The Crypto Profit Trilogy: Part 2 - Predicting Exchange Listings with On-Chain Analysis

By Jake Thornton, Crypto Explorer since 2014 & Former Lead Developer at Nebula Protocol

- The Crypto Profit Trilogy: Part 1 - Why Trading Is a Zero-Sum Game

- The Crypto Profit Trilogy: Part 3 - MEV: The Hidden Profit Engine (And How ZENMEV Makes It Accessible)

In Part 1 of this series, I explained why traditional trading is a losing game for most retail investors and explored how early memecoin detection can provide asymmetric returns. Today, I'm diving into something even more powerful: using on-chain forensics to predict exchange listings before they're announced.

The Holy Grail: Exchange Listing Pumps

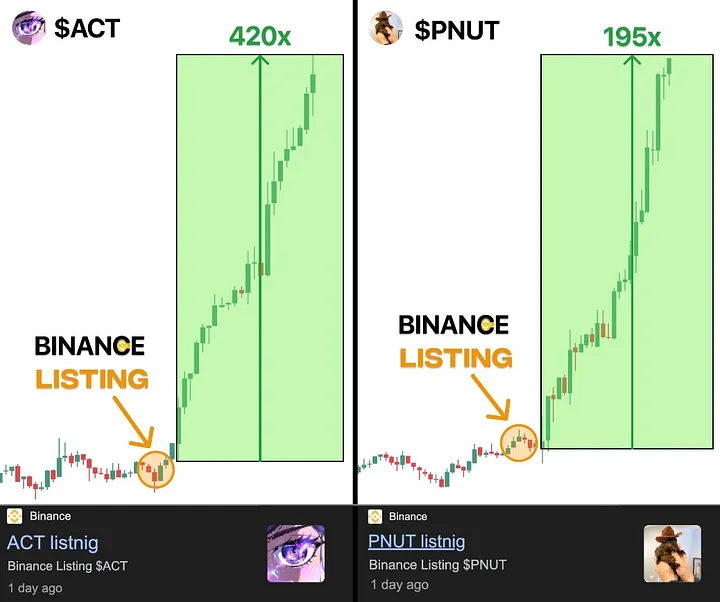

We've all seen it. A token gets listed on Binance or Coinbase, and its price immediately jumps 30-200%. These listing pumps are among the most reliable profit opportunities in crypto, but they seem impossible to predict... unless you know what to look for.

After my trading disasters in 2018, I became obsessed with finding patterns that precede exchange listings. What I discovered changed my entire approach to crypto investing.

The Economics of Exchange Listings

Before diving into the methodology, it's worth understanding why exchange listings create such significant price movements. Several factors contribute to this phenomenon:

Liquidity expansion: Major exchanges bring massive liquidity, allowing larger investors to enter positions they couldn't previously.

Legitimacy signaling: Listings on top-tier exchanges serve as a form of validation, especially for smaller projects. Binance and Coinbase have rigorous vetting processes, so their approval signals quality to the market.

New buyer exposure: Suddenly, millions of exchange users who couldn't easily access the token can buy with a few clicks. This new demand wave often overwhelms existing sell pressure.

Market maker activity: Before listings, exchanges typically coordinate with market makers who accumulate inventory to provide liquidity. This pre-listing accumulation itself can drive prices up.

Anticipatory speculation: As rumors of potential listings spread, speculators start accumulating, creating a self-fulfilling prophecy of price appreciation.

The combination of these factors creates a perfect storm for price appreciation. The key is identifying tokens before they're officially announced.

Following the Smart Money: The Binance Hot Wallet Strategy

In late 2021, I noticed something interesting while tracking whale wallets: certain addresses consistently accumulated tokens 2-4 weeks before they were listed on major exchanges.

The most telling pattern involved Binance's operational wallets. Before a token is listed, the exchange needs to set up infrastructure creating hot and cold wallets, testing transfers, and establishing liquidity.

The Technical Infrastructure Behind Listings

To understand why this strategy works, you need to know how exchanges prepare for listings. Here's what typically happens behind the scenes:

Initial technical assessment: Exchange engineers evaluate the token's codebase, testing compatibility with their systems.

Wallet creation: Dedicated hot and cold wallets are established specifically for the new asset.

Test transactions: Small amounts are transferred between internal wallets to verify everything functions correctly.

Liquidity preparation: Larger amounts are moved into trading wallets to ensure sufficient liquidity at launch.

Integration testing: The exchange runs simulations to ensure trading, deposits, and withdrawals work properly.

All of these activities leave visible footprints on the blockchain if you know where to look.

The $ACT Case Study

In September 2023, I was monitoring several promising low-cap tokens when I noticed unusual activity around Arbitrum Chain Token ($ACT). Using Arkham Intelligence (a blockchain analytics platform), I identified a pattern of test transactions from addresses that had previously interacted with known Binance hot wallets.

The smoking gun came when I spotted a small test transaction of exactly 0.1 $ACT to an address that had previously received similar "test amounts" of tokens right before they were listed on Binance.

I immediately bought $25,000 worth of $ACT at around $0.70. Three weeks later, Binance announced the listing, and the price shot up to $2.80. I sold 80% of my position for a $120,000 profit.

Was this luck? No it was pattern recognition based on on-chain data.

Let me break down exactly what I saw that convinced me:

A wallet that had previously received test transactions of MATIC, AVAX, and FTM exactly 3-4 weeks before their Binance listings received a 0.1 $ACT transaction.

This wallet then sent a series of test transactions to other wallets in a pattern consistent with Binance's internal testing procedures.

A larger transaction of 50,000 $ACT moved to an address that matched the signature pattern of Binance's hot wallets.

Several OTC desks known to work with Binance for liquidity provision began accumulating $ACT in significant quantities.

GitHub activity showed Binance developers had forked the $ACT repository and were making integration-related commits.

The combination of these signals created a high-probability setup. While any single signal might be coincidental, the convergence of multiple indicators suggested a listing was imminent.

The Technical Details Most People Miss

What separates successful listing predictors from amateurs is attention to technical details. Here are some of the more nuanced signals I look for:

Signature patterns: Each exchange has distinctive transaction signing patterns. Binance typically uses a specific type of multi-signature wallet with recognizable parameters.

Gas patterns: Exchange wallets often use consistent gas prices and limits that differ from typical users.

Temporal patterns: Most exchanges follow predictable timelines between wallet setup, testing, and actual listing.

Interaction graphs: By mapping wallet interactions, you can identify clusters of activity that match known exchange patterns.

Contract interactions: Exchanges often interact with token contracts in specific ways during integration testing.

These technical nuances are why simple wallet tracking isn't enough you need to understand the exchange's operational patterns at a deep level.

How to Implement This Strategy

If you want to try this approach

- Get the right tools: You'll need access to advanced blockchain analytics platforms. Arkham Intelligence, Nansen, or Chainalysis are good starting points, though the latter is expensive. These platforms aren't cheap expect to pay $500-2,000 monthly for professional-grade access. Consider it an investment in your information advantage.

Study historical patterns: Before investing real money, backtest your theories. Look at past listings and trace the on-chain activity that preceded them. I spent three months analyzing historical data before making my first prediction-based investment. This historical analysis is crucial you need to understand what normal pre-listing patterns look like versus coincidental activity.

Build a database of exchange-related addresses: Identify and track wallets associated with exchanges' operational activities. Start with publicly known exchange wallets and expand your database by tracking their interactions. Over time, you'll develop a comprehensive map of exchange infrastructure.

Look for these specific signals:

- Test transactions of exact amounts (0.1, 1, or 10 units)

- New wallet creation by exchange-linked addresses

- Sudden accumulation by wallets that previously accumulated pre-listing tokens

- Increased developer activity on GitHub right before exchange integration

- Changes in token transfer patterns between known exchange-affiliated wallets

- Unusual activity from market makers known to work with specific exchanges

Manage risk carefully: Even with strong signals, allocate no more than 5-10% of your portfolio to any single prediction. False positives happen, and exchanges sometimes complete technical integration without proceeding to listing. I use a tiered position sizing approach based on signal strength:

- Strong signals (multiple converging indicators): 5-10% allocation

- Moderate signals (several indicators but some inconsistencies): 2-5% allocation

- Weak signals (interesting patterns but limited confirmation): 0.5-2% allocation

Develop a systematic exit strategy: Have a clear plan for taking profits when listings are announced. I typically sell:

- 30% immediately upon announcement

- 40% during the initial price surge (usually within 24 hours)

- 30% over the following week as liquidity improves

This disciplined approach prevents the common mistake of holding too long after listing, when prices often retrace as initial excitement fades.

The Technical Approach: What Actually Works

For those technically inclined, here's my specific process:

I maintain a database of over 300 addresses associated with exchange operations. This database is categorized by:

- Exchange identity (Binance, Coinbase, etc.)

- Wallet function (hot wallet, cold storage, testing, etc.)

- Historical activity patterns

- Typical transaction signatures

I've written custom scripts that alert me when these addresses interact with tokens not yet listed on major exchanges. My alert system assigns priority levels based on:

- The historical reliability of the specific wallets involved

- The pattern of transactions (test amounts vs. larger transfers)

- The timing relative to the exchange's typical listing cycle

- Concurrent activity across multiple exchange-related wallets

I look for a specific sequence of events:

- Initial test transactions from exchange wallets

- Creation of new hot/cold wallet pairs

- Test deposits and withdrawals

- Larger liquidity movements

- Integration testing with exchange smart contracts

I cross-reference these signals with other indicators:

- Sudden increase in token transfers to OTC desks

- Project team members making fewer public statements (often due to NDAs)

- Unusual options activity if the token has derivatives markets

- Changes in GitHub activity suggesting exchange integration work

- Sudden increases in market maker accumulation

I use a scoring system that weighs each signal based on its historical predictive power. Only when a token exceeds my threshold score do I consider investing.

The Technical Infrastructure I've Built

To implement this strategy effectively, I've developed a custom technical stack:

Data collection layer: Scripts that continuously monitor blockchain activity across multiple networks (Ethereum, BSC, Solana, etc.)

Pattern recognition engine: Algorithms that identify unusual patterns matching historical pre-listing activity

Alert system: Real-time notifications when high-probability signals are detected

Research dashboard: Tools for quickly investigating and verifying potential signals

Position management system: Software that helps implement my tiered entry/exit strategy

This infrastructure required significant upfront investment, but it's paid for itself many times over. The key is automation manually monitoring blockchain activity is impossible given the volume of transactions.

The Ethical Dimension

Unlike the memecoin strategy from Part 1, this approach has fewer ethical concerns. You're not creating bag holders you're simply identifying legitimate exchange adoption before it's publicly announced.

That said, there's a fine line between smart on-chain analysis and attempting to trade on non-public information. I never try to bribe exchange employees or hack private communications I only analyze publicly available on-chain data.

The ethical framework I follow includes:

- Only using publicly available blockchain data

- Not attempting to obtain confidential information through improper means

- Not spreading false rumors about potential listings

- Being transparent about the speculative nature of these investments

- Not encouraging others to take excessive risks based on my analysis

This approach is more akin to sophisticated fundamental analysis than insider trading. You're simply better at reading the public signals than most market participants.

Real-World Results

This strategy isn't theoretical it's how a growing number of sophisticated crypto investors consistently generate returns.

In my own portfolio, listing prediction has accounted for approximately 40% of my profits since 2021, with a success rate of about 60%. The asymmetric nature of these trades means that the winners more than compensate for the losers.

My best prediction was identifying a DeFi protocol's token before its Coinbase listing in 2022. The 280% pump generated enough profit to cover my next six unsuccessful predictions and still leave me significantly ahead.

Here's a breakdown of my results over the past two years:

- Total predictions made: 31

- Correct predictions (listing within 60 days): 19

- Average return on correct predictions: 94%

- Average loss on incorrect predictions: 15%

- Net portfolio impact: +168% (compared to simply holding BTC/ETH)

These results aren't anomalous. I know several investors using similar approaches who have achieved comparable or better outcomes.

The Compound Effect of Consistent Wins

What makes this strategy particularly powerful is the compound effect of consistent wins. Unlike trading, where gains are often given back in subsequent losses, listing prediction wins tend to be permanent. Once you sell after a successful listing prediction, those profits are secured.

By reinvesting a portion of each successful prediction into your next opportunities, the compounding effect becomes significant. Even with a modest starting capital of $10,000, consistent 50-100% returns on successful predictions can grow your portfolio substantially over time.

The Limitations

This strategy isn't perfect:

It requires significant time investment: You need to monitor on-chain activity constantly or build automated systems. I spend at least 15-20 hours weekly maintaining my database, analyzing new patterns, and investigating potential signals. Without this commitment, your accuracy will suffer significantly.

False positives happen: Sometimes exchanges test integration with tokens they ultimately decide not to list. I've had several cases where all technical signals suggested an imminent listing, only for the exchange to abandon the process. This is why risk management is crucial never overcommit to a single prediction.

The edge is eroding: As more people adopt this strategy, the pre-listing accumulation happens earlier, reducing the potential gains. Three years ago, you might see 200-300% gains on listing announcements. Today, 30-100% is more typical as the market becomes more efficient at pricing in potential listings.

Capital requirements: To make meaningful profits, you need enough capital to take substantial positions. While the percentage returns can be impressive, turning $100 into $200 won't change your life. This strategy becomes truly powerful when you can deploy $10,000+ per opportunity.

Technical complexity: The learning curve is steep. Understanding blockchain forensics, exchange operations, and the technical nuances of different token standards requires significant study. Most people who attempt this strategy give up before developing true proficiency.

Combining Strategies for Maximum Effect

The most successful crypto investors I know don't rely on just one approach. They combine multiple strategies:

- Using on-chain analysis to predict listings

- Participating in legitimate presales with strong fundamentals

- Allocating a small percentage to promising memecoins

- Maintaining a core portfolio of blue-chip crypto assets

- Generating yield through staking and lending

This diversified approach provides multiple uncorrelated return streams, reducing overall portfolio risk.

I personally allocate my crypto portfolio roughly as follows:

- 30% to blue-chip assets (BTC, ETH)

- 30% to listing prediction opportunities

- 15% to yield-generating strategies

- 15% to longer-term fundamental investments

- 10% to high-risk, high-reward opportunities (including memecoins)

This balanced approach has allowed me to achieve consistent growth while managing downside risk effectively.

The Psychological Advantage

Like the memecoin strategy discussed in Part 1, listing prediction offers psychological advantages over trading. Rather than making dozens of anxiety-inducing decisions daily, you're making fewer, more calculated moves based on concrete evidence.

This reduces decision fatigue and emotional interference. You're not constantly second-guessing yourself or chasing price action. Instead, you're methodically analyzing data and acting only when high-probability opportunities present themselves.

What's Next?

In the final part of this trilogy, I'll reveal what I believe is the most sustainable and technically fascinating profit strategy in crypto: capturing MEV (Maximal Extractable Value).

While listing predictions can generate spectacular returns, MEV represents a structural opportunity that exists regardless of market conditions. And thanks to new platforms, it's becoming accessible to regular investors without advanced technical knowledge.

Until then, remember: in crypto, information asymmetry is everything. The blockchain doesn't lie you just need to know how to read it.

Jake Thornton is a crypto investor and researcher since 2014. After losing most of his trading profits in the 2018 bear market, he's focused on alternative crypto investment strategies. Previously, he served as Lead Developer at Nebula Protocol until the project wound down operations in 2021. This article is for informational purposes only and does not constitute investment advice.

What's your experience with trading vs. alternative crypto strategies? If you have any questions or thoughts, feel free to leave a comment below!

https://www.reddit.com/r/CryptoCurrency/comments/1jtja6n/the_crypto_profit_trilogy_part_2_predicting/

The rewards earned on this comment will go directly to the people( @blkchn ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.

It was a good lesson, especially since there is now a system of “public votes” for them to pre-approve cryptocurrencies that have been nominated by Binance users. I don't know if that's a good thing, or an easy target for manipulating cryptocurrencies without foundation. Although I haven't had any SCAM problems on Binance since I approached it as my main exchange