Will BITCOIN cross $100k this time?

Hello Readers,

I hope all of you are doing well in life and enjoying the day with your family and friends. For those of you who are active in this wild crypto realm, I guess you all are enjoying the thrilling vibe of the current crypto market, as after spending a long time in the bear season, finally, this realm is awake and has also been accelerating with full power. Not only Bitcoin but most of the alt-coins are now experiencing a great pump at the current time with obviously BTC leading the way and if you are a crypto holder then congratulations my friend on your increased portfolio balance. There was a big expectation for this long-awaited pump among crypto enthusiasts globally and it got its first boost after the US election results where Donald Trump was declared as the next President, as he is well known for his support of Cryptocurrency. But no one expected that in spite of many ongoing global events like the fall of the Bank of Japan, Global financial and economic instability and the ongoing wars between Russia and Ukraine or Israel and Palestine which surpassed the financial growth not only in crypto but also in share market, crypto would take such a huge jump suddenly. But right now the scene has changed entirely and whatever social media you open nowadays whether it’s X, Youtube, TikTok or Instagram - all of them are flooded with crypto related content. So in this post, let us take a dive into the world of crypto and take a look at what’s happening while focusing on Bitcoin. So, if you are interested, let us begin without any further ado.

King of Crypto - Bitcoin $BTC

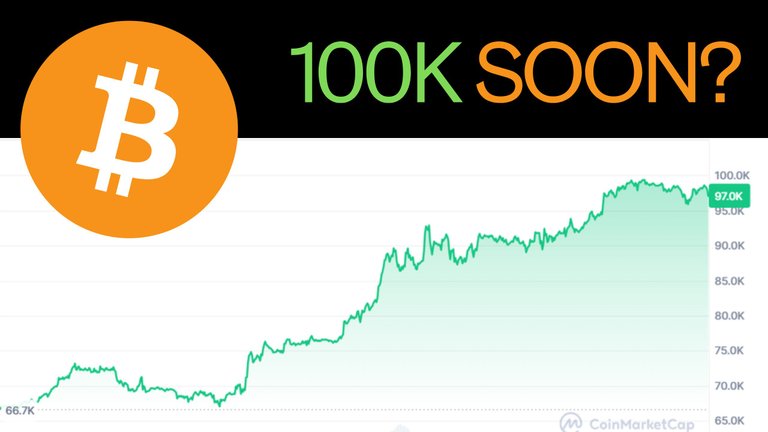

First of all, let us talk about Bitcoin as it is the most popular, most powerful in terms of market cap and the most dominant cryptocurrency that always holds the top place in this sector. The screenshot above which I took from the Coinmarketcap website, represents the price chart of Bitcoin in the last 30 days. If we look closely at BTC’s price action in this time period, we can clearly see that even during the end of October, Bitcoin was roaming around $66k USD. Still, within just 1 month, it rose above 45% and made its all-time high at around 98,790$ on 25th November and is trading closely near that point with a current price of around $97k USD.

Bitcoin Dominance

Since its existence, this is the highest point ever that Bitcoin has reached now and experts are saying it won't just stop here and will probably rally to an even higher price this time. If we look at the current data, Bitcoin currently holds a 1.92 Trillion USD market cap (where the total cryptocurrency market cap is 3.29 Trillion USD) and a whopping 55.74 Billion USD volume of Bitcoin has been traded in only the last 24 hours with more than 15% increment, which clearly reflects the current sentiment around this coin.

The First Mover

Anyway, as I said above, Bitcoin has always been the most dominating coin in this crypto realm and being the first-ever cryptocurrency, it has always been the main pillar of this sector. Because of this, most of the people worldwide recall Bitcoin whenever they think of Cryptocurrency and allegedly most of the people who have ever traded or held cryptocurrency in their life have interacted with Bitcoin first. Maybe that is why Bitcoin always has the advantage of being the first mover whenever a pump season comes and then Alt-coins starts following the trend. So, Bitcoin acts lime an indicator to measure the health and sentiment of the crypto market. As Bitcoin has already made a new all-time high and is still fighting strong, it may be a strong message that alt-coins will follow the path this time as well. We can already see the top alt-coins breaking their resistance levels and reaching new heights, especially Ethereum, Dogecoin, Solana, BNB and even our Beloved Hive as well.

Global Trust in Bitcoin

Not only Retail customers but big and global financial institutions like BlackRock or Microstrategy etc have also started treating Bitcoin and crypto as an asset class and have been investing and holding Bitcoin in their portfolio and also launched ETFs, which obviously opened the door for common people to invest in cryptocurrency and I think it was a huge step which will only benefit this industry even more in future. I just read the Tweet shared above where Microstrategy announced that they bought another batch of 55,500 Bitcoins just yesterday for around $5.4 Billion USD at a cost of 97,862$ per Bitcoin and thus have achieved a BTC yield of 35.2% QTD and over 59% YTD. Earlier they purchased 51,780 Bitcoins with a rate of 88,627$ per Bitcoin as I shared in one of my previous posts and seems they are very confident with Bitcoin and aggressive as well. Right now, they hold a total of 386,700 Bitcoins and who knows if they are aiming to hold at least 1 million Bitcoins in the near future, not to mention this type of news gives people even more confidence to invest and hold onto cryptocurrency and treat this sector as a reliable investment sector rather than a gambling ground.

I hope you liked reading my post and let me know if you are also holding Bitcoin. Express your feelings regarding this ongoing pump season and I will be seeing you all in my next post.

Posted Using InLeo Alpha