The Benner Cycle: Predicting Market Peaks and Troughs Since the 1800s?

What if someone in the 1800s had already cracked the code for predicting booms and busts in the economy?

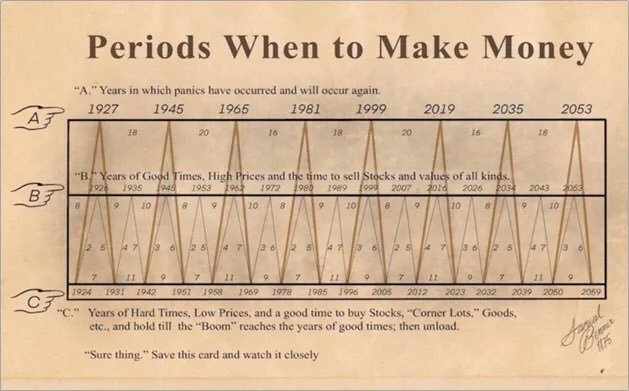

That’s exactly what Samuel Benner tried to do when he published his now-famous Benner Cycle—a chart mapping out repeating cycles of prosperity, panic, and recovery.

The Benner Cycle attempts to forecast long-term trends in commodity prices and stock market behavior using a repeating pattern of years.

According to the cycle, bull markets tend to peak roughly every 8 to 10 years, while major panics show up in a 16 to 20-year rhythm.

Benner laid out this pattern in the 1870s, and incredibly, the cycle has proven eerily accurate through events like the 1929 crash, the 1987 drop, the 2000 dot-com bubble, and even the 2008 financial crisis.

Financial analyst Sergio Avedian recently revisited this topic in a fascinating YouTube video where he breaks down the Benner Cycle year-by-year and overlays it with modern market data.

His analysis shows that the chart—though old—continues to align with real-world market events more often than chance would suggest.

📈

The Benner Cycle chart itself is simple but profound. It separates years into three categories:

Years to Sell Stocks (Market Peaks)

Years of Financial Panic (Crashes or Severe Bear Markets)

Years to Buy Stocks (Market Bottoms)

For example, the cycle predicted a market bottom in 2009 (right after the global financial crisis), a top around 2018–2021, and another major bottom coming soon—possibly around 2023–2024. If that lines up with what's happening now, it's worth paying attention.

Of course, no cycle is perfect, and no one can predict the future with certainty. But tools like the Benner Cycle give long-term investors a broader historical lens—and as Sergio Avedian explains, that historical perspective can be powerful when combined with other data.

![]()

Whether you're a trader, long-term HODLer, or just market-curious, the Benner Cycle is a fascinating reminder that history really can repeat itself—especially when money is involved.