pHBD Stakers Vs pHBD Stakes: Who's Profiting the Most?

Greetings to my esteemed Lions 🦁 on the LeoFinance ecosystem and the entire hive blockchain. It's a brand new day and a time to analyze and compare between two variables on the LeoFinance frontend. It's your friend @faquan, saying hello from this part of the world.

The purpose of any project is to profit both the investors and the investment, now the question is, what is the percentage in-between the above parties? Is it equal or there's a disparity between them.

Today's post will focus on the profitability of pHBD to holders and pHBD stake and create a comparison between them, to know who's profiting most.

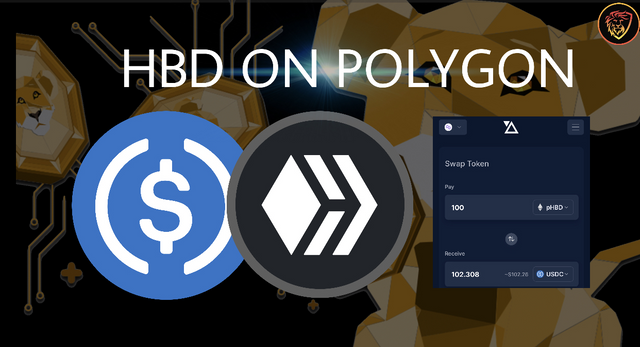

pHBD was launched in April due to the lacuna created by the on-chain HBD supply pool that was deficient prior to the launch of pHBD. This came as a result of the change in interest on HBD savings to 20%.

This saw the imminent launch of pHBD on the Polygon network and today, pHBD-USDC vault has a liquidty pools of about $350k (with a 5 million liquidity pools target yet to be achieved), it has an amazing 29% APR (this reduction came as a result of the bear season, but has the capacity to go beyond it's previous 40%).

According to @khal:

pHBD has about $100,000 staked and has earned $4000 on it. bridge fees and arbitrage have also created a lot of consistent income for the PolyCUB Protocol.Source

This to me is very impressive, because of the short period of which pHBD have existed and the amount of values it has created to the entire PolyCUB project.

pHBD Stakers Vs pHBD Stakes

If the above stakes of pHBD has amounted to $100,000, worth $4,000, what's the profitability of the stakers in terms of $ payouts.

I think I some previous AMA in the month of April, the stakers earn rewards from the pHBD platform just from the amount of APR as at the time of wrapping and unwrapping pHBD. Let's say, the APR was 40% as at the period of wrapping pHBD, what'll be the rewards of the pHBD staker, if it drops to 29% APR?

It should be noted that the essence of wrapping and unwrapping pHBD to and from the polygon network is to create liquidty pools for the project, with a reward pool as incentives for the holders.

Remember that everyone is at liberty to wrap and unwrap pHBD-USDC vault at anytime, but has about 0.25% fee that goes to the PolyCUB protocol.

The truth is that, we cannot compare what goes to the protocol with the rewards that a pHBD staker gets from wrapping and unwrapping pHBD.

It has been said previously that the PolyCUB linked projects are to create more values for the PolyCUB project and there are about 4 value accrual channels for pHBD-USDC vault.

I'll conclude by saying that, every party in the pHBD contract has an agreed rewards that each is expected to earn within the period of locking up HBD on the polygon network. This means that everyone knows there role in the project.

Posted Using LeoFinance Beta