Evaluating the crash of the famed Web2 Social Media Giant - Meta

Meta is one of the big FAANG gang of leading technology companies of the early 21st Century!!

Stocks of FAANG companies yielded high returns throughout most of the 21st Century

One of the ways to monitor the pulse of the economic market is to observe the performance of major technology stocks. Past decade, we had prominent technology giants lead the market. FAANG is a group of Technology companies whose stocks have been performing phenomenally in the recent decade, because they were the leading technology companies that were experiencing a phase of high growth.

Yes, FAANG stands for Facebook (now Meta), Amazon ( AMZN) , Apple (APPL), Netflix(NFLX) and Google now Alphabet (GOOG). These stocks gave lucrative returns in the past decade, because they were experiencing growth in their business, sales, adoption etc which obviously lead to increasing revenues and net profits.

All these group of companies made end products or offered services that made use of leading edge technology that emerged during the early phases of the 21st century.

However, times have changed and now there are obvious signs that the bullish times of these FAANG companies are over.

Analysing FAANG company Facebook - The largest Social Media Giant on earth

Logo of FB from https://www.facebook.com/ .I must say the slogan is badly drafted here!!

Early Positives as Facebook was a effective social Networking platform

Facebook, we all know, is the leading Social Media company so its stocks boomed. I remember FB existed when I was out of college in 2005 as my friends told me to keep in touch via Facebook. Then someone sent me a friend request which had me open my first FB account.

It was all good, as FB used advanced algorithms analysing our Data and connecting us to people we may know ( like our classmates who studied in the same college, school etc). Similarly, FB analyses our likes, preferences and connects us to events that may interest us happening around the City.

Therefore, FB did good as a social networking platform. Many of us got in touch with our old pals, and joined various groups and events, extending our social Networking and making our time well spent socially.

Meta became a entity favoring powerful villainic forces and exploiting users

Negatives of Meta as a Centralised Entity aiding politicians and breaching users Data privacy

FB eventually turned out to be rotten, as we realised the company under Mark Zuckerberg sells our Data, including information on our likes and preferences to politicians, companies and targets us with ads to profit these powerful capitalist entities placing profits over the interests of users.

Nowadays, due to the reader audience available in Blockchain powered social media platforms like Hive, Steem and Publish0x, I stopped using FB. We crypto people are very much averse to centralised entities like Facebook that sell our personal and intimate Data(which defines us) that we try to refrain from using such platforms.

There is more to Meta now, with it in news for censuring content of users who are critical of Government actions, policies or are using FB to spread word on their protests and campaigns and FB favouring politicians by not taking down offensive posts that promote hate speech that are against community guidelines.

Now, Meta has lost its old allure as it’s acquired a negative image of a villain, selling user data for profits and aiding powerful elements like politicians benefit in their unworthy power hungry campaigns spreading their propaganda polluting and brainwashing the minds of users. By all this Facebook, now Meta has done a lot of damage to the world as well.

What makes Meta super powerful is the information (DATA) it has on a large amount of population

Meta is still powerful, with it having acquired Whatsapp and instagram, so it remains to be the largest and most popular social media platform on this earth. This means, this entity holds bundle loads of information and Data about billions of people on earth.

Meta's advantage is that it has so many users and any product introduced under its brand will obviously have a huge market.

In Between recently, FB rebranded to Meta because they embraced Metaverse, although I am not in tune with all that news. I heard in its Meta avatar, things have flopped.

Facebook has been trying to grow in the crypto space as well as a payment provider!!

I know Meta is trying to make revenues by growing in other ways, like through payments. It is now possible to make payments via Whatsapp for instance.

Facebook tried to get into the crypto space introducing some kind of payments features with Diem being the platform’s native crypto but with Facebook acquiring the reputation of not having honoured it’s users privacy, it got into issues with courts and Diem never emerged. Anyway…

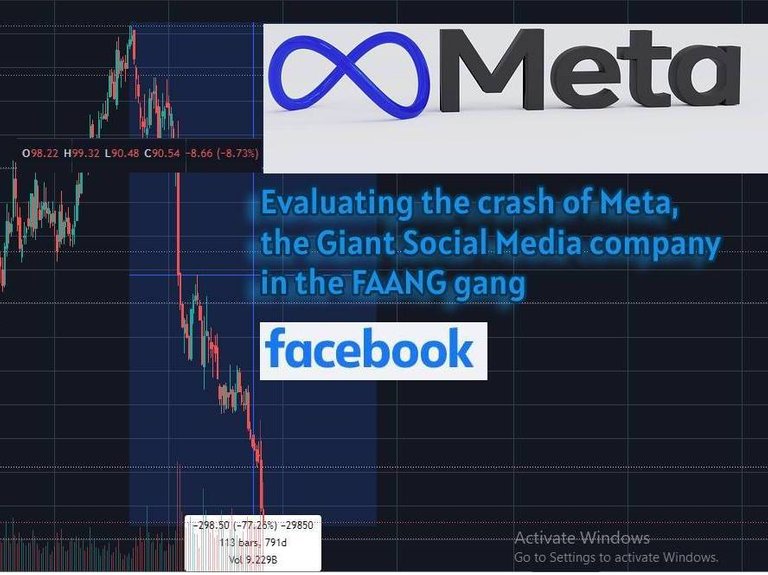

Technical Analysis of the META Stock

Now to analyse the performance of the Meta Stock!!

META is listed in Nasdaq, and this price chart is Meta’s price as tracked by Nasdaq Stock Exchange.

Meta stock price has been on a crashing downward slide since a year ago!!

Meta reached its current ATH prices of $385 in August 2021 and then began its crashing downward journey on September 10th 2021.

Current price of the Meta stock is 93$ with META’s stock value declined more than 68% from its ATH!!

There has obviously been a huge sell off of the META stock as even in the weekly time frame there are huge red candle sticks. There has also been recent huge sell offs of the META stock in the recent months amounting to a 50% decline!! This stock has been falling since a year now.

Currently, Meta has breached the support price range of 120 $. This price range was the stock’s All time low price in December 2019. Now, the price of the stock has gone into the price ranges it was in September 2016 as 95$ was the ATH price of META at that time.

Now with the price of Meta below 95$, 5 years of the stock’s price gains have been wiped out!! This means that all stockholders of META since 2017 who have not sold out earlier are in red.

Major trigger that led to Meta’s recent Price crash!!

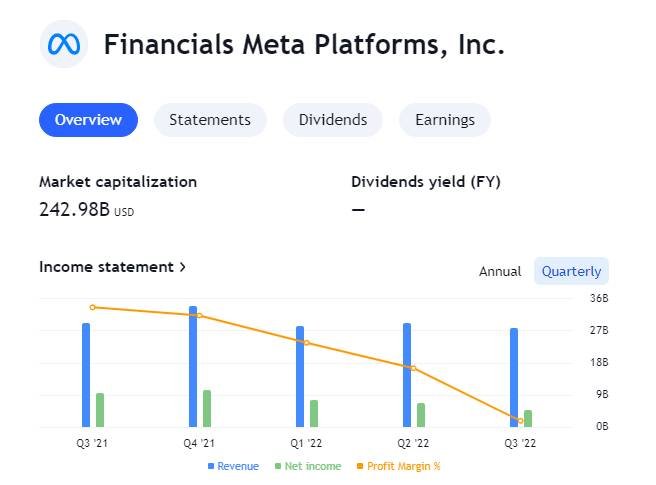

Meta’s declining profits in the recent Q2 Earnings report

In the stock market world, any fall below 40-50% has been a good range to average in, but in META’s case, the stock has fallen way below that percentage. This is severe!!

One of the immediate reasons for META’s latest price decline could be its latest earnings report.

Meta’s Q3 2022 performance came out showing that its Revenues, Net income and Profit Margin has declined from the previous quarter of Q2 2022. Meta’s growth has been declining this year quarter to quarter with lesser revenues, income and net profits.

Investors’ confidence in Meta's future growth prospects seems to be low, which means the market feels that there is no guarantee for the price of the Meta stock to rise anymore.

High time the era of Facebook/Meta dominance ends!!

It’s possible that another company may lead the Social Technology space in place of Meta, a company that’s evolved not only with new innovative technologies, but with a different ethos as well.

Meta’s time as a leading company in the tech space may have ended. The company did lead by employing advanced leading edge Data Analytics Technology which may have been cutting edge at one time but times have changed and evolved now.

*** Today’s new age social media needs to embrace ethos of Decentralisation, Censorship Resistance and User Control over their Data which we know Meta lacks, so I expect Meta’s leading era to fade and (hopefully) end sometime. (Game over Meta!!)***

Today is the era where users get paid for their content when the audience likes their post or creation. This is opposite of Facebook, where our content benefits advertisers, companies, politicians and we don’t even have ownership of the content that we created!!

However, let’s rewind back to Meta’s, i.e ,FaceBook’s golden years and take a sneak peek at its price action which kept booming until it started falling a year ago.

The Golden years of a Facebook stock investor was between 2013 to 2018!!

Rewind back to 2012, Facebook’s stock price was 17$. Last year, the META stock reached its ATH price of $385 which is a price appreciation of 1900% !!!

Tradingview chart.Price Boom period for FB stock was definitely between 2013-1018.

As can be seen, during 2012 to 2018, Facebook stock was doing very well. The stock seemed bought up whenever price fell, experiencing a dip between the 15% to 30% ranges. In 2019, Facebook stock had a bearish phase, the stock fell down 44%. Price resistance level was at 223$, and this resistance which was META’s ATH range it reached in 2018 was crossed only on Covid year 2020 in May.

That time, META’s price took off probably because the excess money supply which the US FED caused with its fiscal stimulus measures ended up propping up asset markets.

One can say that from 2013 to 2018, Facebook stock went through a more natural bullish phase. An investor during this period would have made gains of over 1000%. After that, price of META went up during Covid period upto its ATH price range of 385$ on September 2021, giving a META stock investor another 70% gain.

Now of course, META prices have come to sub 95$ ranges, and I don’t know if that company can ever be a market leader in the social media space again. I think it’s time for a new company that’s not as evil as META to take its place…shrugs!!

One lesson to take away here is capitalise on the trend, they change!!

I will conclude by saying that investing is not a straightforward matter.

Image by Gino Crescoli from Pixabay

Obviously, you invest to make life changing gains, then cash out to enjoy life as a wealthier person. Therefore, when the trend is there one must catch it, else it's no use. Obviously, META maynot be a fundamentally good stock to invest now, as it was in 2012. Now there are other emerging social media alternatives and a different era is unfolding. We never know which entity will be as well adopted as FAANG companies were…

However, our lesson is to make life changing profits and then cash out and then check out other companies that have potential to lead in the period. Don't be married to one stock, especially to one like META, because it’s not a reputed company like it was before…

Next article, I will talk about the next company in the FAANG gang - Amazon AMZ, watch out for that.

Thankyou for reading!!

That is why is important to invest in value and dividends and not to depend on the trend.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share 100 % of the curation rewards with the delegators.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

Read our latest announcement post to get more information.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.