Silver and Gold, 300825

I usually post about Bitcoin here, but on Facebook I regularly share the price of Silver and Gold. Since these are interesting times, it's important to note the price of sound money.

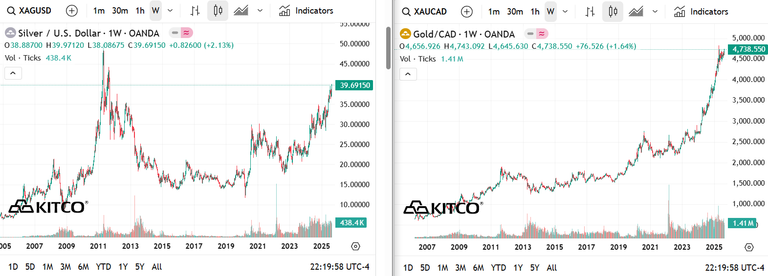

Silver

Silver is $39.69 USD, up from $38.50 USD last update.

$54.55 CAD, up from $52.97 CAD last update.

https://www.kitco.com/charts/silver

Gold

Gold is $3447.43, up from $3355.69 USD last update.

$4738.55 CAD, up from $4617.36 CAD last update.

https://www.kitco.com/charts/gold

Gold is at an All Time High

with Silver rising closer towards it's April 2011 high of $49.90 USD.

"Gold is money. Everything else is credit."

-- JP Morgan to Congress, 1912

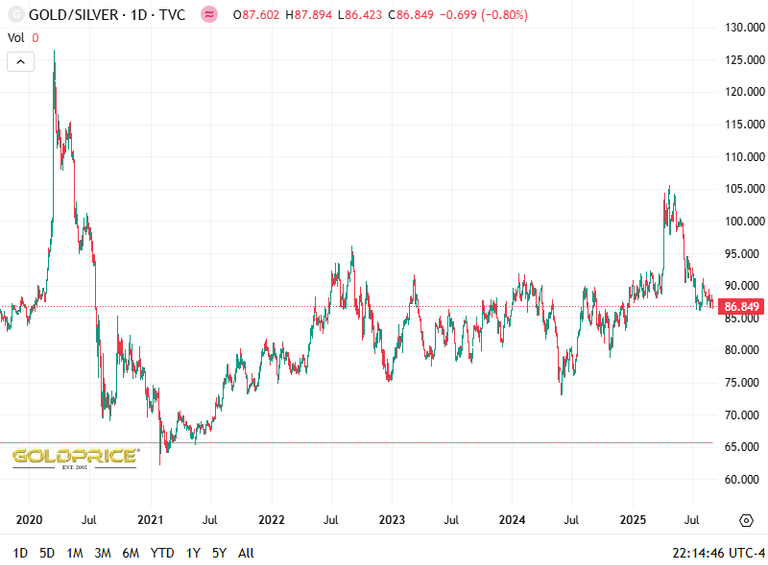

Gold Silver Ratio: 86.849 to 1

Down from 87.188 on 130825, and 87.5 on 220725. How low will it go in 2025?

Historical Gold-Silver Ratios rose to 126 in March 2020, and fell to 62 in January 2021. Before that we had a low of 31:1 in April 2011, 105 in February 1991, and 44 in April 1987.

https://goldprice.org/gold-silver-ratio.html

Silver in the hand is worth a Barrel of cash, when the fiat game ends. The intrinsic value of all currency is the paper it is printed on, burnt for warmth or used as wallpaper.

Or in our case, Polymer notes. Hahahaa

https://www.google.com/search?q=gold+news

https://www.google.com/search?q=silver+news

With a tightening physical market, diminishing above-ground stocks and a persistent structural deficit globally, Silver is looking shiny. Over 50% of silver consumption is driven by electronics manufacturing demand, in things like Solar panels and EVs. With spot prices extending to fresh all-time highs and central bank demand hitting records, Gold is reasserting its role as the world’s premier reserve asset. Foreign governments now collectively hold more gold than U.S. Treasuries, signaling declining confidence in dollar-denominated debt and growing preference for tangible monetary anchors. Strong monetary demand combined with constrained mine supply and limited above-ground float, adding structural tightness to the market.

Precious metals are never a bad hedge against inflation.

!ALIVE

!ALIVE !PIZZA Plus they are shiny!

Just here to say I love your logo extremely eye catching. You're a producer and a filmaker amazing you got another follower 😁👌💪

Thank you so much, I drew this creative inspiration in a single motion! It is my darkflame; creativity, inspiration, tao. That spark of imagination, creation, life. I'm so glad you like it, and thank you for your support 🙏 !ALIVE !PIZZA

Amazing thank you brother is there a channel for movies that you produced that I can check out?

!ALIVE

!PIZZA

$PIZZA slices delivered:

@darkflame(7/15) tipped @mirroredspork

darkflame tipped caelum1infernum

caelum1infernum tipped darkflame

Come get MOONed!