Bitcoin, Bitcoin Mining, Uses And Regulation

Years ago, concerns over the traditional banking system were raised which got a lot of people thinking. When people could not get access to their funds as and when they wanted, it became a growing concern. This was just the tip of the problems with the traditional banking systems. They never offered transparency and you were not even in control of your own money you worked so hard to save, keep or invest in the bank. This made people start looking for alternatives that would offer the best solutions for them. The one common theme with these banking systems was "centralization". Centralization meant single authority or ownership serving as an intermediary or third party between you and your money.

Talks for financial systems were people were in charge of their money, got access to it as to when they wished removing third parties and providing utmost transparency began to emerge. It did not sound very realistic at first since the centralized financial institutions were what everyone knew but these theories and whispers soon gained ground in around 2008. All these theories will fall under one umbrella, "decentralization". Decentralization meant that most if not all the wrongs of the traditional financial banking systems will be put right and still maintain the good parts.

All these were taken into consideration and signs of progress of developing a financial system for the people became real in the year 2008. This marked the era of a new financial world, a game changer as we are enjoying today; " bitcoin" which gave birth to "cryptocurrencies".

What Is Bitcoin

In the year 2008, "Bitcoin.org" became registered as a domain name which has become global. Bitcoin is a big name now that almost everyone has heard of. What happened next has given another interesting feature to bitcoin. This domain name, Bitcoin.org is now protected by "WhoisGuard". This means that the identity of the person or persons who registered the domain name is sealed from the public. That information is not public. This act demonstrated that bitcoin can bring something traditional banking systems did not have, anonymity. Not everyone wants to attach their face to their account so this realization meant that people who did not want to have their information were totally safe.

Bitcoin was developed as a cash system that would be peer - to - peer. Peer - to - peer or P2P which means there is no need for third parties. Transaction happens directly between parties involved. These transactions are executed with the help of codes known as smart contracts . Bitcoin was developed by Satoshi Nakamoto. An individual, a group, no one knows. Satoshi is anonymous and has been that way since 2008 leaving a lot of people wondering as to whether the real identity will ever be known. There have been a few guesses as to who Satoshi might be but all those have proved to be wrong. One might be left why it is believed Satoshi Nakamoto created bitcoin when the identity is unknown. This is because in 2008, a cryptography mailing list was published with writings, "I have been been working on a new electronic cash system that is fully peer - to - peer, with no third party". This was published under the name Satoshi Nakamoto.

To use bitcoin and make it different from the banks, a blockchain was created. This blockchain is what bitcoin runs on and it allows it to be decentralized. The blockchain is a distributed ledger technology that records every transaction carried out promoting transparency. It increases security as well and helps to protect the account of those on the blockchain.

Bitcoin is a cryptocurrency meaning it is a digital asset and cannot be hand held like normal currencies such as the us dollar and pounds.. Bitcoin can be bought and traded on the market, mined and has evolved from just being a peer - to peer cash system. It is referred to as the mother of all cryptocurrencies since it marked the start of crypto. A lot of other cryptocurrencies have been created since Bitcoin in 2009 which are called altcoins.

The First Bitcoin Block

Genesis from religion means beginning and here it means the same. The genesis block is the first bitcoin block that was mined to officially begin the cryptocurrency and bitcoin revolution. It is called block 0 or block 1. Anyone who wants to see the first bitcoin mined can still go have a look at it using a bitcoin block explorer. This is what cryptocurrencies and blockchains is all about, the transparency. The genesis block is on the distributed ledger as well as all other blocks that have been mined since then.

Bitcoin Mining

The mining of bitcoin has evolved since 2019 when it was first mined. In the beginning a personal computer was enough to mine bitcoin. That is why you hear some people say they mined bitcoin in the past but either due to changing their computers or something else, they lost the mined coins. Now, you need very powerful computers to mine. Bitcoin mining is described as solving a hash or complex mathematical problems in attempt to validate bitcoin transactions on the blockchain. The miners are in competition with each other and the first to do it is rewarded as a block reward.

Everyone can be a miner as long as you have the resources to do so. You can join the mining pool if you do not have enough resources. All you need is a computer with the right software. Those that have the means but cannot mine hire a team to do it for them. The miners are rewarded but after every 4 years, these rewards are halved. You might be wondering why people still bother to mine when the rewards are halved. It's simple, more value even for the reduced rewards.

When the first btc when released in 2009, the rewards for verifying a block was 50 btc but as we know, the value of bitcoin then was not like today. Because the amount of btc in totality is limited, bitcoin is halved after every 210000 mined blocks which takes about 4 years to achieve. There have been 3 halving so far with the latest occurring in May 2020. The next bitcoin halving is expected to occur next year 2024, which will see rewards go from 6.25 bitcoins to 3.125 bitcoins. Looking at the price of of btc now, 6.25 bitcoins is very worth it.

Bitcoin mining is meant to be complex and so after every 2 weeks, the complexity adjusts depending on the number of miners. Increased miners mean more difficult mathematical puzzles to solve. It takes miners about 10 minutes to validate a block.

Proof of Work

Proof of work (POW) is the consensus algorithm or mechanism for bitcoin. Remember we said miners are rewarded for their work, proof of work acts as a source of proof for these miners. POW is used to validate transactions on the btc blockchain and also reward the successful miners. In proof of work, the competition is important and the rewards given serve as an incentive. It takes quite longer than other consensus algorithms to validate transactions.

Miners have to pull a lot of mining power to validate the transactions which is very energy consuming and expensive to operate. After every confirmed block, it is recorded on the blockchain. The blocks contain all the information about the transaction including a hash. This hash forms the basis of the next block. This is continued and we have multiple blocks creating a chain. This chain becomes immutable. it cannot be altered and whatever is recorded on it is permanent. This gives the bitcoin cryptocurrency and blockchains its immutability function. It creates more transparency and trust.

Basically, proof of work has the mining network engaging in hashing functions trying to verify a transaction. It is completed when the result or the output has a minimum number of starting zeroes. This has a nonce which is a series of numbers. POW allows the nodes or miners to provide proof of work done in the form of using energy and computation power to validate transactions. This prevents dispute over who mined what and promotes the core concept of crypto; decentralization.

How To Get Bitcoin

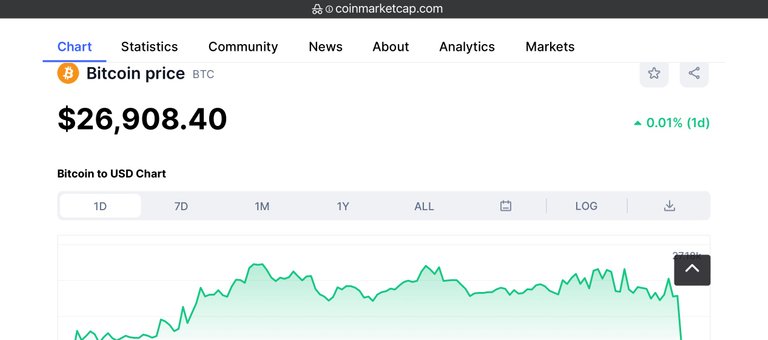

[Price of btc at the time of writing

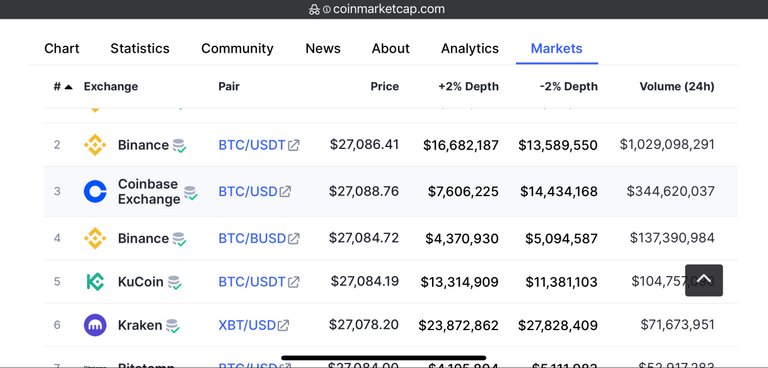

Bitcoin mining is not the only way to have access to bitcoin. You can directly buy bitcoin from the cryptocurrency market. At the time of writing, bitcoin is valued at $26,908 with a market dominance of 45.98% and a market cap of $525.291 B . You can buy bitcoin from binance, huobi, bitfinex, coinbase, kraken, kucoin,, bitstamp, bithumb, among others. Bitcoin is peer - to - peer and so can be directly transferred from one wallet to another.

bitcoin market from coinmarketcap

The Uses of Bitcoin.

Bitcoin is used a form of payment. Once you have btc in your crypto wallet, you can use to to pay for things you purchase provided bitcoin is accepted. It is already accepted in some countries as a form of payment and the most notable is EL Salvador. El Salvador has accepted bitcoin as a medium of exchange.

Bitcoin is used as a form of investment. The cryptocurrency market is a volatile one and risky for that money. As such we are advised not to invest with money we cannot afford to lose. No one controls the crypto market although some big names can influence it with their actions. As such, you can earn a lot more on your investment when you are careful with your bitcoin and taking note of your risks. An example of a good investment would be buying btc when the price was at say $47K and selling at $68K, its all time high. A bad investment would be buying at that all time high and not being able to make profits since then considering the price has gone down since.

The Global Acceptance of Bitcoin And Acts of World Leaders To Regulate It.

Bitcoin has grown so much since 2009 and a lot more people are accepting it. It scares the governments as they know it will take money away from the banks and give absolute control to the people. That is why there are new ways everyday to regulate bitcoin and other cryptocurrencies.

China has banned crypto and Hong Kong have come up with legislation to have every exchange with the intention of retail functions to apply for licenses. The US have decided to come up with their own digital version of the united state dollar, CBDC in an attempt to stop people from wanting to use crypto. Some might say this is good due to the risks involved with crypto largely due to the scams.

Nonetheless, bitcoin has come and it is here to stay. It has changed the financial system by leaving the money in the hands of the owners while giving them the chance to increase their money. Bitcoin promotes decentralization, is very secure to use and is transparent. Satoshi Nakamoto did great with this and who knows if we will ever get a face attached to the name.

Thank you.

Sources ;

Posted Using LeoFinance Alpha

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.