It's one year since Bitcoin ETFs were launched

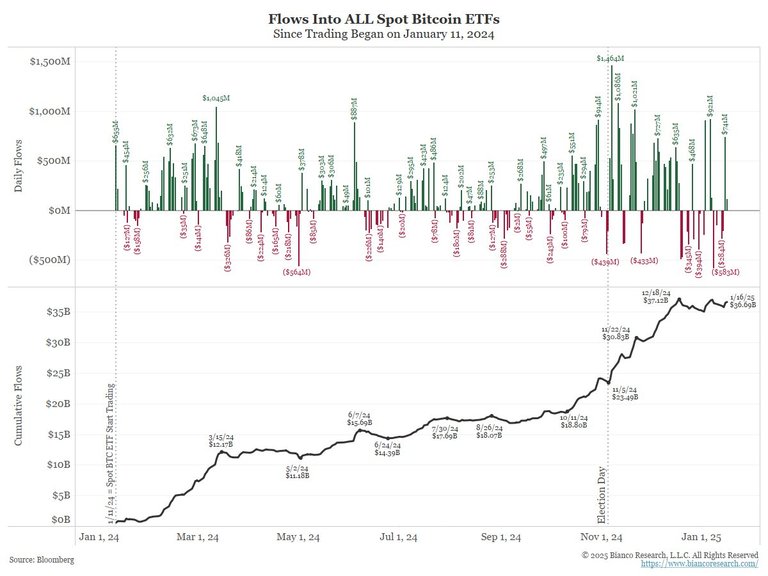

Bitcoin ETFs started trading approximately one year ago on 11th January 2024.

They started with $29 billion due to the GBTC (Greyscale BTC Trust) conversion into an ETF.

Total assets are $114 billion - but that's been caused by the rise in bitcoin's price increasing the value of the ETFs.

The actual net new money flowing into the ETFs is $36.39 billion once you exclude the initial $29 billion Greyscale money:

That's not as much net new money as people predicted. But it's more than the $28.2 billion Michael Saylor's MSTR has added over the same period.

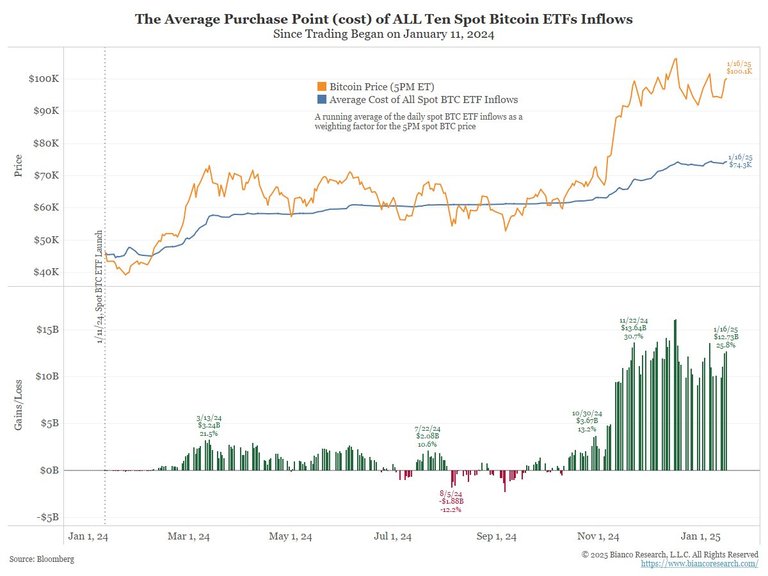

One worrying thing is that the dollar cost average purchase for the ETFs is $74,300. See

That seems to be because most of the purchases happened after the US Presidential election. It won't take much of a correction to put them underwater.

My conclusion is that the effect of the Bitcoin ETFs were over hyped. Yes it allowed American Wall Street types to divert a bit of money into bitcoin. But because these ETFs are traded on mainstream stock exchanges, they are easy to short. As is MSTR of course.

When the next downturn comes in the bitcoin cycle, the ability to short these ETFs will play a big part in price drops. Unless someone on the other side of the world has reason to buy.

In my opinion, Bitcoin's future doesn't depend on these ETFs, it depends on non-Americans discovering reasons to hold it in cold wallets (perhaps as a hedge against unstable governments, perhaps holdings by small govts as a hedge against the whims of the IMF).

Well, you were right that they were over-hyped.

Not enough new money entered crypto.