Bitcoin Crosses $100k | Alt Season coming soon?

Hello Readers,

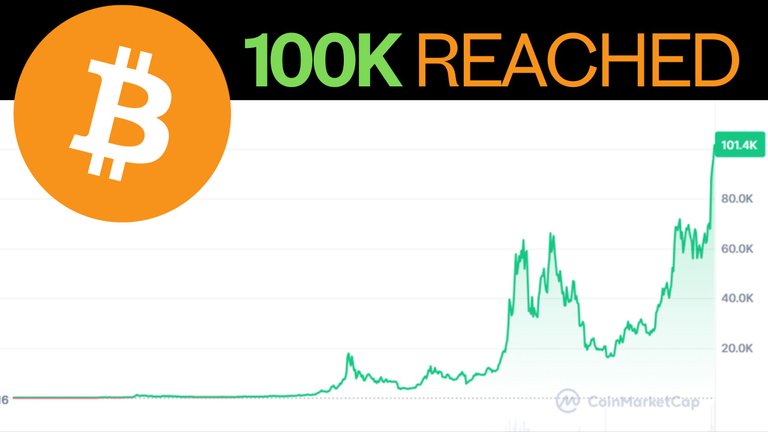

Yes, it’s official now - Bitcoin has smashed through the $100,000 mark. We, all the crypto enthusiasts, investors and crypto lovers around the world have been anticipating this event for a long time and have been crossing our fingers since the start of this pump season. No more speculations, no more doubts and no more skeptical or troll comments, because Bitcoin has once again proved its worth and the power of people. This certainly is not a fakeout, it is the real deal as Bitcoin didn't touch 100k in a blink and came down just for the sake of reaching 100k, it is literally maintaining its position above 100k strongly and right now being traded for 100,600$, even after handling the immediate correction. For those who have been following this long but thrilling rollercoaster journey of Bitcoin like me, this moment really feels historic and monumental. I believe that this incident will pour immense confidence among all investors and the climb from $100K to $200K may be much faster than the struggle we saw from $80K to $100K. In today’s post, let us dive in and try to break down why this milestone is so important and what it means for the future of Cryptocurrency. So, if you are interested, let’s jump right in without any further ado.

From Zero to $100K | A 15-Year Journey

It has been almost 6000 days since Bitcoin’s creator, the mysterious identity Satoshi Nakamoto, executed or mined the first block of Bitcoin back in 2009. Fast forward to today, and Bitcoin’s price has jumped to over $103,000 per coin. This gigantic event has made Bitcoin a six-figure asset - something many thought was impossible even a few years ago. To put this in perspective, when Bitcoin first launched, it was essentially worth nothing compared to what it is in today’s world and maybe in the future Bitcoin may also reach a certain point where 100k$ feels like nothing… or am I being too optimistic?

Breaking the $100K Barrier

Crossing $100K was a huge psychological barrier for Bitcoin and it took a long time to reach this milestone, especially if we count since the last pump season when Bitcoin reached 69k$. Now obviously, as an aftermatch, the old orthodox conversation has now shifted to whether Bitcoin can hit $1 million or not. Some believe it won’t happen in this cycle, or even the next one or even in the next 5 years, but the trajectory is clear. Bitcoin is no longer just a speculative asset or a gambling coin or the internet magic money. it is being recognized as a serious store of value or a simple asset by the world.

In recent times, we have even seeing many high-profile figures weighing in and showing open support for Bitcoin and Cryptocurrency. Former U.S. President Donald Trump has congratulated Bitcoin holders, while Federal Reserve Chairman Jerome Powell further acknowledged Bitcoin and placed Bitcoin as a direct competitor to gold. However, in order to rival gold directly, Bitcoin would need a total market cap of over $10 trillion, which is more than quadruple times its current value.

Germany’s $2 Billion Lost

While most of the Individuals like us or companies and Governments that supported or invested in Crypto are celebrating Bitcoin’s rise, not everyone is certainly thrilled. In mid-2024, Germany’s government decided and sell 50,000 Bitcoins it had seized from criminal activities. At that time, Bitcoin was trading at around $57,501, and by selling their Bitcoin holdings, Germany brought in around $2.9 billion of funds. However, if Germany had held onto those coins, they would now be worth more than $5 billion, almost double!

As Bitcoin has now set a New ATH above $100k, as expected some criticism has poured in already against the Govt decision, especially from German MP Joana Cotar, who called the sale a massive blunder. Cotar also argued that Germany should have kept Bitcoin as a strategic reserve, noting that the U.S. is already considering similar plans. She blamed the decision on ignorance while pointing out that there was no legal obligation to sell Bitcoin so quickly at that time.

Wall Street Joins the Party

Bitcoin’s recent rise to $100K has drawn in not just the attraction of retail investors but also many major financial institutions as well. The US Wall Street is now deeply involved in the crypto market which has a high possibility of further boosting the ongoing bull run. The influx of institutional money has made this market more intense than ever, including big companies like Microstrategy, Marathon Digital or BlackRock, etc.

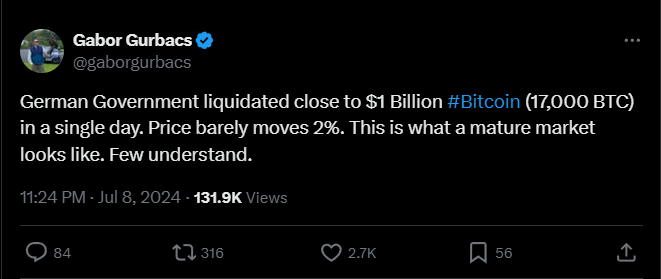

Many of us also know about El Salvador, which was the first country ever to adopt Bitcoin as a legal tender. Well, El Salvador is now sitting on a national Bitcoin stash worth over $603 million, so looks like their big bet has been fruitful. Meanwhile, on the other hand, the concerns about major Bitcoin dumps, like the recent $1 billion transfer from Mt. Gox, seem less significant right now, as the market absorbs large sales with ease.

Altcoin Season Soon?

Bitcoin has been the first mover in the crypto world and whenever Bitcoin rises, the entire cryptocurrency market benefits, as we have seen in the past after Bitcoin’s pump, capital flows into altcoins, and many investors get their portfolios multiplied, so I am strongly hoping the same will be happening this time as well. But as history has also shown, bull markets do not last forever, and they come down, they come at a much higher speed. Eventually, one day in the future the market will correct, and many altcoins may lose value again as Bitcoin consolidates. So, we should be very cautious during trading or buy-sell when dealing with crypto.

The Future of Bitcoin

I think Bitcoin’s rise of over $100K is more than just a financial milestone, it is a cultural and economic revolution and will be marked in history. For those who have been part of this movement, this is a moment to celebrate and for those who are just now paying attention, it is a reminder that the future of money is unfolding before our eyes. Now in the future, whether Bitcoin hits a new milestone of $200K, $500K or even $1 million or not, one thing is certain it has already changed the financial world forever. Please note that nothing in this post is Financial Advice and please DYOR before investing in crypto.

Information Source

I hope you liked reading my post about Bitcoin, its story and its probable future. Let me know what you think about Bitcoin and its future. Let me know in the comment section below and I will be seeing you all in my next post.

Posted Using InLeo Alpha

Bitcoin news is pleasant to hear now