Zero To Hero Challenge Ep10: The Bottom Feeders

How low can we go? Feels like we are playing a twisted game of limbo with the stock markets right now.

Every directional move presents a new challenge. Currently Im knee deep in chop zone with the $BBIG shares moving sharply in the final day of Q3.

Q4 is already looking gloomy as the economic stats have not improved much across the board. We are on the cusp of a much greater economic crisis being brought on by sovereign debt, but that is a conversion for another day.

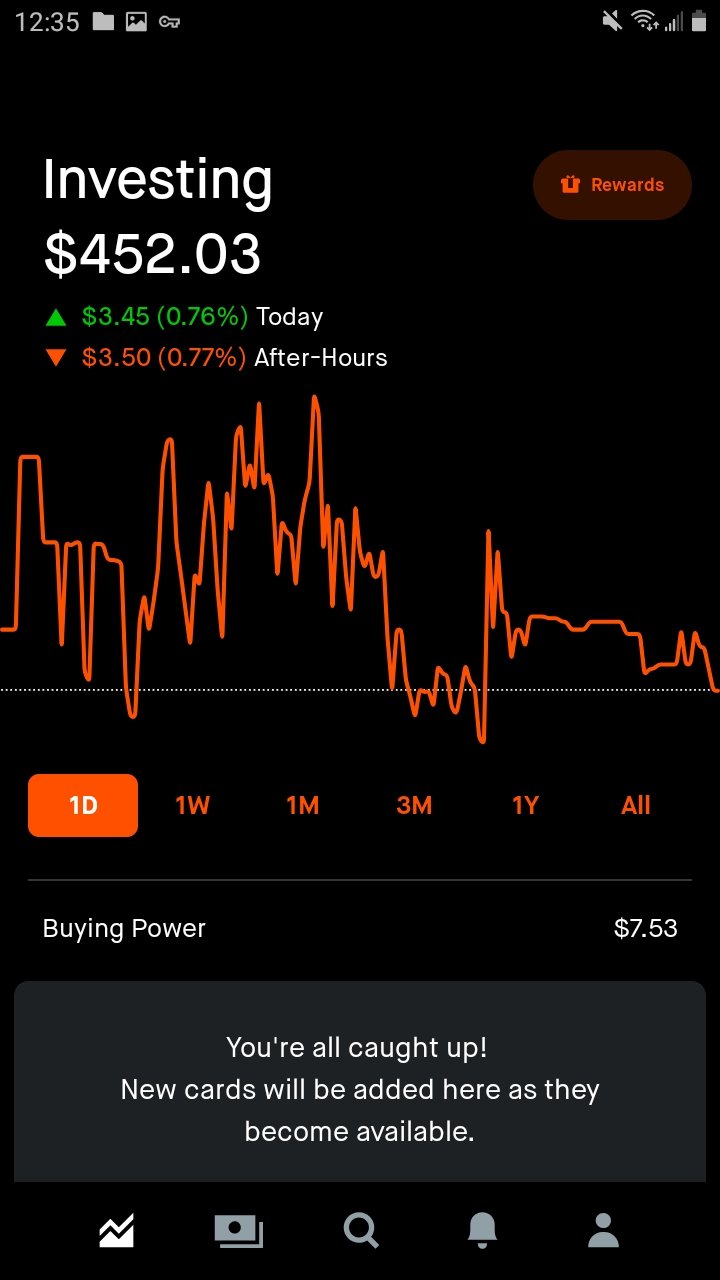

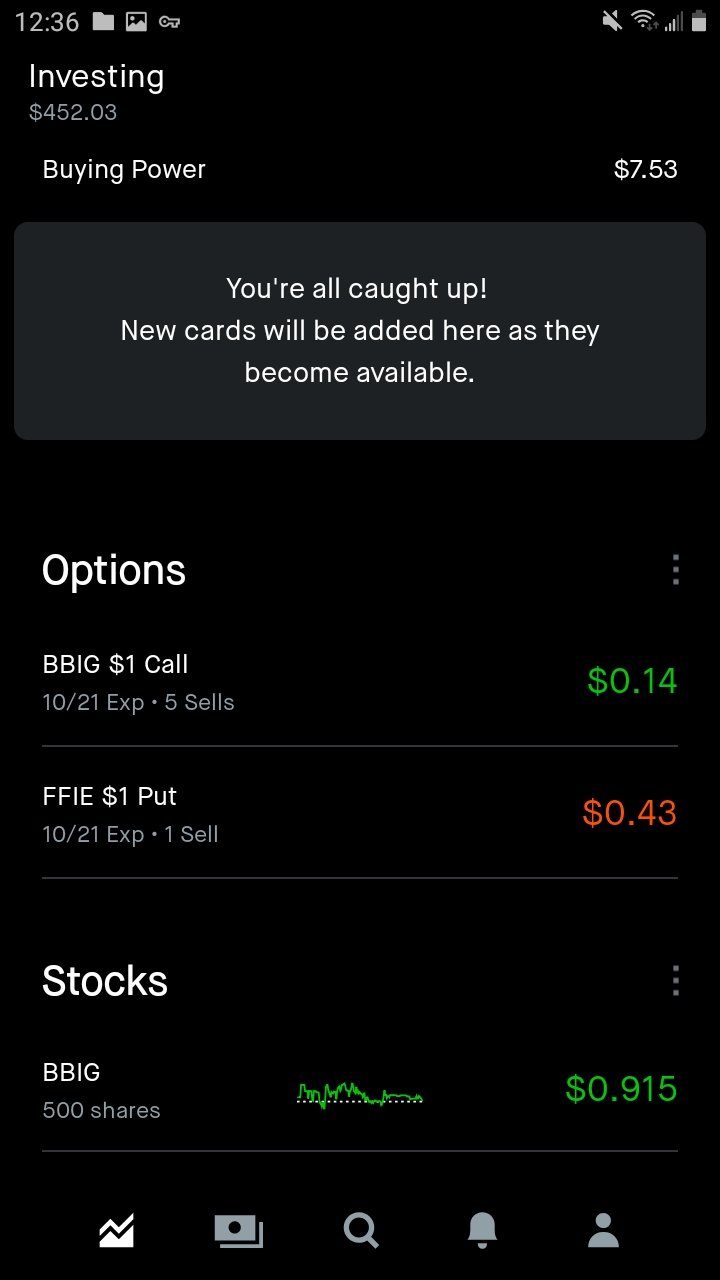

Here is what my portfolio is up to:

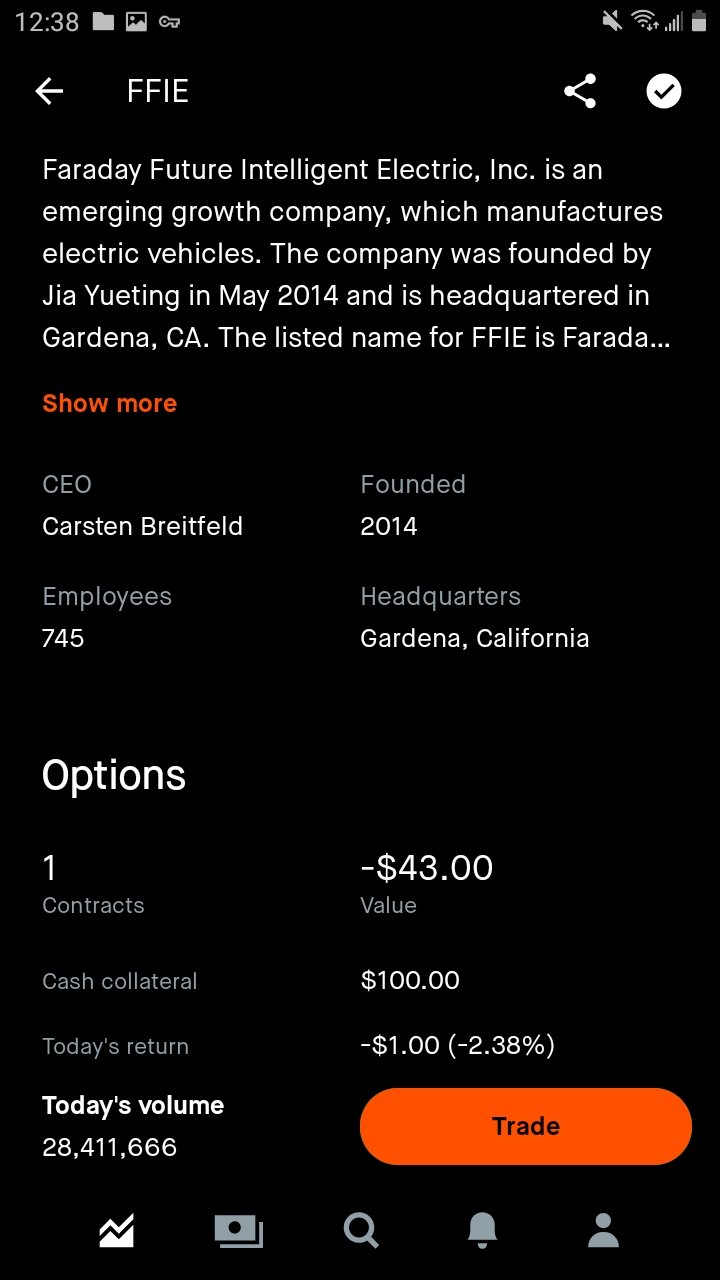

This week I sold a cash covered put on $FFIE using my premiums collected from $BBIG covered calls.

Lets just say their stock isnt performing so well, and this could in fact be a very dicey play. If Faraday closes below $1 by October 21st then I will be assigned to buy 100 shares at $1 each.

The stock is currently trading around 64 cents, so that would be a total loss of $36. Luckily I was paid $40 in premium to open this contract which makes my breakeven 60 cents per share. Should the price close above $1 on the expiration date then I will get back $100 in collateral clean and clear.

In summary I want $BBIG to remain below $1 and for $FFIE to go above $1, within the next 3 weeks.

Also I have been contemplating adding more capital to my position but think its best to hold off until the market certainty returns to stocks. Perhaps stacking Bitcoin would be a better alternative while its below $20k.

@ecosaint Please boost this post for extra BEE curation!