Zero To Hero Challenge Ep 16: Circular Logic

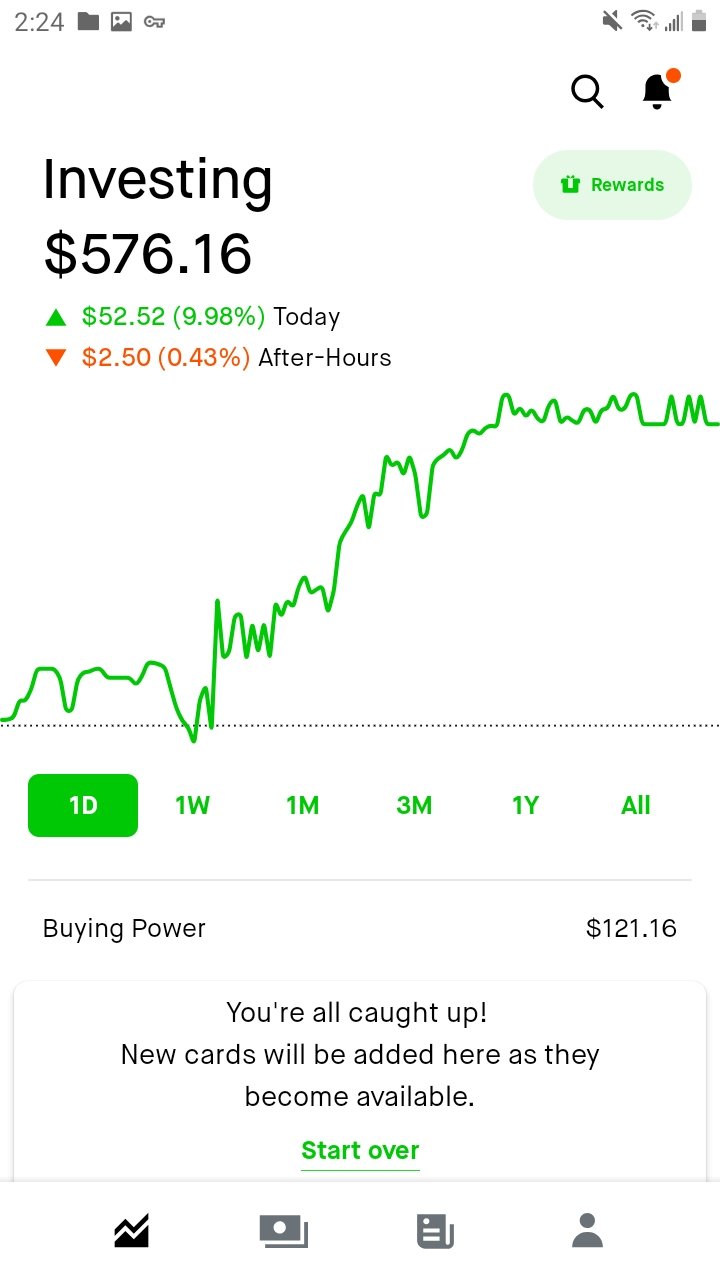

What an amazing day today has been! $BBIG popped off only 5 cents but that was enough for me to reap some benefits and the ability to write $1 calls in the money for higher premiums. From the price increase alone I made $25 then I was able to play the $SPY options both one the way down and back on the bounce up.

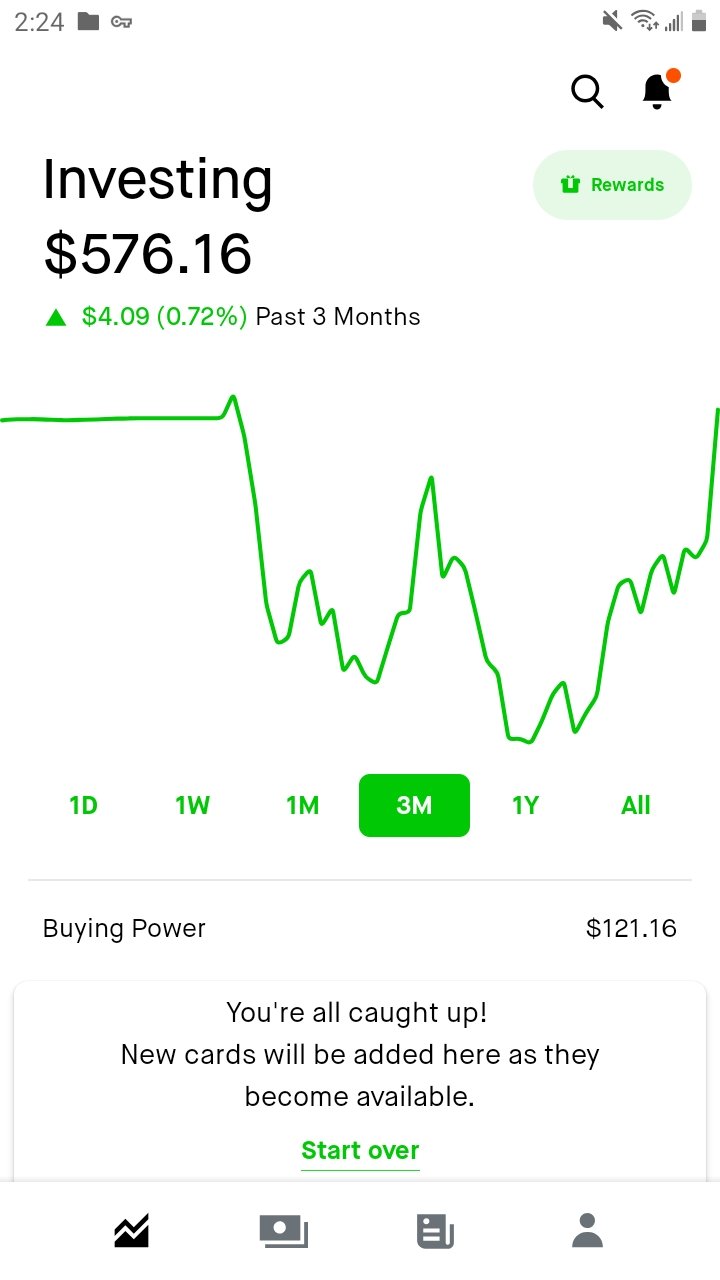

Oh and did I mention Im finally breaking even for the last 3 months! Sheesh, what a ride.

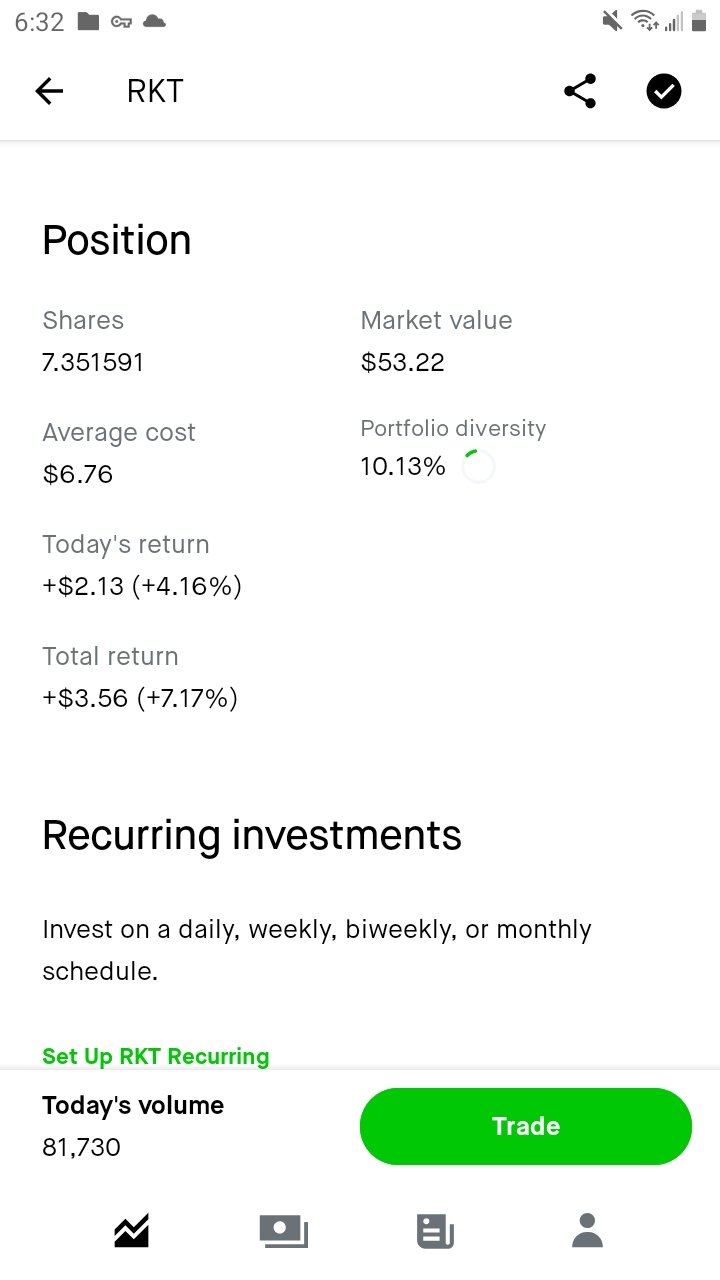

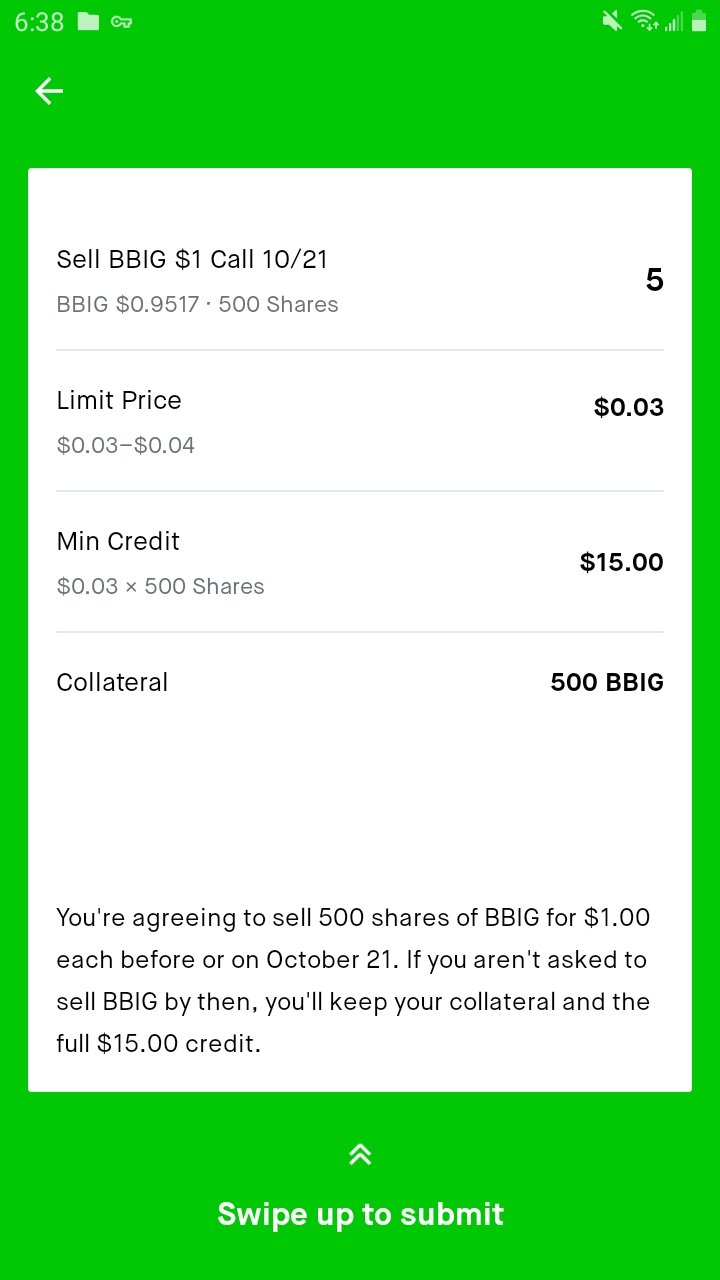

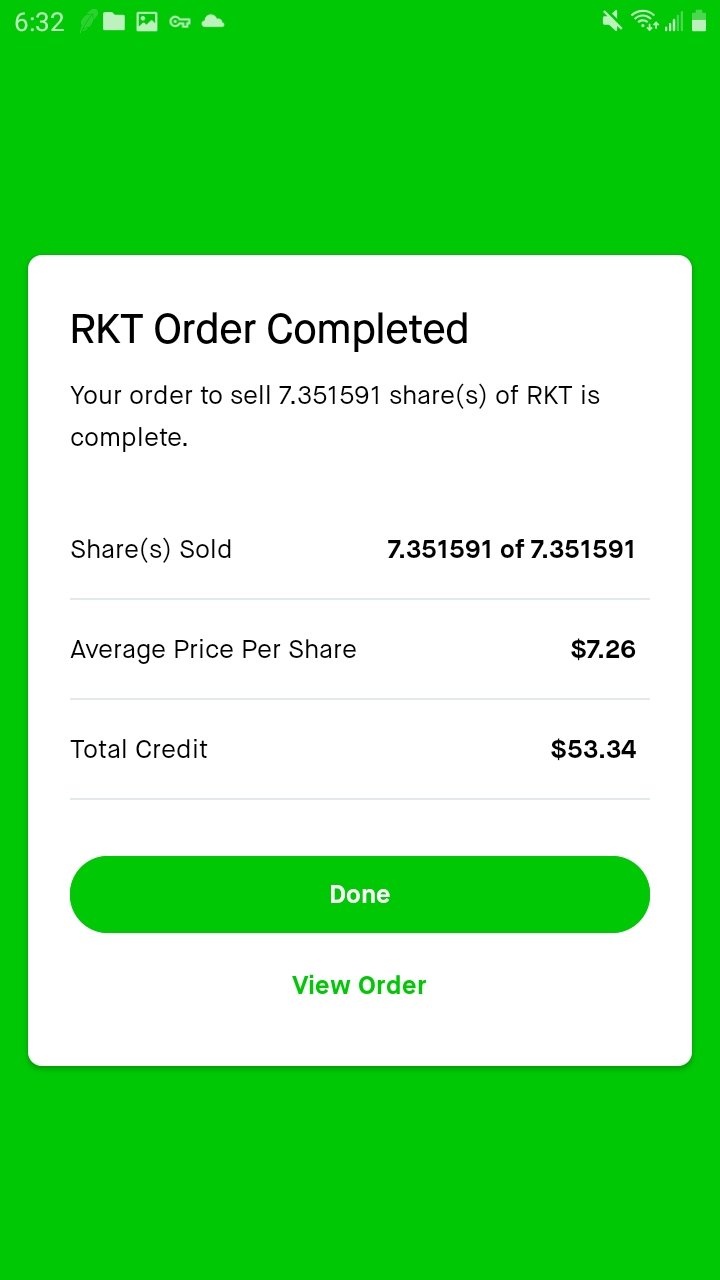

First the day started by me accepting my boredom and writing $1 calls Exp 10/21 for only $3 premium each, ugh. That was a quick $15 in the pocket but locked up my 500 shares as collateral. I quickly sold my $RKT shares off for a few buck profit, as it popped early and always dumps back down.

Then since I noticed the SP500 had gapped up massively it was time to short the top which is always fun. The price showed a quick peak almost instantly 2 minutes into trading. These kinds of days usually go one way- start high and sell down.

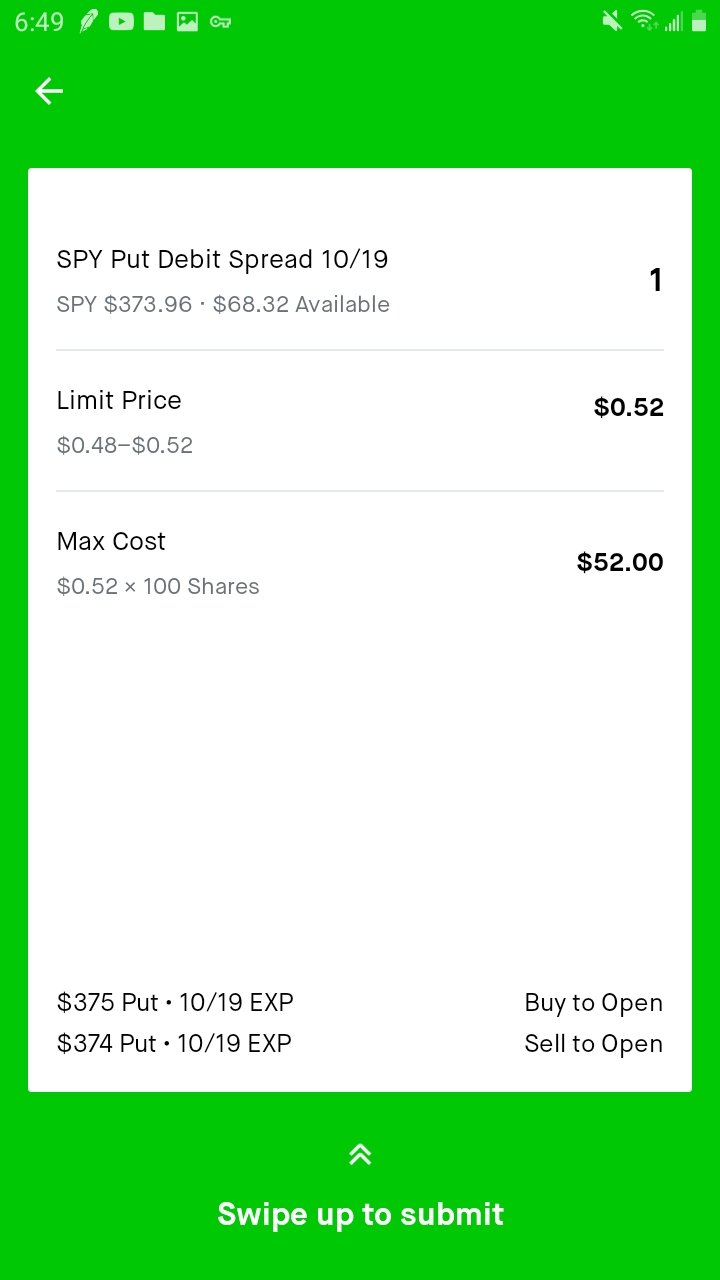

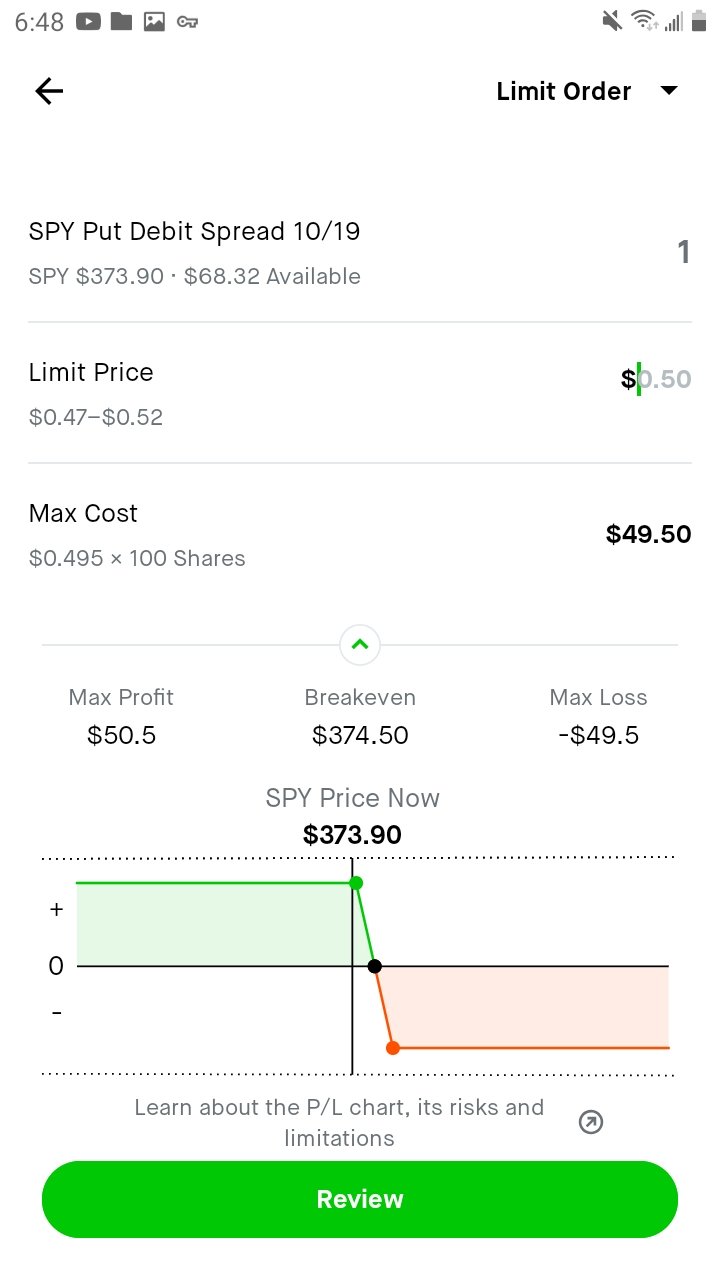

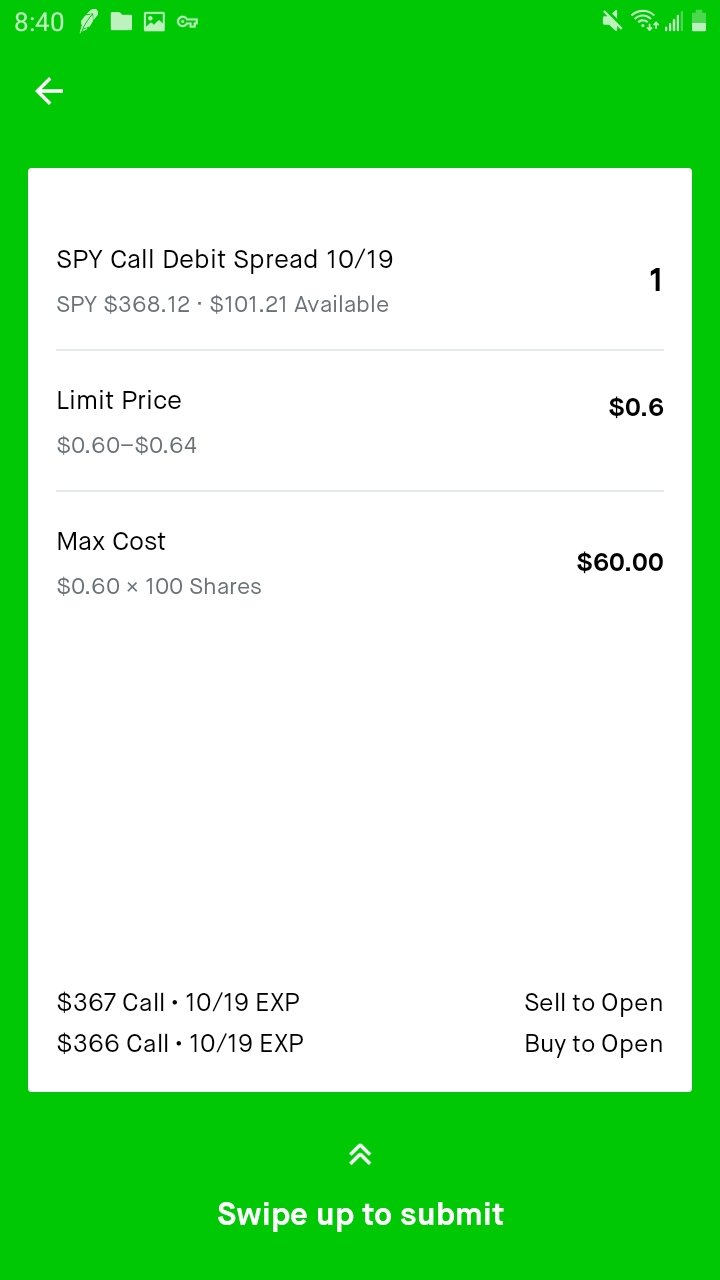

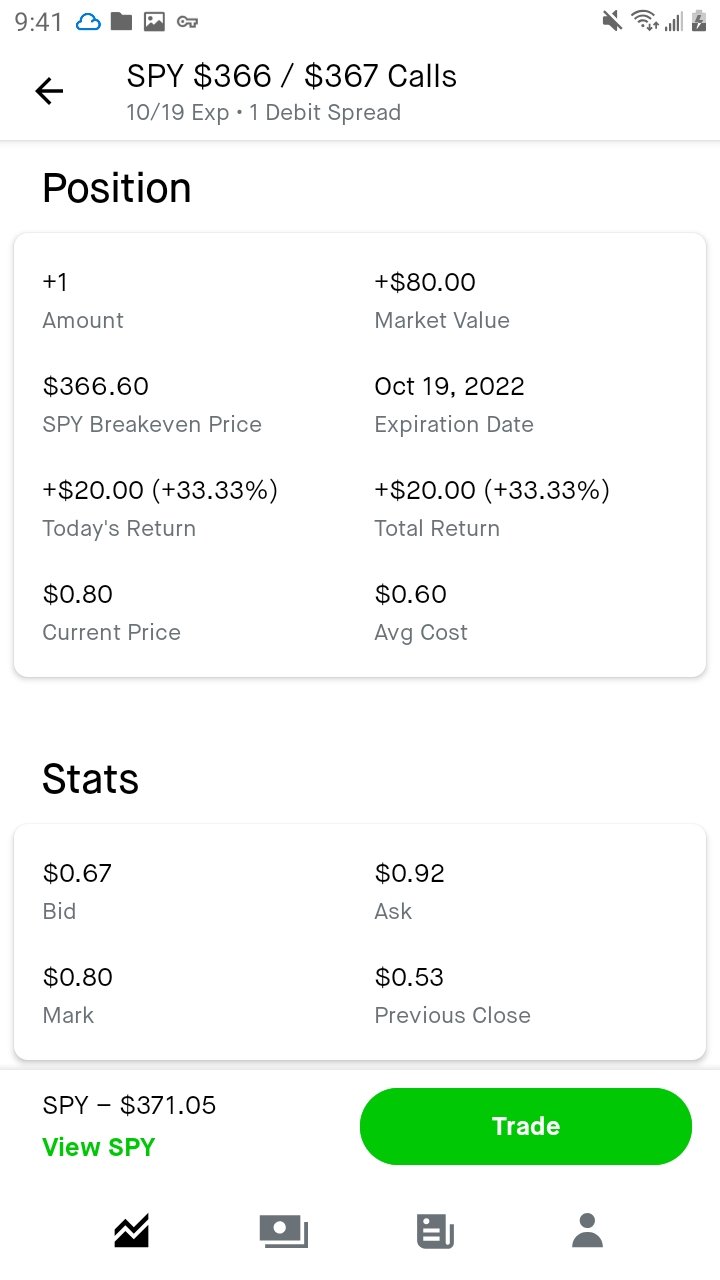

But I cant outright buy PUTS on the market that would be stupid and what a retail trader does! Im not dumb so I decided to use a "limited risk" trade known as a DEBIT SPREAD to still short while risking less capital overall. I wont go too much into details but its a two leg option where you both buy and sell a put/call in the same contract. The max loss is your premium, and max gain is the difference between two strike prices choses minus the premium paid.

I was able to quickly profit and exit this position as the SPY tanked below $370 and the volatility spiked. Debit spreads are a little trickier to get out of since there is an bigger spread on the bid and ask prices. I was able to turn $52 into $70 which is a 38.46% profit in only about an hour.

Since the SPY seemed to find support here near its previous days trading range ($367) I decided it was time to flip bullish! Crazy right? Nope this was also highly profitable where I was able to turn $60 into $80, a 33.33% profit on the way up.

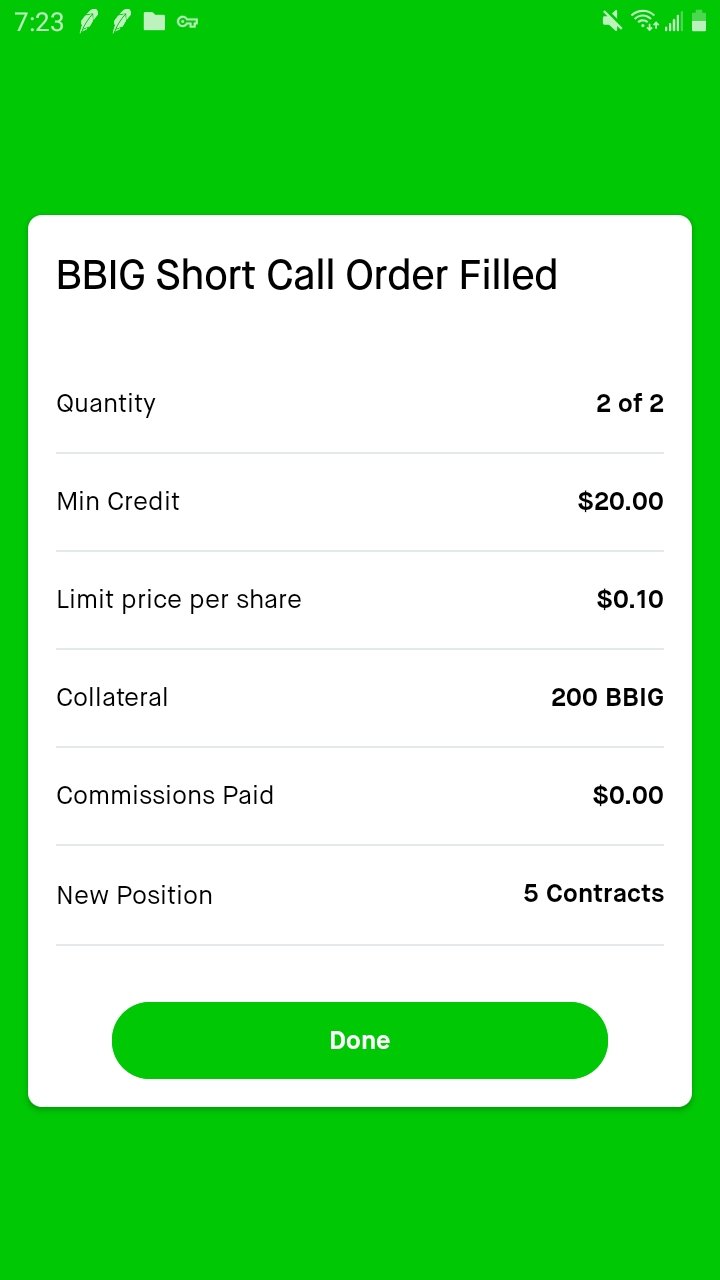

In the midst of all of this, BBIG decided to pump past a dollar again. Right after I had sold my calls too, how rude. So I bought back the calls I just wrote, at a $4 loss each. Then quickly wrote calls expiring next week to collect a total of $50 from 5 contracts at $10 a pop. This will decay faster and allow me to capture more value when rolling

over to the next epiry.

Thats all for today, stay active and stay hungry. Trading is not for the weak minded.