Reverse 50/30/20 Rule When You Get an Increment

50/30/20 Budgeting rule states that you allocate 50% of your income to the needs, 30% for your wants and the remaining 20% to your savings. In this way your income will be used everywhere along with increasing your savings. This budgeting rule is best for people who wants to start savings and they don't know how. Using this budgeting rule they will have clear allocation and thus you will know where your money is being used.

Now sometimes we can change the allocation, for example, you don't want to use your money for wants and your needs is more, then you can change the allocation as 70% needs and 30% savings and likewise you can change however you want.

But the problem is people starts increasing their needs and wants as soon as their their income increases. They will start to buy house, start buying car, more gadgets and what not. So their needs and wants are constantly increasing with their money but the savings remain the constant. This is where the reverse 50/30/20 rule for increment comes into picture.

The Reverse 50/30/20 rules states that when you get an increment in your income, the increment money should be reversed in the order that the 50% of the increment should go to the savings, 30% of the increment should go to the wants whereas 20% of the increment should go to the needs. In simple terms, if your money increased by $100 every month after the increment, then $50 will be saved, $30 can be used for your vacation, or any gadgets purchase and the $20 should be used for needs increment.

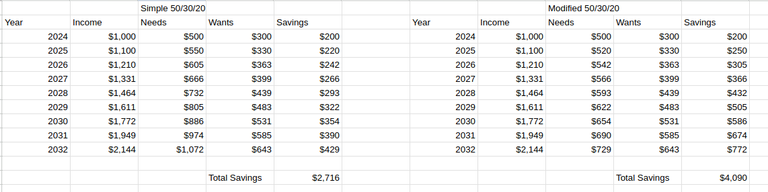

This will make sure that the increment in your income means that your savings increases proportionately and not your needs. This will make your that one time your savings is close to 50% of your total income and that what you will want in future too. I am sure that there is inflation where the prices increase in commodity is actually increase your needs subsequently. So if we compare both the method then in the 8 years you would have saved around $4000 whereas in simple saving you would have saved $2716. You can refer the simple sheet below to understand it better.

And in the 8 years time your savings money would have increased your needs money and thus you will be saving more than you are expense towards your needs. So I would suggest everyone to start with the modified 50/30/20 rule or reverse 50/30/20 when you get an increment and that should happen every year.

Posted Using InLeo Alpha

Learning how money works unlocks how the world functions.

That's absolutely true...

👏 Keep Up the good work on Hive ♦️ 👏

Congratulations @codingdefined! You received a personal badge!

Wait until the end of Power Up Day to find out the size of your Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts: