LBI Weekly Holdings and Income report - Week 17 - week ending 24 November 2024

Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI has just recently come under new management, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

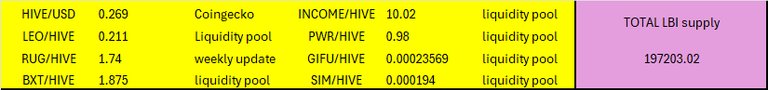

I missed publishing last weeks weekly update post, so all comparisons in this update will be to the positions 2 weeks ago. It's been a great 2 weeks for the value of the fund, so lets dive in. Here are the asset prices used at the time of this report.

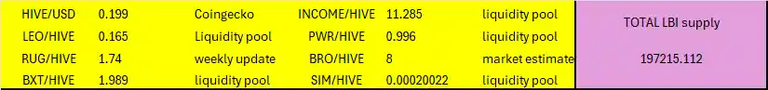

Obviously, there has been price changes since this, with these numbers around 12 hours old, from when I closed the week off last night. Just out of interest, here is where we were two weeks ago:

HIVE and LEO are the two most important ones for us, and both have had a great run over the last couple of weeks - HIVE is up nicely, and LEO is up well compared to HIVE, meaning its up bigly in USD terms. Winning.

Anyway, on to the details:

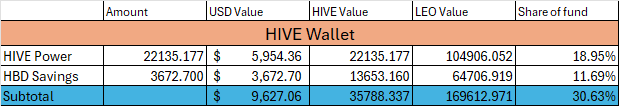

HIVE Wallet.

Slow growth for our HP, with a lack of content from me meaning growth is basically curation and inflation. HBD dropped, as I used some to buy a position in GIFU. In hindsight, I should have pulled more out, and swapped it to HIVE based assets, but never mind, we are doing well regardless, and probably approaching a point where we should work on building up our HBD balance to prepare for the future.

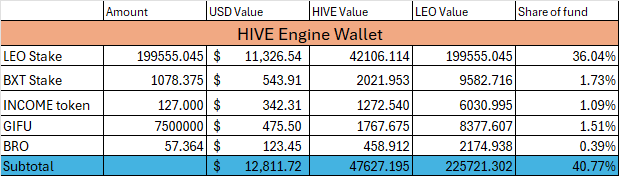

Hive Engine wallet.

LEO is the standout, for sure. In USD value terms, it is up $5000 over the last two weeks, nearly doubling in value. The other assets here have mainly tracked HIVE, without much variations. So USD values are all up a bit, but HIVE values not so much and LEO values for these assets are down. The LEO stake is now 36% of our total asset base. It was hovering around 25% not too long ago, which shows just how well it has performed recently.

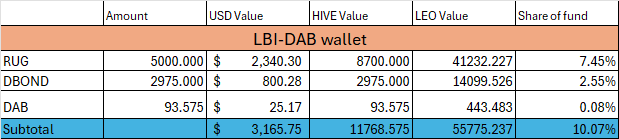

@lbi-dab wallet.

Steady growth here in HIVE terms. RUG generates nice returns, and I unstake a good portion of those returns to give flexibility for the income, which you will see below. I did buy a few more DAB last week, and drop a little order in every now and then to pick up a few here and there. Over the last two weeks, we have gained 20 DAB in total, and 75 DBONDS - and used a decent chunk of gains on top of that to top up the income distribution. A very handy wallet, that definitely contributes more than it's 10% of the funds asset share in benefits for us.

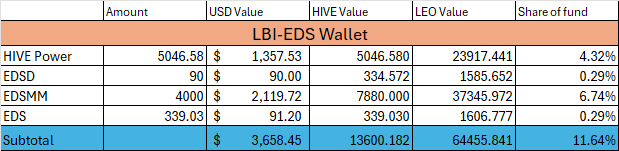

@lbi-eds wallet.

This is our most passive wallet, and just does its thing without me touching it. 45 EDS in growth over the last two weeks. As our EDS grows, the income this wallet generates will grow. Nice and simple, and not much to report. Buying the EDSMM was a great move, and made this wallet really easy to run. I'd like to boost the HP delegation, and maybe start to build up EDSD again, but it's not a short term priority.

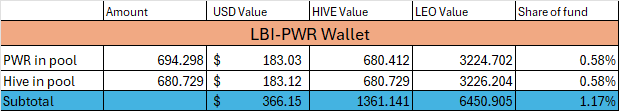

@lbi-pwr wallet.

Steady and predictable for this wallet. It spins a little income out, and grows each week buy 15 to 20 Hive value. Not much to report really. Again, boosting the delegation to increase daily PWR drops would be nice, but not really likely in the short run.

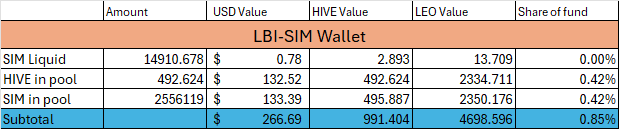

@lbi-sim wallet.

Steady income is the goal for this account, It spins out yield each day, and grows slowly. SIM has not done as well as other things lately, so this wallet is lagging a bit.

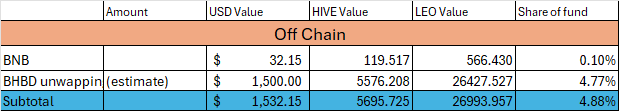

Off chain.

No changes. We are up to week 17 of waiting for a resolution for our bHBD unwrap. ........

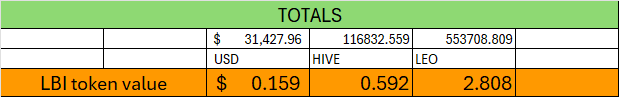

Totals.

These are nice numbers, with the fund having pushed well over the $30,000 mark. It seems like a very short time ago that it was struggling to hold $20,000, and now we have pushed so much higher.

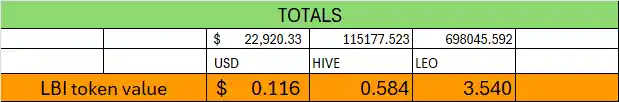

These are the numbers from two weeks ago:

The LEO value of the fund drops noticeably as the price of LEO increases. This is expected, as the majority of our assets are HIVE or USD valued. My focus is the USD value of the token, and it is doing real good.

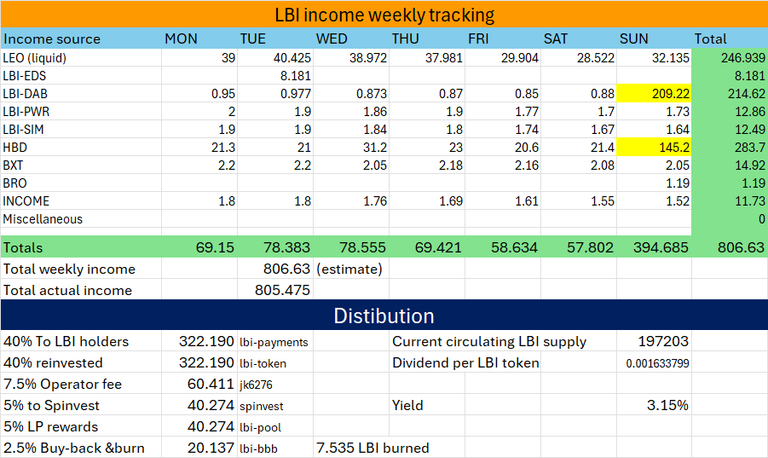

Income report.

It's getting harder and harder to maintain 800 LEO for the income distribution each week. Much of our income is HIVE, and this HIVE is converting into lower amounts of LEO as the price of LEO outperforms. Anyway, I made it again this week, but had to scramble around 350 LEO from a couple of places to do it. The DAB wallet kicked in, with sales of DBOND yield from RUG being the source. I'll never sell assets to maintain income levels, but I will accept lower asset growth to do so. We still added 75 DBOND over the last two weeks to our asset base, despite selling maybe 120 in that time.

7.535 LBI's burned this week, and the dividend yield is at 3.15% this week. Dividends were paid out last night. Just a note on yield, the APR in the liquidity pool is really high at the moment, around 20%. Our biggest LP participant so far has exited the pool, so their is nice juicy APR available. Liquidity is back down to quite small levels, so don't use it to trade significant volumes of LBI tokens.

Round up.

The last couple of weeks have been fun. It is always nice being in crypto when numbers go up. Let's see how this run pans out, if we see new ATH for HIVE or LEO. LEO 1:1 parity with HIVE would be interesting, but who knows. There is much bullishness around LEO amongst the true believers.

Thoughts on LSTR

A new fund has appeared, called @leostrategy, which has a stated aim of buying as much LEO as possible, using a similar method to Michael Saylor's Bitcoin purchases. I'm not clear on why they use the term leveraged, when it seems no debt is involved, just issuing new LSTR tokens to buy LEO. LBI won't be investing in LSTR, as I'm not comfortable investing in a custodial fund run by anon's. If I knew who was running it, I might consider it, but each to their own. I notice that @khaleelkazi is the biggest investor, I wonder if he knows who is behind it? Anyway just keep the risks in mind. LBI started out years ago with a similar mandate - sell tokens to buy LEO. Over the years it has evolved and the sole focus on LEO has faded in favor of a more portfolio approach. It really is a basket of HIVE assets with LEO as a cornerstone investment.

Different investments, different growth stages and different focuses. I wish nothing but the best for Leostrategy and LSTR investors. It is good to see people trying things, and launching new projects. It is good to see LEO being bought and the price rising. Happy days, and best wishes.

That's it for this weeks report, have a great week everyone.

JK.

@jk6276

Posted Using InLeo Alpha

Thanks for the update. !BBH

@lbi-token! @fiberfrau likes your content! so I just sent 1 BBH to your account on behalf of @fiberfrau. (4/20)

If LSTR works LBI will greatly benefit.