Mutual Fund Stress Test

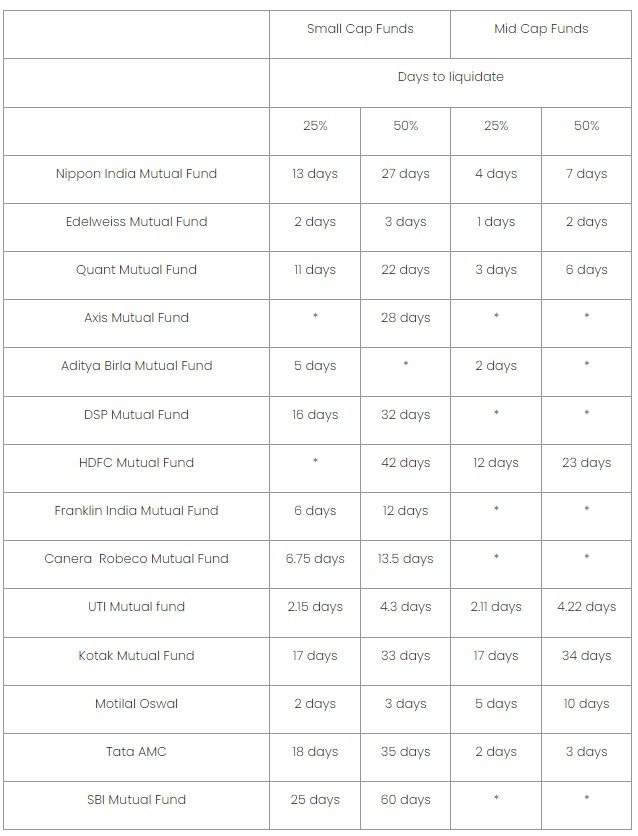

Just like a load test in our code which determines how fast our website will work if more and more users simultaneously use it. Similarly, the stress test in Mutual funds determines how fast they can give investors money back if there is a surge in investor redemptions. Mutual fund companies have to conduct these stress tests mainly for midcap and smallcap in accordance with SEBI. So similar tests were conducted recently and the results were:

PC: https://www.icicidirect.com/

Let's recap our Stock Market basics, when demand increases buyers will be more than sellers and the price moves up whereas when there is a crash or supply increases, everyone wants to sell. The sellers will try to sell at any price to get out of the market as soon as possible. Now if it happens, Mutual fund investors will also try to redeem their investment and thus Mutual funds have to sell their stocks for liquidity.

This increases the redemption pressure and since the Mutual fund industries are quite big, they have to sell at low prices till they find the buyers. Thus it reduces the NAV of the mutual fund, which means your Mutual fund will give less returns as compared to the benchmark.

If you have been seeing the market closely, in 2020 Franklin had to close 6 mutual funds because they could not provide liquidity. I was actually investing in one of them and I got the money back after a year or so. The same situation can happen in any fund, but the risk becomes quite big for small caps and medium caps because people want to come out of those stocks as soon as possible.

Let's go through the Stress Result data once again. So SBI will take 60 days to liquidate 50% of its Small Cap. And this is mainly because of the size of the portfolio. SBI has one of the biggest portfolio in Mutual Fund and thus it takes the biggest amount of time. Now if most of the people wants to sell their portolfio because of the market crash or for any other reason, then it will be a huge problem for the liquidity. So this is actually very good for the investors because they can check the data and find out which mutual fund can provide liquidity to you.

As a investor we would not like to sell our portolfio in case of market going down but a lot of people do that and thus it's individual choice though.

Posted Using InLeo Alpha

My suggestion is Quant Mutual Fund. This is smallcap fund and give high return.

My Mutual Fund investment- HDFC Smallcap- 500, SBI small cap- 500 & Quant- 1000

Yes Quant is doing really great, but I would still give them another year or so before making any changes