Fee Structure Changes Coming to Hive-Engine

Hey all, I'm working on a slow progression of how we handle fees on Hive-Engine.

Problem: We want more liquidity.

Current Solution: Use Bee to incentivie staking

Problem: It doesn't work very well

New Solution: Lower Gateway fees and add a fee to trade on Liquidity Pools. Hive-Engine will take no % on the fees for LPs.

We're going to lower the gateway fees from 1% to 0.75% (BSC and ETH fees will remain 1% on withdrawal since there are no fees on deposit).

While doing that we're going to introduce fees on the diesel pools. Pools will now have a 0.25% fee per transaction. Note, 100% of the fees will go to the liquidity provider. Maybe in the future we'll add a small fee to go to Bee token holders, but it's not the next priority.

Anyway, this isn't the final solution. We'll keep tweaking, but we're going to try this out for the next few months and see how it goes.

Changes are planned to go live at 8pm Eastern 1/25/22 (8 days from now). |

Measuring success: If this goes well we'll have deeper liquidity pools provided by more people, and they're generating the best fees in the entire industry for liquidity providers. We'll see.

hmm, Maybe .5% and .75% on withdrawals seems a bit better, Must buy more workerbees than.

how about @aggroed lowers fees down to 0.1% ONLY for users who buy like a LOT of BEE or worker bee or whatever lol

Now that's an airdrop!!

I confess to know very little about staking liquidity.

I staked liquidity for a while... but I was not sure it was doing anything.

Can someone point me in the right direction with that?

You stake Liquidity and if the pool has rewards, you get them periodically. That's basically it.

Alright. What token is used for the rewards?

And when you say "if" that means that there is no guarantee that there will be rewards?

View more

This change, as I understand from this post, will cut 0.25% of anyone who uses a pool for swapping and those tokens will be distributed to the liquidity providers. This should increase the earning of the providers overall by exactly those 0.25% of the overall transaction volume.

check out the open source pools on https://alcor.exchange we need to learn from the math and work of @avral from Golos , the OTHER steem fork!

View more

If you are overwhelmed by the Tribaldex UI, https://beeswap.dcity.io/swap?your_positions is a bit simpler and does a good job overall.

Thank you. That's new to me, I'll give it a shot.

I tried the Tribaldex one and yes it was a bit difficult to understand.

View more

sure, here is the right direction: https://beeswap.dcity.io/swap?pools

tribaldex is great for superuser/devs/etc,

beeswap is great for liquidity providers.

both interact with the same pools.

Nice. Thank you very much.

I will check it out but also follow up once I regain liquidity after buying all the #Splinterlands packs I could buy!

just think of staking liquidity like you are a bee in a hive collecting sunlight by the square meter through photosynthesis

see its simple, you collect pollen like interest and hah

hahaha ok im not serious about that analogy but i was about to do that

But you get points for creativity!

POLLEN

see, this one gets it

View more

If you want to take the bee theme to a higher level, check out the SWAP.HIVE:PLN pool. It has some rewards in the usual tokens, and then a whole bunch of bee-themed gaming tokens. From an analogy standpoint, it's mind-blowing!

Would be nice if Diesel pool owners had the ability to specify a percentage of these fees to go to the LP reward pool. Although I believe there is a fee to create a reward pool for a Diesel pool so that would be prohibative.

At that point, since the fees go to pool owner, should they be able to set the fees?

having some settings like that available would be nice as a pool owner but would also need some really clear UI work done on the frontends ahead of time so people are making informed decisions. personally I'd love more pool contract options but also I'm a crazy person so there's no telling what I'd do with it.

btw you might already have got this, but I think the fees are going directly to liquidity providers by expanding the value of their shares in that pool, and not to the person that created the pool, since the point is to give more incentive for adding liquidity across every pool, and I think it stands a good chance of working, at least to some degree.

Don't blow smoke up our ass blow splinterlands cards up there silly :P sounds good, .25 fee is manageable. funny comment just to see if you read these.

oh it will be read

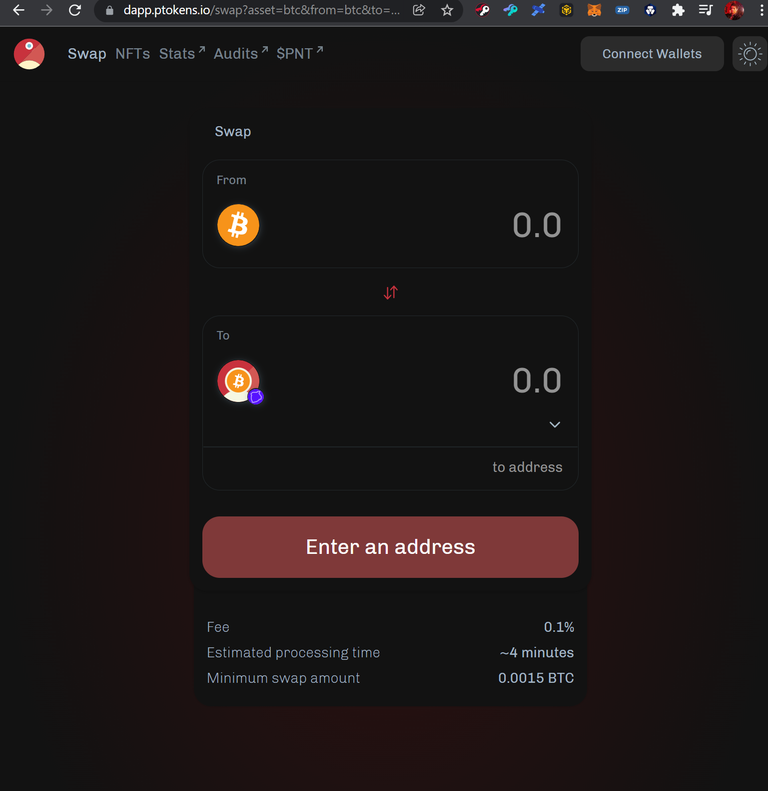

the fees on dapp.ptokens.io are now 0.25%

it is a nice low fee at least!

View more

So interested to see how it goes with the trade fees... have you thought about letting the LP pool creator decide which system to use (this new one or the previous one)? Or are you forcing all pools to the new system?

As a large Liquidity provider myself I'm very intrigued of course but I also do use the system to do trades so both options are interesting. Seems like there was however an interesting marketing potential to not be the same fee as all the other LP exchanges. Aka .20% seems like an option.

As for the deposit fees:

I would have said something lower than .75% maybe .5% coming in... you need more liqudity IN the ecosystem and there are 3 competitors all doing .25% anyway but they run out of liquidity pretty often (or at least when i look) but it's hard to get used to .25% then be willing to jump to .75% ... Go for the big play... push for huge amounts of money and tons of users via the lower fees. Unless of course you're looking for measured growth and not the problems that come along with bigger viral growth.

I think if it were 'optional' or a setting that pool creator could modify, then we run into a problem with "owner is MIA" or potential hijacking scenario where someone makes a pool between 2 popular tokens and messes with the settings into something not ideal for anyone. It would also create a contrast that made any pool with fees look like some type of negative thing you're supposed to avoid through circumventing around between the pools that turned it off.. and whatever charity it offers to the people swapping is coming from the opportunity cost of the liquidity providers, in a way. For those reason I think the universal fee is better, even though I personally love to have more options available.

Makes sense... However I keep hoping that if there is a will to make it work there will be a way.

View more

i want a way to use scotbot style settings for staking to stake my pool deposits so i cannot even withdraw from the pool for X amount of time or even never . forcing people to have to have the token to take out the swap.hive etc .

There options already available that do 0.25% and most people moving a serious amount likely use them. There will however always be people who use the default option unknowingly.

an example of 0.25% fees for Ethereum/BSC pegs of tokens across many other chains, even eosio / dpos ones have pegs .. their PBTC for example has many millions of dollars more in volume and supply (of real btc backing) than swap.BTC .. and PBTC has their eosfinex partners from bitfinex working with the ptokens.io github: PROVABLETHINGS guys (Who DID say I CONVINCED THEM to add HIVE to their system )

https://dapp.ptokens.io

ok so today its 0.1% .. (Its exciting to imagine what a Hive, EOS or Telos chain would do with the fees made from just this swapping, while using PBTC or swap.BTC has no fees to transact on our main net eosio/dpos chains ... but the money does FLOW when people want to withdraw to the main net (WHich they hopefully wont need to do as theyll directly sell swap.BTC or PBTC for eps/telos or swap.HIVE and just keep the token in the ecosystem....

so just an example of the only OTHER big peg of Bitcoin that 8is actually used on a DPOS / EOSIO network by tens of thousands of active users, without any fees, except when they want to withdraw to actual BTC and then they pay the BTC fee + the 1% fee, which i see now can be lower ... (and we know theres always the idea of binance style tokens you hold/stake to get a cheaper withdraw fee etc )

whats cool is to imagine we take up all that Bitcoin transaction fees traffic, and sorta freeze a lot of BTC into our ecosystem, and only charge money for the GATEWAY like this like pnetworkdefi ptokens.io or @privex ... and use that model to literally fund the hivedao .. using what were going to bitcoin and ethereum transaction fees... and use communities to plug into erc20s like telos evm... man im going too fast 1000 mph again gotta slow down

When I learned about beeswap, I was ecstatic to go from paying the 1% deposit fee to 0.25%. That was huge for me. Been telling anyone I know who's moving funds into the HE to use them. 0.75%is still high imo

I must say I really liked fee free transfers in the pools, I'm going to miss that. But having said that with fees you might be able to attract more liquidity which could bring the price down of a swap.

That's the logic they're going with, and I think it will work out.

A small fee is vastly preferable to 1%+ price swings because of low liquidity.

Is that 0.25% fee per transaction for adding/removing liquidity, just swaps, or both?

It's for doing swaps, and goes to the liquidity providers.

Thanks for clarifying, Kenny!

!PIZZA

!BEER

View more

I am unfortunately totally lost. I'm guessing contextually that gateway fees are the deposit/withdrawal fees? But I haven't the foggiest idea what a liquidity pool is.

you can see/use them here: https://beeswap.dcity.io/swap?pools

this is a way for people to swap one token for another, using the liquidity provided by people.

for example you can take $10 of DEC and $10 of SPS and add it to the pool, then you would have some shares of that pool, get some rewards, and make it more stable when people go to swap between those, because higher amount of liquidity means a single trade will have lower price impact. Different pools have different token pairs, volume, liquidity, and rewards. It's somewhat new around here, but it's awesome.

Ahhhhh okay, that makes sense. Thanks for the explanation!

its like the uniswap of hive engine

"contextually" btw

"contextually" is what I said?

View more

Fair solution in my opinion :)

so fees will accumulate in LP or paid in liquid both sides of the LP?

interesting Question, imminently the same, but very different as time progresses

in-case it isn't found, I think it was implied in a comment below that the fee is added directly into the pool (so liquidity providers have same share, but the shares value increases)

View more

I actually thought they'd get paid in Hive, like BeeSwap but...maybe I'm wrong.

no, I don't think that makes sense unless every single swap fee were also paid in hive, which also doesn't make sense, so it's most likely that whatever token is being swapped is also the one that is used to pay the fee (or 0.125% on both sides of the pair after swap)

Awesome. I have been thinking for a while something like this was needed, not because I want to pay fees, but because without this some of the pools have nearly zero incentives, so with this change people can justify adding liquidity to pairs that have some volume even if nobody has added a reward distribution contract for it. I think it's a little double-edged since some people might have knee-jerk reactions (hive spoils us, you know), but I can attest that I am now even more stoked to add more liquidity to everything whenever possible, more reason to keep bringing in outside funds, and I think 0.25% is fair.

tl;dr - Great news as far as I'm concerned.

There won't be fees for adding or removing liquidity. Fees gather in the pool as trades happen.

If they gather in a pool with no distribution contract or rewards contract how will the distribution be determined?

liquidity providers each have a specific % of the pool, based on their shares, based on how much they've added to that pool... I don't understand where this question comes from because it seems obvious? well, I guess that's only if you're active there, maybe from outside perspective it seems more complicated than it actually is.

Basically if you have 100% of the pool liquidity and people are adding value to it from the fee, then you still have 100% of the pool afterwards, it's just larger now, does that make sense?

View more

ahhhh.... this makes your post make more sense- I really thought by 'transaction fees' you meant adding liquidity.

What you really meant was every swap would generate additional income for the LP not that adding or removing liquidity would be penalized.

Looks solid, cheers !BEER

View or trade

BEER.Hey @aggroed, here is a little bit of

BEERfrom @manniman for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Will there be a fee for adding / removing liquidity or only for swapping?

good question

I have the same question.

no

thanks!

Thanks for update.

0.5% would be even better ;)

If the fees are too high would anybody swap?

I meant the deposit fee

Interesting! Im just learning about spinterlands related liquidity pools and liquidity pools in general today, wonderful to see this and finally follow your profile after playing since August!

I have been wondering after reviewing the SPS whitepaper recently, a significant amount of SPS is allocated monthly to LP incentives. I remember in SEPT there was a SPS liquidity incentive with Pancakeswap syrup pools which has since ended. Adding SPS bonus incentive payouts to all tribal dex/diesel pools- splinterlands related LP pool payouts would be awesome, what do you think?

currently the SPS airdrop is still going, which includes a lot of the DEC pools, so I'd imagine more SPS LP rewards would come near the end of that or some time after, to keep things a bit more coherent and not flood the market.

makes sense!

So are the pools on H-E the same as the ones on BeeSwap? Or are they totally different?

If they're the same, then do these fees being discussed only apply when you're using H-E/TribalDex? And BeeSwap has it's own fees?

I guess I'm not 100% how these all fit together...

you have the right idea just needed confirmation:

yes, beeswap/tribaldex/HE all show the same pools, and will have the same fee

PIZZA Holders sent $PIZZA tips in this post's comments:

torran tipped kennysgaminglife (x1)

@wanderingmoon(1/5) tipped @aggroed (x1)

You can now send $PIZZA tips in Discord via tip.cc!

Looking forward to the changes and start adding to these pools. Thanks Team

I think a fix % fee speech against super high volume deposit/withdrawals.

There must be a cap somewhere. Maybe 100$ or 500$, but someone that deposits a million for some trades never wants to pay such a high % fee. Special because it's the only fee and shows up quickly.

Lower fees on hive would be cool :)

Makes Sense.

I have another thing in mind. We are using multiple pools on HE for same token. For example, we have 4-6 pools for just DEC and is try for BEE and every other token which distributes the liquidity. It would be better to have pairs with standard token like hive or BEE whatever team choses and get a deep liquidity. So if someone wants from DEC to BEE, they will auto use DEC to HIVE and then HIVE to BEE pools, instead of using an illiquid pool of DEC to BEE.

I really liked the idea of Thora chain where everything is pooled against RUNE. So Rune value is derived from what is locked in liquidity and you can do swap on any listed tokens without creating redundant pools. We can try to work this for HE pools as well and may be use BEE token for every pool. This would increase demand for bee and also give deep liquidity for larger swaps. We don't need redundant pools. Let me know if you need help on idea/concept.

Here is thorchain for example only: https://app.thorswap.finance/

I made a German translation of this post for a better information of the German-speaking users.

$WINE

Hi @theguruasia, You Or @aggroed Belongs To Hivewatchers/Spaminator or In Our Blacklist.

Therefore, We Will Not Support This Reward Call.

(We Will Not Send This Error Message In Next 24 Hrs).

Contact Us : WINEX Token Discord Channel

WINEX Current Market Price : 0.290

Hive is so ready for series A big money angel investors and for splinterlands to be on CNBC

capital ackzas to peopel who cant normally get it

1000 plots for $800,000 virtual land, but also have stuff that sells for $0.22 very important that theres a variety, that you can start from $0.22 and MAYBE trade or POST your way up to $50k nft i mean dude, if you become a hero an dget investors or big twitter users into hive, you can really become powerful and rich inside the hive community and become a legend if you can get big names to talk about hive or post on here

its like the secret exploit to actually socially engineer twitter, get hive clout and fame and use that to get whales to upvote you forever ... just get one big name or company or organization to buy Hive

Can someone tell me what staking bee is for?

I like this, totally free transactions are awesome but more liquidity is even better. Can't wait to see how this evolves. Oh, and it should help with the impermanent losses.

Great, mid-game rule changes and penalizing trades in order to get more liquidity? How does that even start to make sense? Starting to feel more and more like the old Steemit Inc is now running hive-engine.

"giving incentive for liquidity providers to get more liquidity? How does that make sense?"

yes, that's the question you're asking.

What happens with liquidity when a stock exchange with say a competitive 0.1% stock trading commission gets hit with a 0.15% sales tax by the country it resides in?

Penalizing transactions doesn't normally create incentive for liquidity to grow. It normally does the exact opposite.

So, how does proposing it helps liquidity in this case even start to make sense in the slightest?

AFAICS, these are exactly the type of weird back of a napkin theory mid-game rule changes that Steemit Inc used to pull on us, and the type of weird back of a napkin theory mid-game rule changes that nuked two of my projects back in STEEM days.

Please explain to me how I'm wrong?

View more

I can't wait to see how this works out and thanks for the update.

!PIZZA

!HBIT

well, this should stop the in and out dec buyers and dumpers that hop in and out of the LP pools right near snapshot time. bravo.