LBI Weekly Holdings and Income report - Week 31 - week ending 2 March 2025

Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI came under new management last year, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

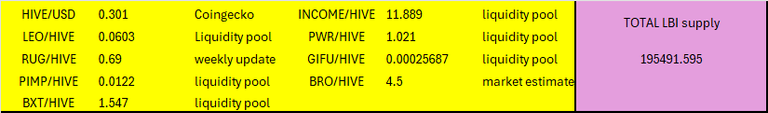

There has been some significant changes over the last week - read on for all the details. Tha Asset prices at the cutoff time for this report are as follows:

And here is the link for last weeks update for comparison:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-30-week-ending-23-february-2025-457

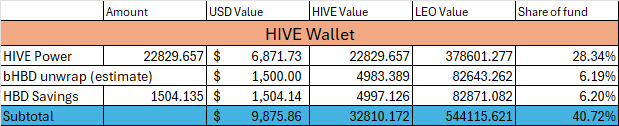

Hive Wallet

This week I removed 500 HBD from savings. These funds have been added to the DAB wallet, to boost it's growth profile. The HBD was traded to HIVE at around $0.28 each. The short term impact is that our income you will see below has dropped a bit from HBD. This is a short term adjustment, and the growth that the DAB wallet will exhibit will be much better than the 15% yield on HBD. Aside from that significant move, we gained around 41 HIVE, which is a little down on previous weeks. Our HIVE power delegations have changed also, we have significantly boosted our @empo.voter delegation which I will discuss more in the PWR section below.

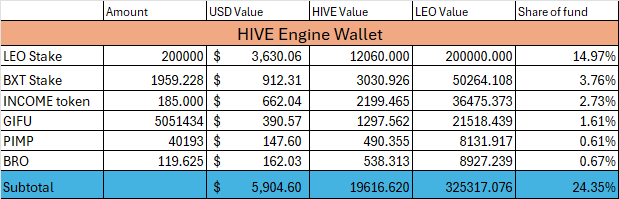

HIVE Engine

Only small additions here. Didn't really focus on these tokens during the reshuffles done this week. Our GIFU and BRO delegations increased a bit with the reshuffle, so they will grow slightly quicker now.

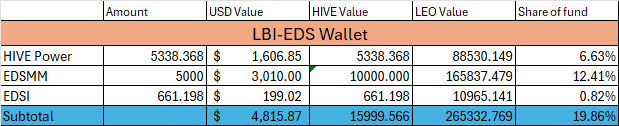

@lbi-eds wallet

Nothing new to report for this wallet. Predictably, 25 EDSI added for the week. Our HIVE income coming from this wallet increases every week. Boring, but exactly what this fund likes.

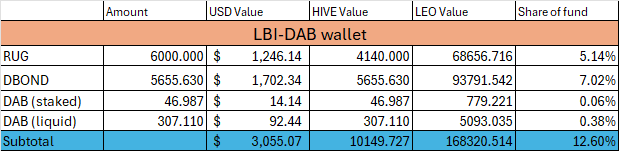

@lbi-dab wallet

This wallet is where all the action has been this week. At the start of the week, I shut down (temporarily at least) the @lbi-storage wallet, and sold those assets. Funds were moved into here and a chunk of DBOND was bought off the market at 1 HIVE each. Later in the week, the HBD withdrawal happened, and more DBOND was bought, along with another 1000 RUG. Finally, I pulled some funds out of the PWR wallet, and bought even more DBONDS.

All up over the week we added 1000 RUG and a little over 2080 DBOND. In addition, I bought some DAB and we have a combined total of 354.097. All of these moves were designed to accelerate the growth of this wallet. Now we sit back and assess how that move goes.

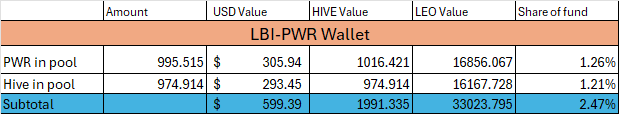

@lbi-pwr wallet.

In the end this week, we have taken a step backwards. In order to add so many DBOND's, I did pull some funds out of the PWR pool. All up we are about 260 Hive value down on last week. In good news, this should come back fairly quickly. As I mentioned above, the PWR delegation from the main wallet has been increased. This means we are now making more PWR per day, and will build this wallet up again. It is really handy to have a fund of liquid tokens that can be accessed if an opportunity pops up. I would not rule out dipping into this wallet again if a good deal presents itself. Either way, a step back this week, but faster growth also secured.

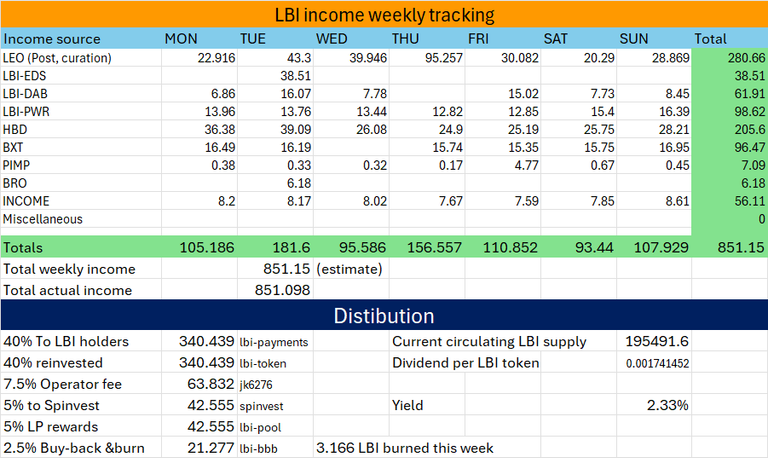

Income Report

Income is lower this week, since we changed our delegations around. The changes made have prioritized boosting our growth of assets over income, so this week is kind of a reset week for income. HBD income, and LEO income are the main spots that have dropped. However, we should return to growth and will push back up from this base of 850 LEO for the week, depending on the LEO price.

The dividend run has happened, and one problem was fixed but a new issue arose. There had ban a fault with the distribution related to accounts that had all their LBI in the liquidity pool. This likely affected around 10 people, however the amounts of LEO was quite small. We are only talking 1 LEO max per week. This issue has been fixed now. However a new problem popped up for holders with both liquid and pooled LBI, where the pooled LBI was not counted. Again the numbers are small, and our coder has already resolved the issue so it won't happen again. Just wanted you all to know that these issues have been identified and resolved.

3.166 LBI burned this week. The liquidity pool is at a fair price, with the pool price of LBI sitting at 6.67 LEO currently and the asset backed price being 6.78. I've been trying to maintain a slightly pegged price in the pool lately using my personal wallet to trade back and forth to keep it close to fair value.

Conclusion

A decent week all round for us. Income dropped a bit, but growth has been prioritized and we should see that flow through to higher income in the long run. I note that the PWR APR for delegations has been increased to 12%, which is perfect timing for us as we just increased that delegation. I'll do a long form post later in the week about our PWR wallet, and plans moving forward.

Thanks for following along with LBI's progress, hope you all have an awesome week.

Cheers,

JK.

Posted Using INLEO

Have the dividends to LBI from the diesel pool been fixed? Or should I remove them from the pool?

The pool rewards are working fine. You should be getting the daily LEO payout from the pool no worries. The issue was you were missing out on the weekly dividend from our income (paid each sunday). With your quantity of LBI in the pool that would only have been around 0.2 - 0.3 LEO each week. This issue is fixed and you received your weekly dividend as it should be.

The pool pays much better, so imho it is best to keep your LBI in there. I will need to find a way to add more LEO to the rewards contract as liquidity grows, to keep the yield competitive.

Thanks for the support for LBI.

From how you described the problem back then, it seemed to me like you were distributing the rewards via a script and that there was a problem with it for distributing rewards to liquidity providers.

But I see you have rewards added to the pool's reward contract, in which case, things should be fine. Thanks for your answer!