on what’s best for them. They believe in family, community and faith.

It’s like, if someone falls sick, relatives would contribute money. If someone lost a job or had an accident, friends and neighbours would support. So with this, these kinds of informal support systems have always been an alternative to insurance.

And because of this mindset, insurance sometimes feels like signing up for a problem that has not happened yet. Many people would wonder and ask, “Why should I pay for something I don’t use or may never use?”

In Nigeria, income is not always steady, and our basic needs already stretch the budget, so such a question may even make sense. Insurance can feel like an extra burden for an average Nigerian who is trying to put food on the table, pay rent and handle transport costs.

However, as I grow older, I have a changed perspective and truth is, life has a way of reminding us that unexpected things happen. Imagine your savings that took years to build then suddenly wipes out due to sudden illness, an accident or even a small business loss.

When you begin to hear stories of people who sell their property or even take heavy loans to settle emergencies, one wouldn’t even think twice about insurance and the thoughts of it sounding like a luxury won’t even make sense, but it’s like a safety net.

To me, insurance isn’t a money pit. It’s like having peace of mind. It’s like you paying for sleep at night without having to worry about the “what-if”. You may never need to use insurance, but if you do, it can save you from financial disaster.

Having insurance can be an advantage to an individual in the sense that the risk would be shared among many people and not only you.

Having said this, I won’t fail to mention the trust gap in my country, Nigeria. Imagine when it’s time to pay out, then issues like hidden terms, delayed claims or the companies disappearing become another thing to face.

These are fears planted in people that they are also being careful. Trust me, Nigerians are willing to invest when they believe and are assured that their money is safe and their claims will be honoured.

I wouldn’t mind if I get an insurance tomorrow and I am more open to such an idea because it’s for my future. Medical bills can show up unexpectedly, and having a backup plan isn’t foolishness, but you, making a wise decision, which would bring relief. It doesn’t matter how small it is, but taking the first step feels better than doing nothing.

Insurance isn’t about expecting the worst to happen. It’s about being prepared if they do.

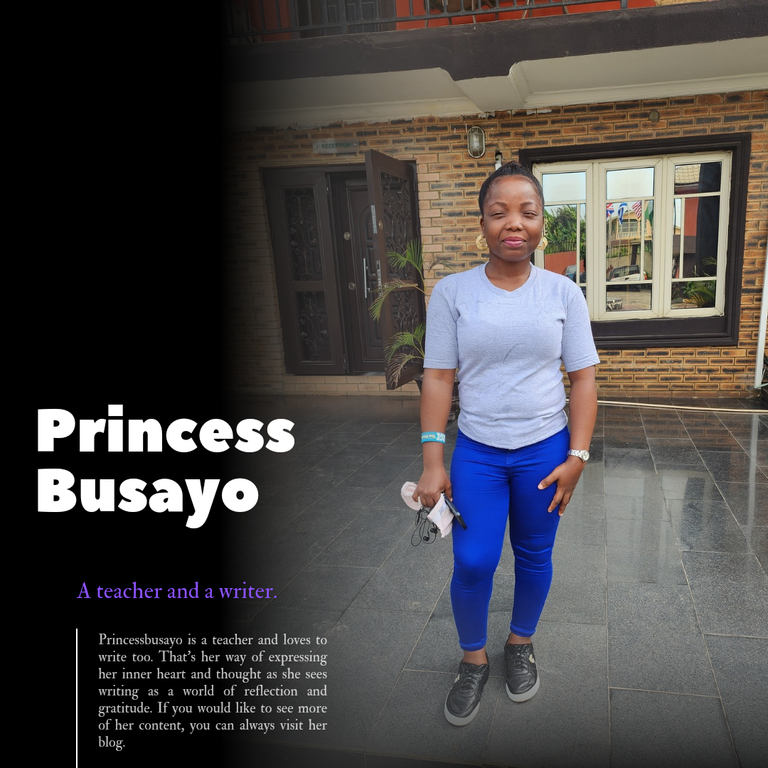

Image designed on Canva

⚠️⚠️⚠️ ALERT ⚠️⚠️⚠️

HIVE coin is currently at a critically low liquidity. It is strongly suggested to withdraw your funds while you still can.

Make me remember a time I worked at an organisation, where they said part of our salary would be removed to secure insurance, till today , I don't know where those part of my salaries are.