Nigeria's total debt rose to $103 bln in 2022 - is the Nigerian economy at the verge of collapse?

Greetings to my esteemed friends on the InformationWar platform and the entire hive blockchain. It's another day and time to share with you news on Nigeria's total debt and how the country intends to get more indebted in months to come. It's your friend @faquan, saying hello from this part of the world.

Nigeria is known as the giant of Africa but due to economic challenges facing the country and rapacious corruption that has engulfed the state. It's so unfortunate that corruption has crippled into almost all spheres of the Nigerian society, making it very difficult for the country to come out of debt crisis.

Most debt accumulated by Nigeria comes from steady request for loans from International agencies such as the Paris Club and countries like the US, France and China. This loans has resulted into economic backwardness for the West African country.

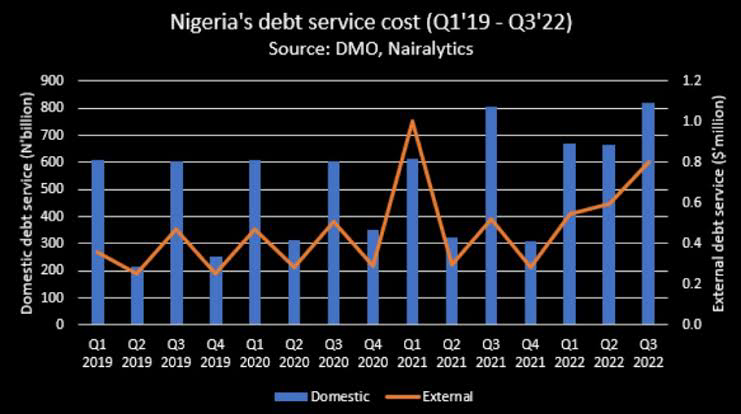

Nigeria's total public debt rose to 46.25 trillion naira ($103.1 billion) in 2022, from 39.56 trillion naira a year earlier, as the government ramped up borrowing to fund its budget deficit, the Debt Management Office (DMO) said on Thursday.

Nigeria's debt-to-GDP ratio stood at 23.2% in 2022, compared with 22.47%, within the country's self-imposed limit of 40%, the DMO said.

Nigeria's total public debt could rise to 77 trillion naira this year, the head of the DMO, Patience Oniha, said in January, if parliament grants approval for a central bank temporary advance to government to be swapped to bonds coupled with new borrowings to fund the 2023 budget.

Why is Nigeria's Debt Rising on a Yearly Basis?

This particular section of this post is my personal analysis of what could be the possible reasons why the Nigeria's debt is increasing constantly.

One of the major reason for the above is the fact that most of the loans gotten from overseas borrowing agencies aren't utilized properly. For instance, if the government proposes to use loans for construction of roads or let's say agriculture, the countries that offered the loans will want the Nigerian government to buy equipments from their country and also make use of their citizens to carryout such contracts and still pay the contractors with foreign currencies. This on its own is weighty on the loan.

Apart from the fact that the government make use of foreigners to execute the contracts, most local contractors are corrupt and could execute contracts using substandard materials which are not durable.

Secondly, most loans borrowed with high interest rates are shared among corrupt leaders (whose initial intention of collecting loans was to bring infrastructural development to the people) for their personal aggrandizement.

Possible Solution to the Nigeria's Debt Crisis

- government should reduce the rate at which they borrow from international loan agencies by resorting to building an export economy rather than a constant import economy. Truth be told, Nigeria has all it takes to become economic dependent and also an exporting nation.

- reduce dependence on oil export and diversify to other economic ventures such as agriculture, mine and steel.

- loans shouldn't be collected if they can't service themselves. One of the ways a loan can become profitable is when it can service itself.

Thanks!