LBI Weekly Holdings and Income report - Week 54 - week ending10 August 2025

Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI came under new management last year, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

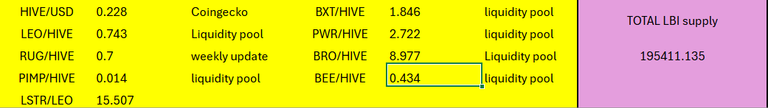

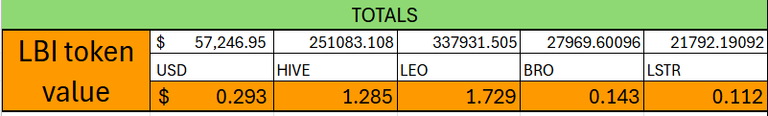

What a week - these are the weeks that make running this project fun. LEO has boomed, and our fund is riding the wave at the moment. Had to cut this report off at some stage, so here are the token values at cut-off time.

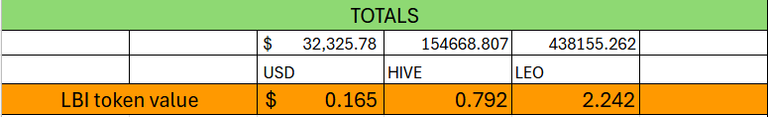

And here is last weeks report for comparisons:

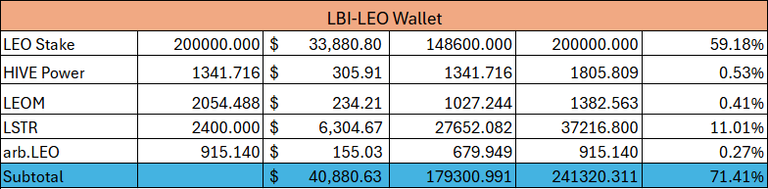

@lbi-leo wallet.

All I can say is WOW. This wallet is now 70% of our fund. It has more than doubled in value in a week, from $17500 last week to $40800 currently. Our 200,000 LEO is looking better and better every day, and LSTR has jumped also, our 10,000ish HIVE investment is now worth 27500 HIVE 🤯

- Where do we look to take profits, and shift some of these gains to other LBI divisions?

- Do we even take profits, or are we ride-or-die on LEO?

- What next?

These are all questions that role around in my head every time I see LEO continue rising. Personally been burned hard in past runs with getting greedy and holding too long. What say you, LBI holders?

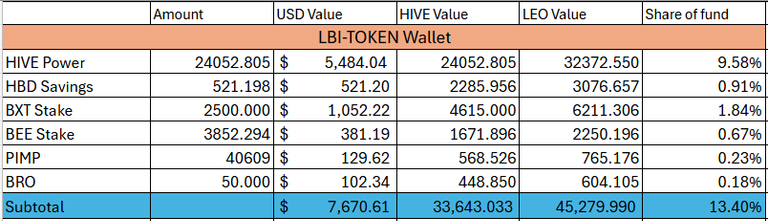

@lbi-token wallet

Everything else is very pedestrian compared to the LEO wallet above. Gained 100 HIVE Power, sold a few BXT, wallet is up a few hundred $$ in value. What would have been considered a good week not long ago is now very boring in comparison.

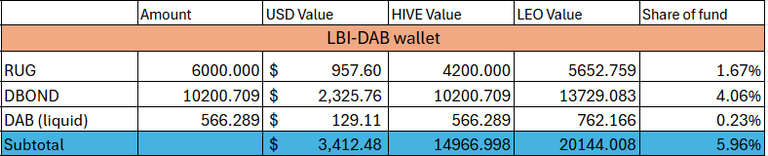

@lbi-dab wallet

Minted 38 DAB this week, which is a great result, and that is leading to steady growth in our daily drip. Everything is doing its job here. Would still love to see a RUG update, so we can get a more accurate, up to date valuation. But it is what it is, and RUG is still working minting us DBOND each week.

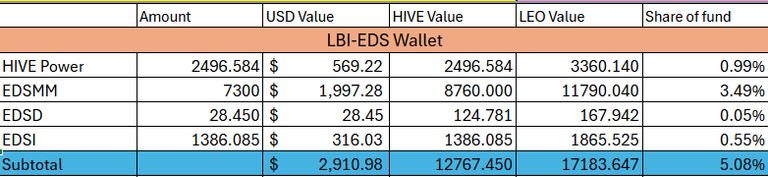

@lbi-eds wallet

Same thing here - a good week overshadowed by LEO. Minted 30 EDSI. Hive income grows each week, despite the move to lower the APR. Our EDSI grows faster than the drop, so we still increase each week.

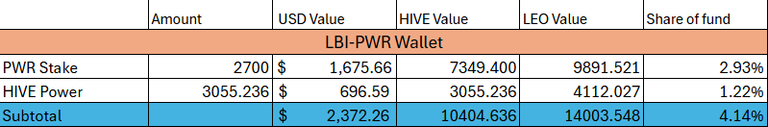

@lbi-pwr wallet

Added HP into this wallet this week, and would like to add more. PWR is going well, increasing in value with ETH's move up. Our PWR holding increased in value $500 over the week, and the token is well balanced in the pool to its asset backed value. A nice position for us to grow if we can, and gives us exposure to leveraged ETH.

Totals

The numbers say it all, here is what it looked like 7 days ago:

YES, we really have gained $25,000 in value over the last 7 days

Amazing really, for a fund that had a total value not too long ago of around $20,000

The BRO and LSTR values are included now because we have liquidity pools with these tokens, and putting the asset backed value comparison gives people easy visibility on the pool price of LBI compared to the asset backed value. Do with this information what you wish.

Note, those values are already outdated - LEO has surged further up and is now over 0.8 HIVE each.

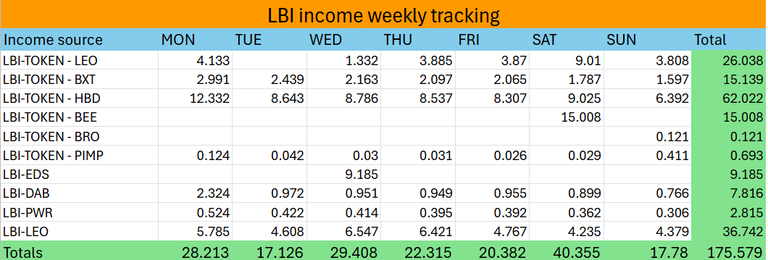

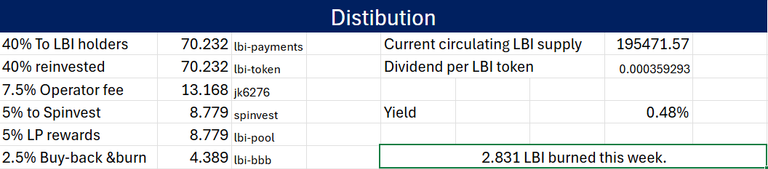

INCOME

If you notice 2 payments from us this week, the first one was a test to make sure the dividend bot was picking up LBI in the new pools correctly. It looks all good, so I have sent out the full dividend run.

Once again, income has dropped significantly, in terms of LEO token numbers. In fact, the value of this weeks dividend run in $$ terms is better than the last few weeks - worth around $12 based on the prices at the start of this post, even more now. If you missed the post I did about Liquidity for the LBI token do check it out.

Need to find ways to boost our LEO income.

Conclusion

All up, it has been an amazing week, and next week looks like it will be incredible also. Anyone willing to guess what price LEO will be trading at a week from now?

Thanks for checking out this weeks update.

Cheers,

JK

@jk6276 for the LBI project.

Posted Using INLEO

I would say a little profit taking is never a bad idea. However this LEO run does seem a little different. Take a little here and there but hold on to most of it to see where this goes.

The point of investment fund is to have someone who:

(1) looks for opportunities

(2) rebalances books when the investment hits

Good job on (1), esp with LSTR. Questioning (2) sounds weird.

Of course, some of the people that now know that going 100% into LEO is the obvious way are LBI holders. All the fund manager is obliged to do to serve them is to paste links to LBI:LEO (LSTR:LBI) liquidity pools.

I think we should try to take some kind of profits and maybe move them into HBD or something to recoup what we lost from before.

Nice! Weekly reports keep us informed. Eager to see how income sharing impacts the token's value! 🚀

Gotta let it ride for now. The mechanics behind LEO and LSTR should support much higher prices down the road. This is why I was advocating buying up LEO when it was so low, rather than diversifying it out, but at least we didn't empty the coffers. Very happy you made the call on the LSTR. That seems like it is really going to help the fund overall far into the future, and will give it some flexibility down the road.

For my money, I think we should see where this wave takes us. This is just the tip of the iceberg.

Fantastic work and a great week. I'd start considering distributing HBD instead of LEO as dividends.

Wow that's pretty good increase, I'm personally in favor of taking some profits so there's more room to put towards other potential investment.

I think we just stick and hold and let the value grow for now. LEO according to the tokenomics is only going to keep climbing.

Hello lbi-token!

It's nice to let you know that your article will take 9th place.

Your post is among 15 Best articles voted 7 days ago by the @hive-lu | King Lucoin Curator by polish.hive

You receive 🎖 0.5 unique LUBEST tokens as a reward. You can support Lu world and your curator, then he and you will receive 10x more of the winning token. There is a buyout offer waiting for him on the stock exchange. All you need to do is reblog Daily Report 752 with your winnings.

Buy Lu on the Hive-Engine exchange | World of Lu created by szejq

STOPor to resume write a wordSTART