Bitcoin is still one of the best performing assets of the last decade

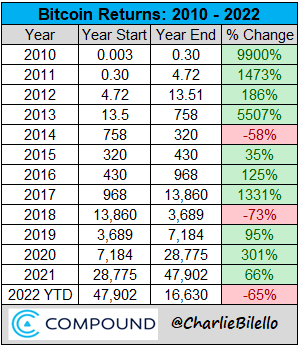

Here is the chart of returns from 2010 (when bitcoin was first sold for fiat, establishing a price):

There have only been three bear years, 2014, 2018 and 2022. The combination of increased adoption and decreasing supply caused by halvening every four years and Satoshi not selling his stash, have supported the price.

One massive caveat: for most of bitcoin's existence, Quantitative Easing has been in place. QE causes asset-price inflation, and that includes the fiat price of bitcoin.

In 2014, the Fed stopped QE, and in 2018 they did mild QT where they let maturing Treasuries run off the books instead of reinvesting them. And in June 2022, the Fed started letting maturing assets run off their books again, accelerating the pace from October.

Is it a coincidence that those three years have been a bear market for bitcoin? I think not.