On Overview of Stable Pools on Cronos

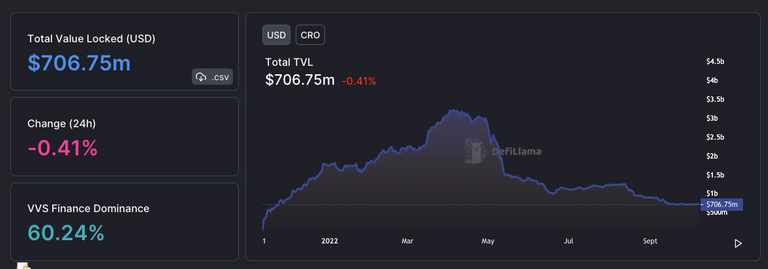

Cronos chain is the 8th largest DEFI chain* by Total Value Locked at time of writing in October 2022

I've had some stables locked up in Cronos for several months now and it's done OK, and this post just reviews the current offerings on Stable farms and considers whether it's worth my staying Vested in the chain...

I provide below an overview of the three largest protocols by TVL which are:

- Tectonic

- Single Finance

- CougarSwap

*excluding the comedy 'chain' Tron.

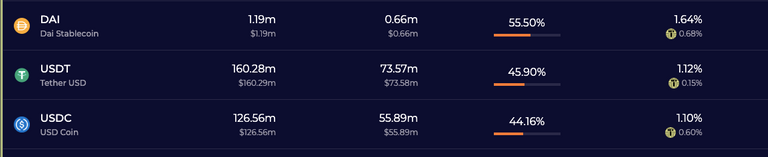

Tectonic

Tectonic is the largest lending platform which has only disappointing returns on offer...

Better than nothing and for relatively minimal risk, but simply not worth it IMO!

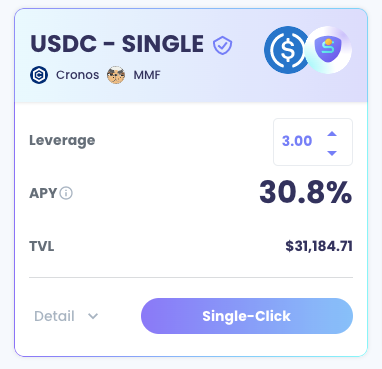

Single Finance

The only offers available on Single Finance for stables involve pooling stables (USD shown below) with Single, the native DEFI token of the network for a 30% APY

Or you can pool USDC with the more established CRO for a 14% return

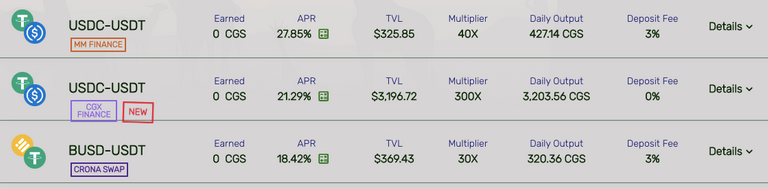

CougarSwap

CougarSwap is a yield aggregator which IMO offers the best returns on pure stables pooling - averaging out at around a 20% APY

But there is usually a hefty 3% deposit fee, and so you'd need to leave yer funds staked for at least six weeks to make your money back and by that time the CGS price may be a lot lower, meaning the yield will be lower.

There are also options with higher returns for pooling the native CGS token with stables, but we all know what happens there - yer stables get sucked dry!

Final Thoughts - Cronos - worth sticking with it...?

There is ONE significant advantage to using the CRONOS network - IF you have a CRO credit card....

You can stake for a return and then farm your yield out straight to your credit card and exchange for fiat to buy your weekly coffees and shopping, or even fill up yer car without having to rely on centralised exchanges such as Binance or Kraken.

However this isn't so much about this system of crypto to fiat extraction having greater security, as really the Credit Card itself is your centralised point of control rather than the exchange.

Rather it's about convenience - you can just go straight from the CRONOS chain to the CRO wallet app on your phone rather than having to go CRO-BSC-Binance-Bank.

The main downside of CRONOS is that I'm not convinced about how decentralised and to get the best returns you need to buy either CRO or whatever DEFI shitcoin is native to the particular protocol you are staking to!

While CougarSwap offers decent returns on pure stables, this depends on the value of their native token holding up, which history tells us is VERY unlikely!

So for me I'm not inclined to leave any funds in CRO, the convenience of extraction doesn't outweigh the risks of having to hold and pool these DEFI coins!

The more I look at these options the more I'm happy to just rely on Hive and Hive-Engine to pool or save my stables!

I have a bit of CRO sitting with CDC waiting for the bull market to come back. I am sitting on some pretty big loses so far.

If it ever comes, it hasn't been pretty the last year or so!

I do not own any CRO but seems like they are kind of offering some decent return considering the stables. With the recent hacks and other security issues I am kind of staying neutral in this matter. I do have stables atm and I will have a look at these pools. While as of now my best bet would be HBD I suppose! I am yet to decide which way should I take! lol

The more i look at it the more I think HBDs all the way.

When I checked out Cronos a long-ish time ago I didn't like two things: one that you mentioned, the native farming tokens, and second, the fees - they were quite high at the time, high enough to hurt compounding. At the time their ecosystem was very young as I remember. I think they only had CroDex. Now you already mentioned 3 others and no CroDex.

Offerings have grown for sure, I guess it's due to the Credit Card making it more visible.

Crodex is around but lower down in terms of TVL.

I agree the fees aren't great it's very much a once a fortnight maximum thing for compounding!