Crypto.com changed credit card rewards, now what? A Canada perspective.

What happened

Last week we were bombed with a email with the news from Crypto.com that they would change their credit card rewards system. I posted 5 months ago about some crypto trade systems that we can deposit FIAT money here in Canada, since we can't use Credit Cards in here to buy crypto )(HERE). In this post I mention that crypto.com was good option, since we can e-transfer from our bank directly.

And in addition I mentioned that the credit card has great benefits, I had the ruby card which I had to lock 500 CAD without any interest for 180 days, but I had 2% of cashback in CRO. In addition, I was planning to migrate to the indigo card to lock 5,000 CAD to get a staking reward of 10% p.a. and also a cashback of 3% by purchase in the credit card.

The platform and the credit card gained a lot of popularity and it grew a lot in the market. It will be even a sponsor from the FIFA World Cup soccer championship from this year.

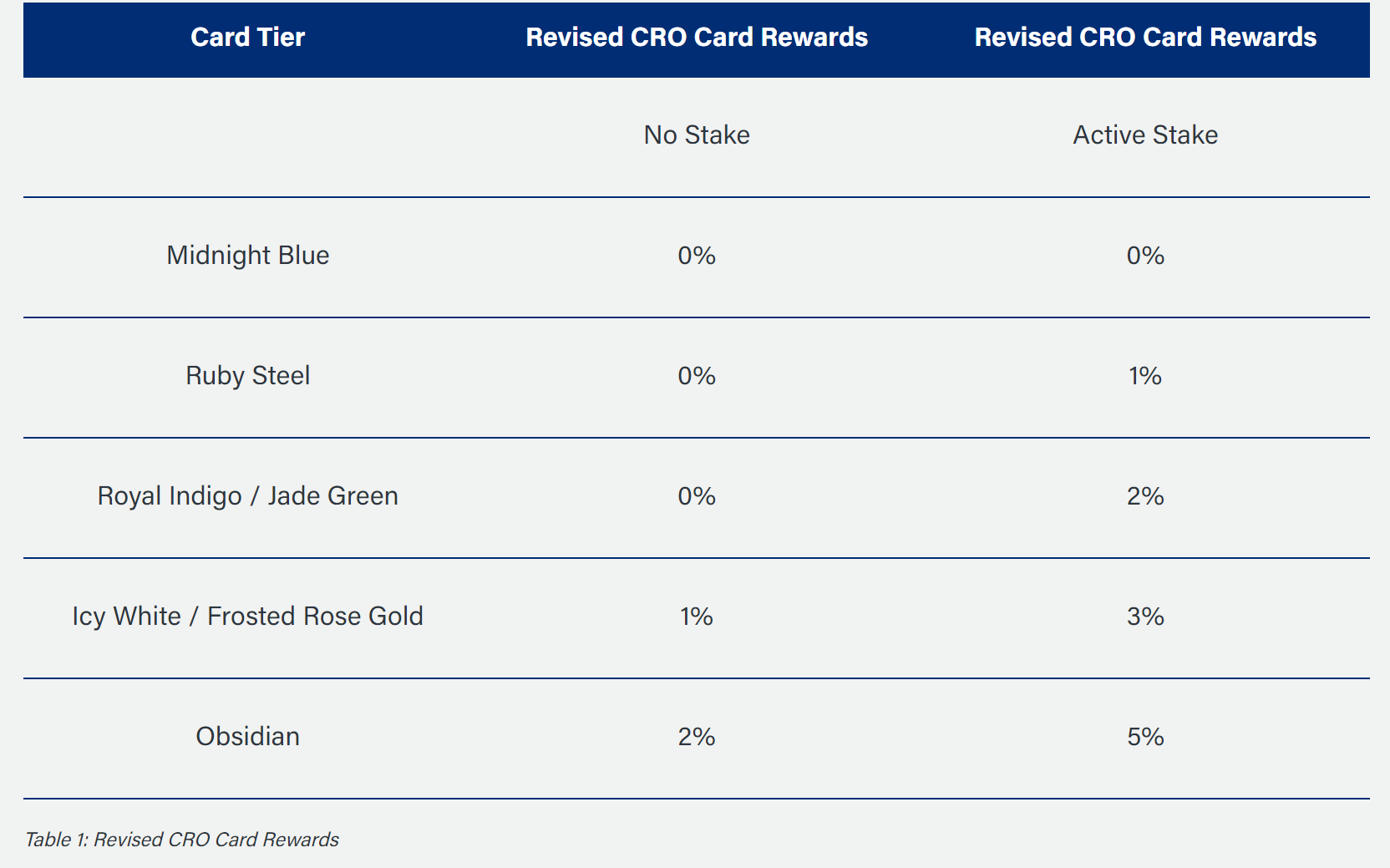

So, last week they announced a terrible cut in the cashback rewards and even in the staking, initially the ruby cashback would be from 2% to 0.5% and for indigo from 3% to 1.5%, in addition limits of 25$ (ruby) and 50$ (indigo) of cashback per month , with no more staking rewards. That made everyone crazy. CRO value dropped a lot. So they revised a little bit with the following:

As you can see, Ruby users will get 1% of cashback rewards and Indigo 2%. It is better then last week, but still is a crash, since you have similar options in the market. The limit of 25$ and 50$ is still ongoing. However, Indigo staking will give 4% p.a. now. CRO was already dropping because of the market mostly and some other problems, such as security instability in the past couple of months. But this unpopular changes made people to question more about the project. In my personal opinion I am one of these people. I still need to wait almost one month to unstake my remaining CRO( which were the 500 CAD in the beginning and they dropped now for half of this value). However, I transferred everything that was into supercharge events to HBD here in Hive. But about credit card what to do here in Canada?

Canada options

Well, I have been using shakepay platform for a while, mostly the daily shaking rewards. Every day that you enter in the platform and shake your phone you get progressive satoshi rewards, the day one starts with 100 satoshi and every consecutive day shaking it you get on top of it. I have a bad memory and I could only keep 30 something days in a role shaking and I could get around 300 satoshis in one day. But I always forget one day and reboot the count of consecutive days. Their platform is very limited, you can only buy BTC and ETH. However, they have a virtual pre-paid credit card that you can store in your mobile wallet which gives you 2% back in BTC until you reach 5,000$ in rewards. This is the same cashback that crypto.com is offering for Indigo users but NO NEED OF ANY STAKING. Of course those 5,000$ will end in one time, hopefully there are going to be other options in that time. If you want to join shakepay you can use my referral link HERE.

In The same post that I cited crypto.com, I cited wealthsimple, which is a big stock and crypto platform here. They have this credit card that they give you 1% cashback to your cash account, or you can choose to automatically invest into your stock or crypto account. It is a similar reward that crypto.com Ruby users will get now and again with NO STAKE rewards.To join wealthsimple you can use this referral HERE

Mogo is a Vancouver based platform to negotiate BTC. You can negotiate BTC from their mobile app. Their credit card gives 50 satoshi back for every purchase. I know that is a low value, you can get more shaking at shakepay. I added this option in here because they have a nice project of replanting trees, for every purchase they plant trees for you which is interesting.

Netcoins is another platform that gives you a pre-paid credit card. They have a good cashback of 3% in the first 3 months. After that it drops to 1%, getting to the same amount of the current Ruby card and wealthsimple.

Other option

While coinbase doesn't get in here with their 4% back in their credit card from the US. We can also think about other credit cards that gives cash back without being in the crypto world. The best option for me is the Simplii Financial Cash Back Visa Card. For the first 4 months they give you 10% back in restaurants and bars, this falls to 4% after this period. In addition they give you 1.5% back in groceries and gas, and 0.5% in other purchases. This is the only not pre paid credit card mentioned here.

It said that crypto.com forced me and others to leave the project, but let's see how it goes with the other options. If there is something better that I don't know, don't forget to comment!

Posted Using LeoFinance Beta

after watching the decisions crypto.com has made as a business, i will not care whatsoever if they are thrown under the bus metaphorically speaking and litigated into submission for securities offerings.

i want to make a claim of false advertisement, i got a card specifically for the cash back, and wouldnt have touched their shitty KYC garbage service without that cash back.

all of the accountants in my family now think crypto.com is a ponzi scheme with the CRO after watching the way they responded to the drop in share prices, these people are so bad at business they couldnt even handle the bad press and share price reductions.

Yay! 🤗

Your content has been boosted with Ecency Points, by @gwajnberg.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more