The Digital Landscape is Changing: Challenger Banks vs. Cryptocurrency

The financial world has seen a revolution in recent years with the rise of digital technologies and the increasing popularity of cryptocurrencies. The traditional banking system has faced a significant challenge from challenger banks and now, with the rise of cryptocurrencies, these challenger banks are also facing a new threat. The competition is on multiple levels.

In this blog, we'll explore the relationship between challenger banks and cryptocurrency and how cryptocurrency could potentially replace challenger banks altogether.

Innovating On The Status Quo

Challenger banks, also known as neobanks, are digital-only banks that offer financial services through online platforms or mobile apps. They aim to disrupt the traditional banking system by offering lower fees, better customer service, and innovative features that traditional banks do not provide. A popular example is Ant Financial, an affiliate company of the Alibaba group. Ant Financial is arguably the biggest fintech company in the world. However, there are also other challenger banks like Revolut, N26, Chime etc.

Challenger banks have been very successful in attracting younger generations, who are usually more comfortable using digital technologies and are looking for a more personalized banking experience at their fingertips. Challenger banks are very mobile friendly if not mobile only.

Changing The Status Quo

Cryptocurrency, on the other hand, is a decentralized digital currency that operates on blockchain technology. It allows individuals to transfer money and make payments without the need for a central authority or intermediaries. Cryptocurrency also offers a level of anonymity, as transactions are recorded on a public ledger but not linked to the real-world identities of users.

Furthermore, cryptocurrency offers lower transaction fees when compared to traditional banking services, making it an attractive alternative for many people especially those who frequently transfer money or make online payments.

Mutual Benefit?

While challenger banks and cryptocurrency both aim to challenge the traditional banking system, they differ in their approach and their target audiences. Challenger banks focus on providing a better banking experience for their customers, while cryptocurrency focuses on offering a more secure, efficient, and affordable financial system.

However, the rise of cryptocurrency has forced challenger banks to adapt and integrate cryptocurrency into their platforms if they want to remain competitive.

Some challenger banks, such as Monzo and Revolut, have already begun offering cryptocurrency services, such as the ability to buy, sell, and hold digital assets. By doing so, challenger banks are expanding their offerings and attracting customers who are interested in cryptocurrency.

This integration could potentially benefit both challenger banks and cryptocurrency, as challenger banks can attract a new customer base while cryptocurrency can benefit from the stability and trust that challenger banks offer.

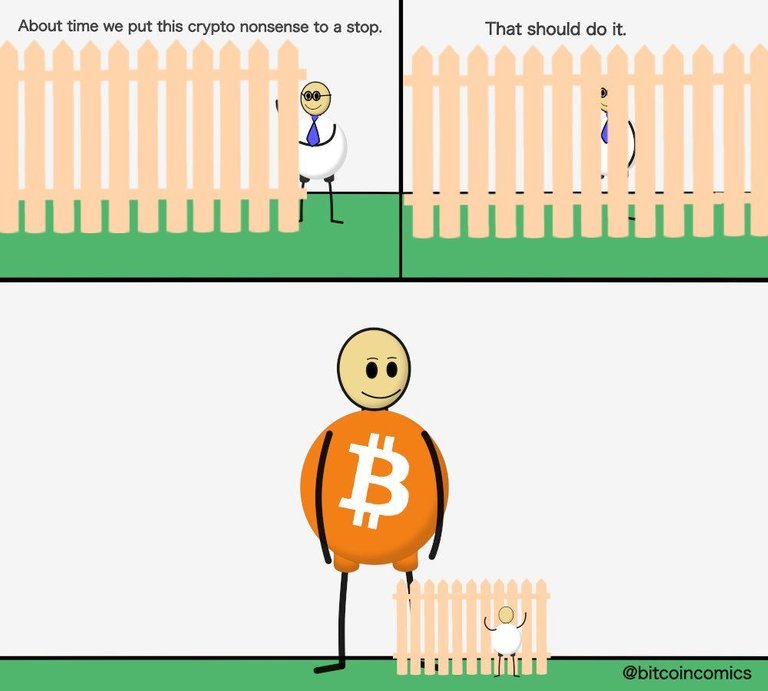

However, cryptocurrency also poses a threat to challenger banks as it has the potential to completely replace them. Cryptocurrency operates on a decentralized platform, which eliminates the need for intermediaries, such as banks, to handle transactions. This means that individuals can use cryptocurrency directly to transfer money and make payments, bypassing the need for a challenger bank or traditional bank.

Moreover, cryptocurrency has a significant advantage over challenger banks when it comes to cross-border transactions. With cryptocurrency, individuals can transfer money anywhere in the world, instantly and at a much lower cost (It's FREE with Hive), compared to traditional banking services, including challenger banks. As cryptocurrency continues to gain popularity and acceptance, it could potentially replace challenger banks as the preferred choice for cross-border transactions. And also eventually replace them altogether as the preferred choice for all financial transactions.

Conclusion

The relationship between challenger banks and cryptocurrency is both of competition and collaboration. Challenger banks are challenging traditional banks by offering a more convenient, affordable, and innovative way for customers to manage their finances, but they are also being challenged by cryptocurrency.

Cryptocurrency offers a decentralized and borderless financial system that provides a level of anonymity and financial freedom not possible with traditional banking services. As the digital landscape continues to evolve, the relationship between challenger banks and cryptocurrency will also continue to develop, and it will be interesting to see how they shape the future of finance.

While cryptocurrency has the potential to completely replace challenger banks, only time will tell if/when it will be able to reach its full potential and challenge the traditional banking system in all its aspects.

Thanks For Reading!

Profile: Young Kedar

Recent Posts;

● Artificial Intelligence: Are We Approaching The Tipping Point?

● The Blockchain Revolution: How Close Are We To A Tipping Point?

● Understanding The Tipping Point Of Technology: Why Some Innovations Take Off And Others Don't

● Exploring The Practical Uses Of Cryptocurrency

● Exploring The Theory Behind Cryptocurrency

● The Meritocracy Debate: How Does It Align With Incentivization Models?

Dolphin Support: @cryptothesis

Posted Using LeoFinance Beta

I would just like to draw your attention to the following.

Don't use images for which you don't hold the license or author's rights, especially if they are not free to use for commercial purposes. (Publishing a post with which some kind of profit is made, no matter if in fiat or crypto, is considered as commercial purposes.)

Using an image that is not your own without an obtained license or some other type of author's/owner's usage consent is considered plagiarism.

Naming the source doesn't help, as it's still unauthorized usage. As well, an image is a work as a whole, so referring to some fair share use (like quoting some portion of some other author's text) wouldn't help or erase that plagiarism thing.

I know that you are relatively new around here, but these are some general rules of publishing (online and offline), and they are equal for the textual part and for the illustrative part. And the fines for plagiarism are quite high (e.g., they may be counted in thousands of dollars for just one image).

Besides, someone else without the patience to explain all of these may report you even here on Hive, and your post may get downvoted, and you will lose all your earnings.

Therefore, I think it's really something worth taking into consideration and taking care of it.

There are many sites out there where you can take photos and images free to use, even for commercial purposes to decorate your articles. I'll leave you the links to a couple of them, but there are many more similar ones out there that may keep you on the safe side.

Thanks for giving me the feedback and drawing my attention to it. I really appreciate it and will do as you suggest.