Playing Around With Tribaldex Pools | Defi yield farming on the second layer on Hive :)

With all the quirkiness of Hive Engine and Tribaldex, it's still a much better option than having none.

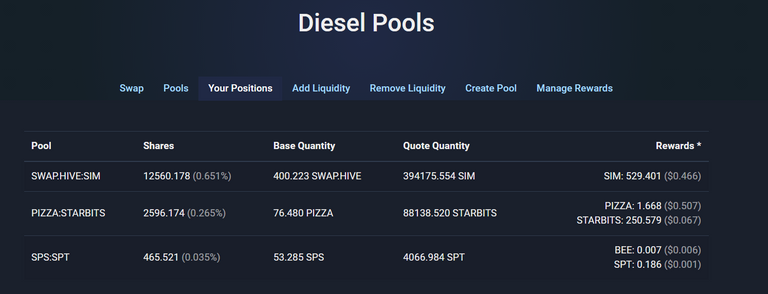

I'm in three pools now, with small positions. The SIM position is my largest one, reaching a 1000$ on occasions, while the other two are 50$ to 100$. Just a play.

https://tribaldex.com/dieselpools/positions

More info will be nice, like a dollar value of your positions and of course the APR :)

Manual calculation shows the SIM:HIVE pool has around 25% APR, while the PIZZA:STARBITS pool has more than 250% APR, mostly paid in PIZZA tokens.

The SPT:SPT pool has very tiny APR for now. There is a proposal to move a lot of inflation from the SPT to the LP.

What is interesting about the diesel pools is that the tribes can allocate a part of the inflation to liquidity providers. It will be interesting to see what % of the inflation will end up to LPs.

LP rewards are more investors friendly, but you need a community as well. Will see what this experiment shows.

yeah, I hope they get a better UI and a better UX soon! But still good that we have it :) It is currently impossible (?) to know the APRs when one is not in the pool...

Almost yes ... you can probably calculate it from the amount of rewards allocated, you get this when you click the coin on the "has LP rewards" note, and the total liquidity in the pool.

Thanks! But they really need to update this as I am sure that many people are not entering because of it. On other defis you can instantly see the APR which is obviously a motivator to start supplying

If you want other (and for me better) UI experience, please try BeeSwap! For me the Pools interface are so much better.

wow! How has this not more exposure?! Thank you :)

You are welcome:)

BeeSwap is only just expanding its capabilities, only quite recently has the Pool option been implemented. More Hive Engine features are planned, so it's worth adding to your bookmarks :)

I feel nobody knows about it, so it should definitely be more promoted!

I try to promote BeeSwap in every possible post where I touch on SWAP.HIVE or the Liquidity Pool topic. I hope it's good hah :)

I've been using BeeSwap to monitor my pools, it seems to have some of that info. available.

Posted Using LeoFinance Beta

Congratulations @dalz.shorts! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 2250 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDeFi liquidity pools on Hive has the potential to really take us to the next level.

Too bad the UIs across all of the different Hive-Engine front-ends suck and as you've shown here, it's confusing to see how much you actually stand to make.

I still think the SWAP.HIVE:SIM LP is by far the best one to be in.

The yield is respectable and at least there's a proper use case for the HE token that you're receiving as rewards (SIM).

The LeoFinance team should really consider setting something up with a proper portion of inflation allocated to rewards.

Posted Using LeoFinance Beta

Its a bit wonky but we are getting there :)

@dalz.shorts! The Hive.Pizza team manually curated this post.

Learn more at https://hive.pizza.

Tnx!

I notice that the pizza ones seem to be renewed monthly while other pools have 300 plus days before rewards end.