You are viewing a single comment's thread:

RE: Bitcoin price 070925

Well here is where we have to use some discernment. I will refer first to the stock to flow, then to the power law.

On the halving cycle, we are 946 days away from the next halving, when the miner rewards will be cut in half.

In late 2013, early 2014, this puts us after the ATH.

In late 2017, there was still an ATH ahead.

As well, at the end of September there was another ATH ahead shortly afterwards.

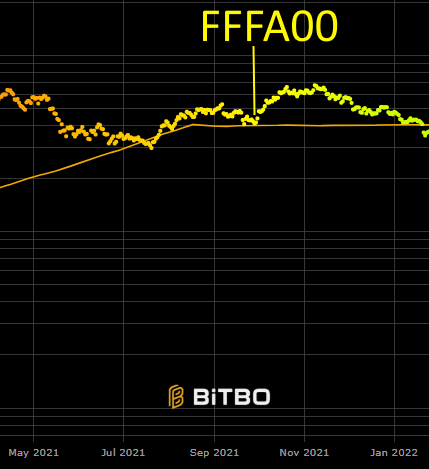

Stock to flow seems to be undervalued, due to increased uncertainty. ['Bitcoin’s price lagging well below S2F expectations reflects the maturing market’s complexity, broader economic factors, and limitations of supply-only models. While the potential for higher prices exists, there is more uncertainty than in previous cycles, and it is important to consider S2F as just one part of a much bigger analytical toolkit'*]

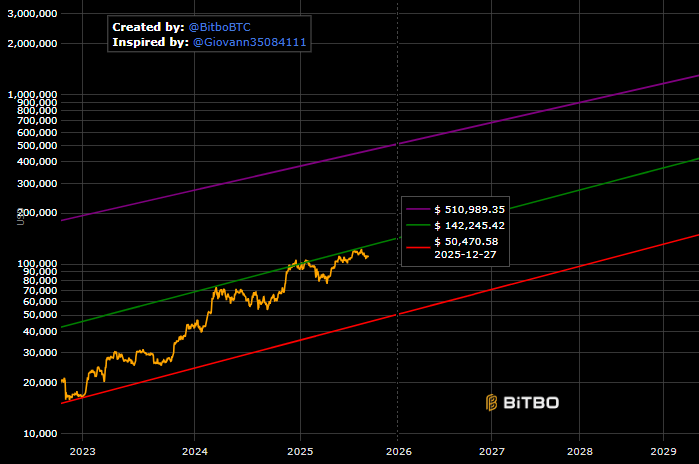

Long term power law puts the lower bound at $50k, upper at $510,000. I always try to keep a long term view of BTC because it continues to surprise me, and betting against it is rarely a good idea.

In 2030, that lower bound is $174k, so we should simply take a longer view and adjust our expectations accordingly. BTC will probably still be ticking along, one block at a time, so the next 5 years we should acquire as much as we can with that $491k median in mind. I think we are close to this cycles top, if we haven't seen it already, September is usually a good time to buy in anticipation of one more top this Oct/Nov/Dec. My humble observations suggest that opportunity has already begun.

However I see Silver as a great opportunity right now that no one should be ignoring.

Silver in the hand is worth a barrel of cash! !ALIVE !PIZZA

!LOL

View more