Zero To Hero Challenge Ep 18: Bad Decisions

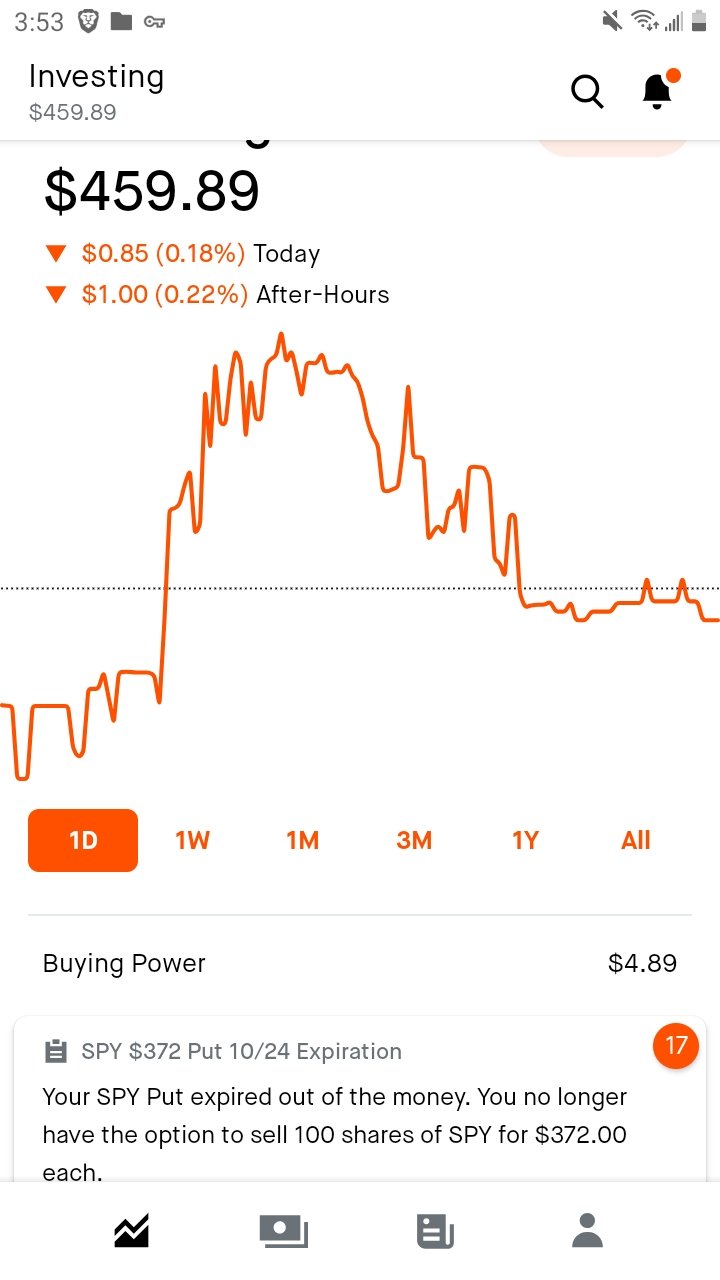

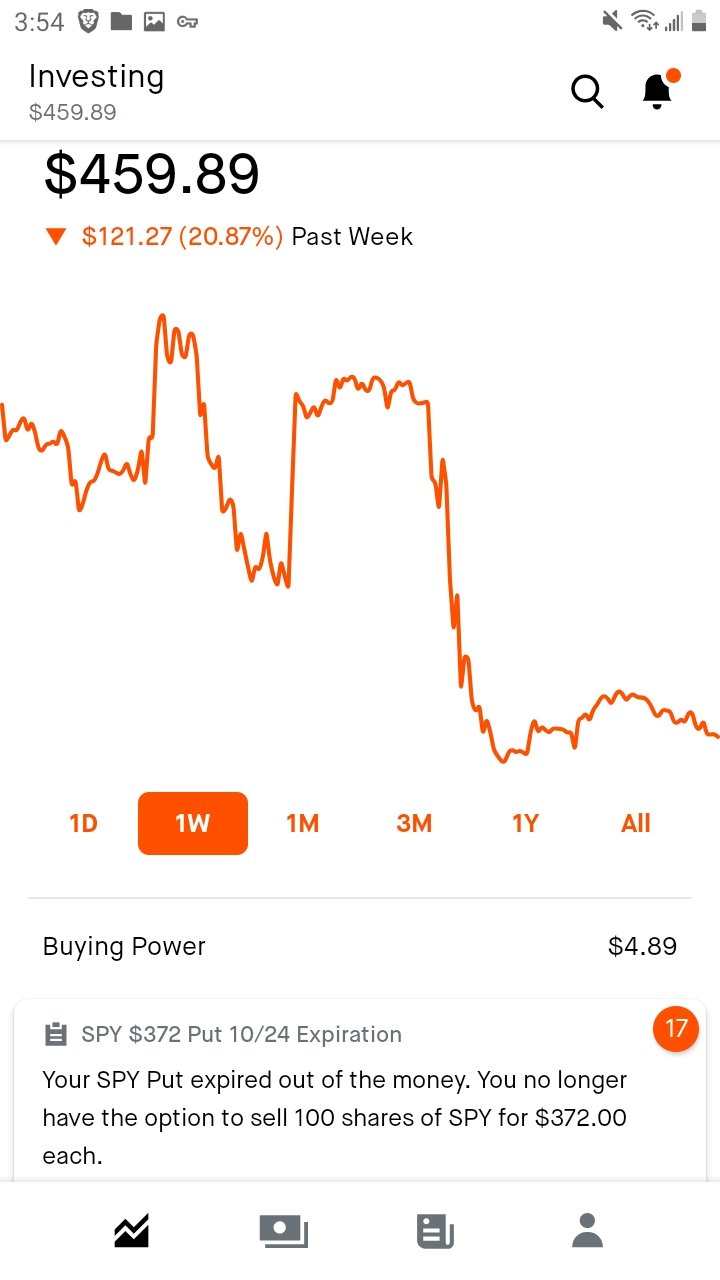

Im not gonna lie, I messed up big time this week by opening shorts on the SP500. We saw a monster rally Monday at opening and it continued the whole day through today (Tuesday). My Put Debit Spreads were very volatile the whole day and were worth about $20 at open. I thought to myself this could be an easy way to make a quick buck- which quickly backfired instead!

So what went wrong. First mistake was simply not taking my small loss and closing out ahead of time when there was still value to salvage. The second major mistake which screwed me was the dumb decision to try and "leg out" of my two leg option. This meant buying back one side and then waiting to sell back the other, potentially at a profit.

What actually happened was this-

I needed cash to buy back the one put option, so I sold 100 shares of BBIG (dont ask why). This gave me $91 which I used $86 of to close half the debit spread. This left me with one $372 put option at a high decay, worth around $60-80

I was trying to offload that at around $100-150 but the volatility spiked up and market rallied the complete opposite direction- this dropped it down to only $20-40. By the time I checked the price again midday it was worthless.

So basically I torched $120 this week when I could have only lost about $10-20 if I had managed that better. Lesson learned- STOP GAMBLING, rely on sure bets only like covered calls.

Essentially I was betting the market would be red on Monday and I lost. Doubled down and lost more. Stupid me, we will see if I can recover from this loss over the next month.

Ive got 500 shares of BBIG left thats it!

Dear @hotsauceislethal, sorry to jump in a bit off-topic.

May I ask you to review and support the new proposal (https://peakd.com/me/proposals/240) so I can continue to improve and maintain this service?

You can support the new proposal (#240) on Peakd, Ecency, Hive.blog or using HiveSigner.

Thank you!

@ecosaint Please bless this post with more $BEE curation!