LBI Weekly Holdings and Income report - Week 50 - week ending 13 July 2025

Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI came under new management last year, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

Missed last weeks report, and trying out a new timing for this one so it works better for my schedule.

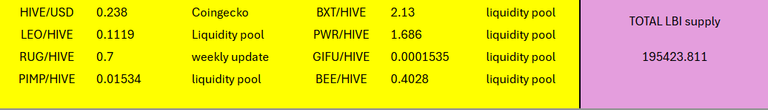

Here are the token prices at cutoff time:

And here is the link to the last report, done 2 weeks ago:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-48-week-ending-29-june-2025-kdt

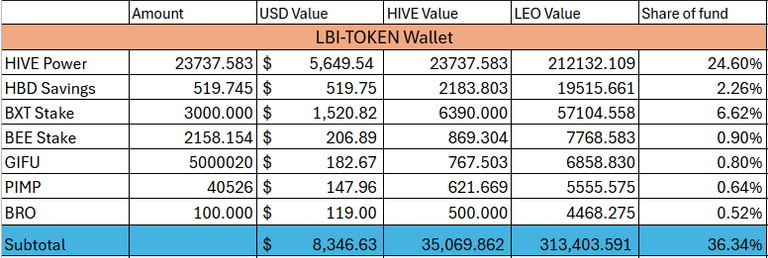

@lbi-token wallet

We have gained 70 HP over the last two weeks, which is poor by our standards and shows the results of a lack of content. Hopefully all my real world drama's and illnesses are behind me now, and with a couple of strongly rewarded posts going to pay out over the coming week, we can get back to faster HP growth. All other holdings in this wallet have been pretty static over the last couple of weeks. The Dollar value of this wallet is up by around $1200, representing the higher HIVE price. HIVE value is virtually unchanged, and LEO value is down a bit (as LEO is up, so everything is worth less in terms of LEO. I'd expect this trend to continue as I'm looking forward to higher LEO prices moving forward.

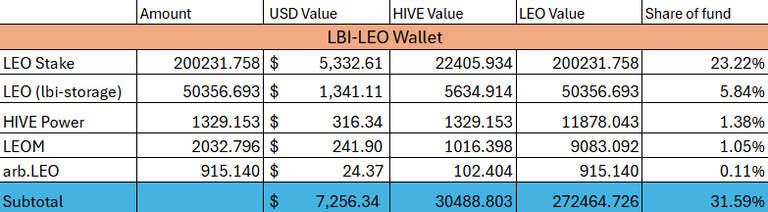

@lbi-leo wallet

Still our number two wallet, for now. From the report two weeks ago, we have gained $2000 in USD value over that time, thanks to HIVE up a little, and LEO up nicely. I did a deeper look into this wallet a few days ago, so won't go on too much here. Watch out for a big LBI governance vote coming soon regarding a potential investment into @leostrategy #LSTR. Plenty of news and decisions to make with these funds soon, so watch this space.

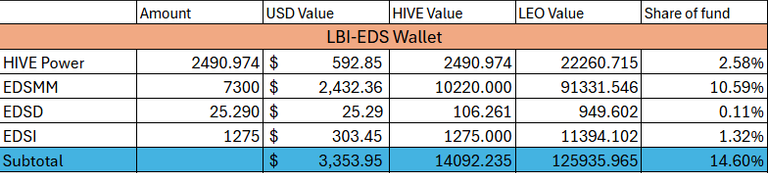

@lbi-eds wallet

I've finished off the move from HP to EDSMM and we now have 7300 of the mining token. This means we should mint around 1460 news EDSI tokens into our wallet each year, from mining. We currently hold 1275. My plan is to let this grow organically by 25 per week, and sell any above that when there is appropriate buy orders in the market. Any that get sold will fund future growth, by either adding to our EDSD or HP (to increase the @eds-vote delegation. Either way, we will be trading short term growth for faster long term growth, and building the wallet in a more diversified way. I have slowly been reducing the carrying value of the EDSMM in our balance sheet. They are currently at 1.4 HIVE each (which is what we paid for our most recent acquisitions). My goal is to continue to reduce this down to 1 HIVE each, as the market is illiquid and selling any quantity of these miners would be a hard task.

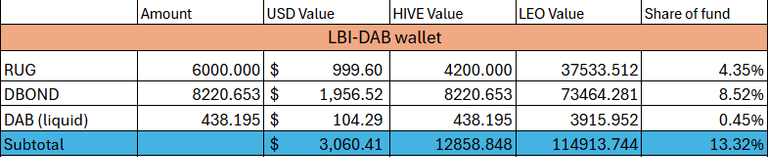

@lbi-dab wallet

We have added nearly 60 DAB to our balance sheet over the last two weeks, showing we are minting around 30 DAB per week. In the absence of any updates from the RUG project, It is hard to know if that valuation is accurate. @silverstackeruk - wen RUG update - @dailydab - Last RUG report was 16 May. For that matter, the last DAB update was March.

Anyway, enough hassling SSUK. The DAB project still works as intended, we still earn DBOND from our RUG holding each week and mint 30 DAB per week, so the investment itself is still on track.

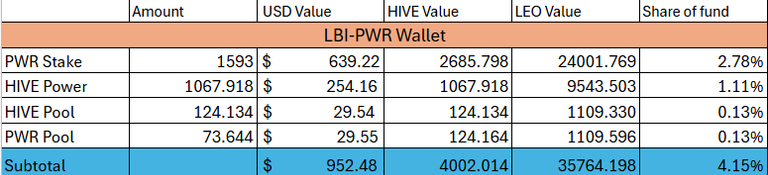

@lbi-pwr wallet

From 2 weeks ago, we have gained around 100 HIVE value, to move just over 4000 total today. The delegation from the @lbi-token wallet to this project has been increased back up a bit recently, and will continue to grow in coming weeks. We have now started to receive liquid HIVE payouts for our staked PWR each day, which is a nice improvement from he project compared to the unreliable mining contract being used to reward staked PWR.

The fundamentals of the PWR project itself are strong, and the value of their wallet has moved up to match the liquidity pool price of PWR in recent days. I'd love to have a bigger position in this project, but will have to get there through a daily grind.

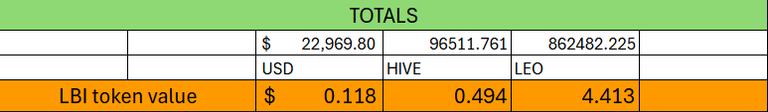

Totals

Overall, we are up $3300 in value over the last two weeks. The price rise for LEO has contributed the majority of this gain, and HIVE increasing in recent days has helped also. HIVE and LEO values have not changed much overall, but the $$$ value is the fun one to watch in a rising market. There is big talk around LEO regarding it's price moving much higher in the near future - lets watch and see how that plays out.

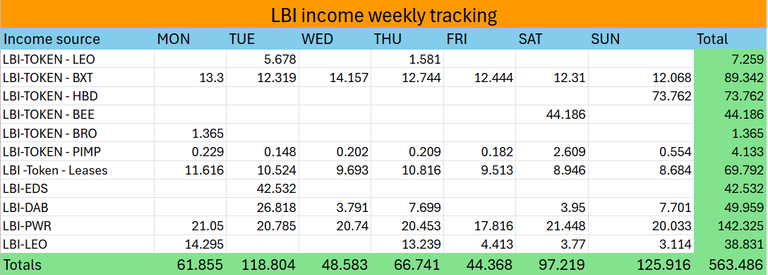

Income

Herer is where higher LEO prices hurt our fund. A few weeks ago, we were generating 1200 LEO tokens per week, now we are struggling to hit 600. A lot of our income is HIVE income, and with LEO moving higher compared to HIVE, we convert that earned HIVE into much less LEO tokens.

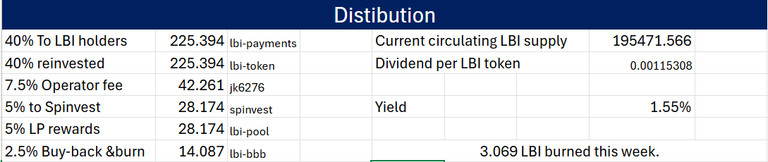

Let's look back to the report on 1 June 2025 (the last proper week without me having lots of disruptions. That week, HIVE was at 0.23, and LEO was trading at 0.0627 HIVE. This made LEO's USD price $0.0144. That week we distributed 481.584 LEO as dividends - valued at $6.94. Today HIVE is at 0.238, and LEO is at 0.1119 HIVE, giving a USD price $0.0266. Today we sent out 225.394 LEO as dividends - valued at $5.99. So, in real dollar terms our income has dropped a bit over that time. I think that can be mainly put down to how much HBD I was using back then to boost the dividend, whereas this last week I have not had much HBD to spare due to a lack of content last week.

The dividend run has happened for this week, and we have burned another 3.069 LBI for the week. I'm looking forward to a better weeks ahead with some decent post payouts to come.

Conclusion

It has been nice to get things back to normal after several disrupted weeks. Everything in our wallets is tracking to plan, and we continue to grow each week in terms of our asset base. Prices are moving up, which is nice. The week ahead is an exciting one, and I cant wait to put the LSTR deal on the table and out to a vote. I think this could be a transformative deal for LBI, and boost our credibility and position in LEO particularly and HIVE generally. I think we are heading into some very exciting times for LBI, and the hard work we have done over the last year of restructuring LBI will start to pay off.

Thanks for checking out this weeks update, as always any comments and suggestions are more than welcome.

Cheers,

JK.

Posted Using INLEO

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Hello lbi-token!

It's nice to let you know that your article won 🥇 place.

Your post is among the best articles voted 7 days ago by the @hive-lu | King Lucoin Curator by polish.hive

You and your curator receive 0.0000 Lu (Lucoin) investment token and a 8.65% share of the reward from Daily Report 724. Additionally, you can also receive a unique LUGOLD token for taking 1st place. All you need to do is reblog this report of the day with your winnings.

Buy Lu on the Hive-Engine exchange | World of Lu created by @szejq

STOPor to resume write a wordSTART