My two years long journey with Holozing Liquidity Pools | Here is why I decided to add more in to it!

Hello to my fellow community members,

Friends, today I revisited my HoloZing liquidity pool positions. About a week ago, I was confused about whether I should add more liquidity or not, but today I am going to share the decision I have made and explain it to all of you.

Friends, my liquidity position can be seen in the screenshot below.

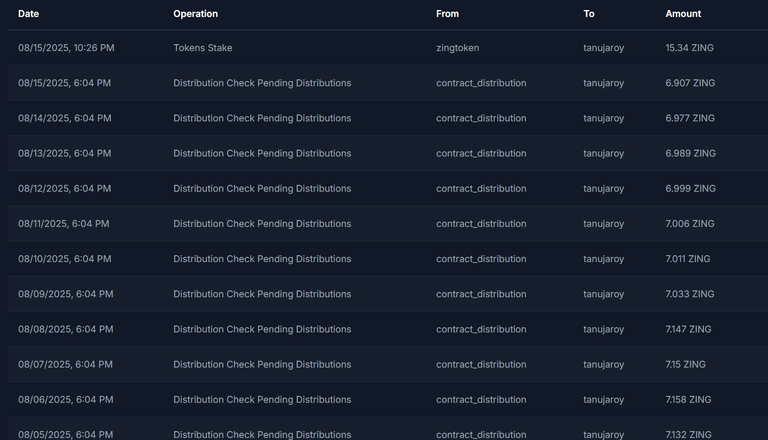

Now, let us look at the rewards I have been receiving for providing liquidity in the pool over the last few months. In the screenshot below, you can see that I am receiving around 7 Zing tokens every day for the liquidity I have provided in the Zing and Hive pair. This is actually a decent reward because 7 Zing tokens a day will give me over 2000 Zing tokens in a year, which is not at all bad.

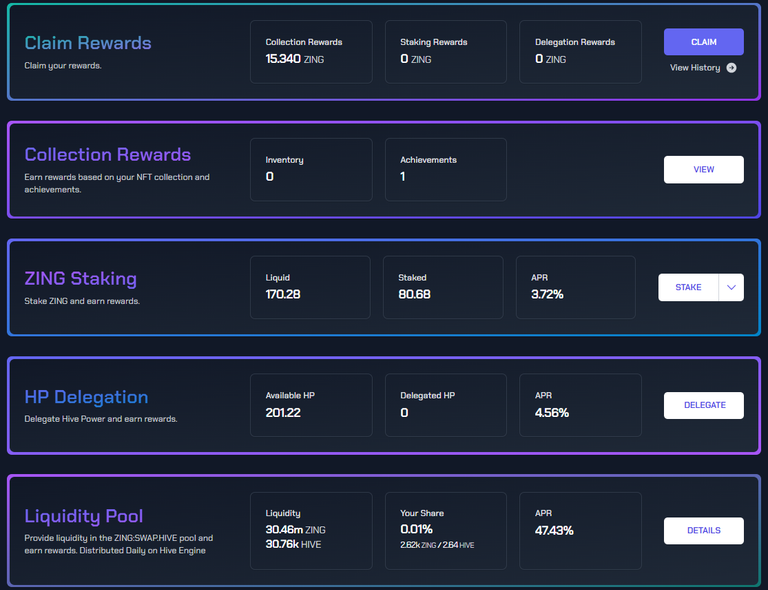

I also realized that I had not opened the Holozing website for a long time. So, I headed over to the website to claim some rewards. I know I am not receiving many rewards there, but friends still, I do not want to leave them unclaimed. In the screenshot below, you can see that I claimed around 15.34 Zing Tokens.

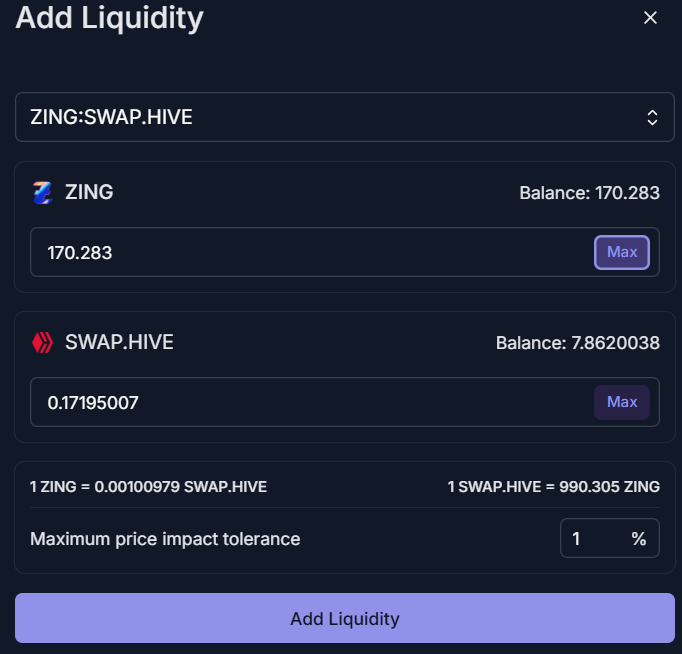

After that, I went back to the Tribaldex website and made sure to use all the ZING rewards I had earned to add further into my liquidity position. In the screenshot below, you can see that I added 170 ZING tokens and 0.17 SWAP.HIVE tokens to increase my liquidity position today.

Today, I also checked when I first participated in the HoloZing liquidity pool and realized that it has been more than two years since I first added liquidity for the HoloZing native token and Hive token, as you can see in the screenshot below.

This is the reason, friends, why I am not going to remove my liquidity position. I have held my trust in the team of Holozing for the last few years, and I know that in the near future the game will be launched and things will probably change. But even if things go the other way, I am ready to accept that because I am not investing too much into the liquidity pools and I am prepared to lose what I am investing at this moment.

So that’s all friends for this blog.

Posted Using INLEO