📊 Hive vs HBD: Trading and Savings Update – August 20, 2025

Today marks another important checkpoint in my Hive and HBD journey. With Hive’s price softening a bit, my balances in both trading and savings accounts have shifted. Let’s break it all down.

🔹 Market Prices

Hive Price: $0.2054 🪙

HBD Price: $1.00 💵

🔹 My Current Holdings

Hive Power (staked): 2,207.619 HP

HBD Savings: 184.662 HBD

Hive in Trading: 1,900.342 HIVE

HBD in Trading: 257.969 HBD

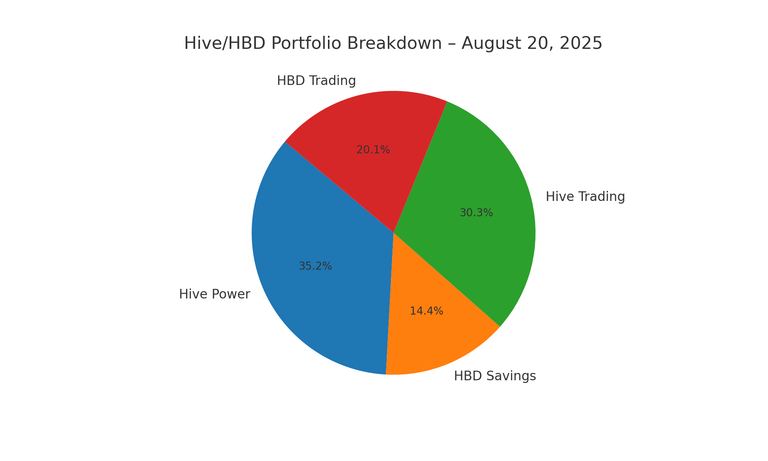

💰 Portfolio Value Overview

Staked Hive Power Value: 2,207.619 × $0.2054 ≈ $453.40

HBD Savings Value: 184.662 × $1.00 ≈ $184.66

Hive in Trading Value: 1,900.342 × $0.2054 ≈ $390.54

HBD in Trading Value: 257.969 × $1.00 ≈ $257.97

➡️ Total Portfolio Value = $1,286.57

⚖️ Trading vs Savings Strategy

Right now, my savings side (Hive Power + HBD Savings) is worth about $638.06, while my active trading side (Hive + HBD in trading) totals about $648.51.

That’s almost a perfect balance, showing that my strategy of splitting between stable growth in savings and active trading for compounding is staying consistent. Even as Hive’s price dipped, the trading side remains productive since I’m able to buy lower and keep positioning for the next rebound.

📝 Reflection

The last few days have shown the importance of having both sides of the strategy running together:

Savings keeps my base secure and slowly growing.

Trading lets me take advantage of short-term Hive price moves.

With the market consolidating near the $0.20 range, I see a chance to continue stacking more Hive through buys, then converting profits back into savings over time.

Congratulations @homerunderby! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 1000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP