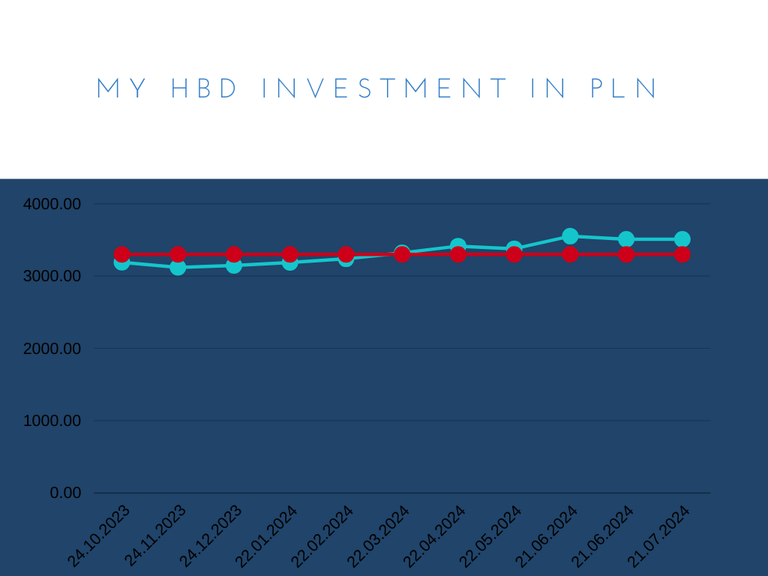

My HBD investment after 10 months

This is my HBD investment showcase for an English speaking audience, that might be interested in how an HBD investment project might perform in "double currency risk". Especially since there are growing demands of changing HBD APR.

My Investment in HBD After 10 Months

What is it all about?

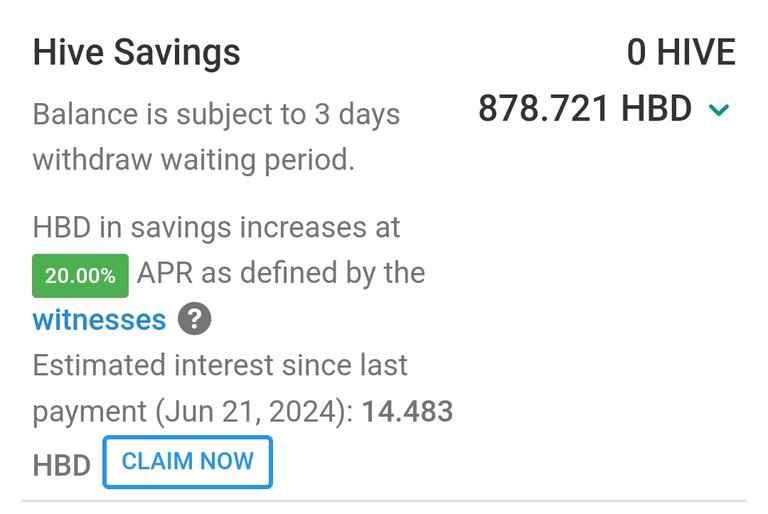

In September/October 2023, I spent PLN 3,300 on Hive, of which I bought 500 Hive and the rest went to HBD. I power downed and sold Hive at the worst possible time - day trading is not my forte.

How did it go?

- USD exchange rate on 21.07.2024: 3.93

- Hive price on CoinGecko on 22.03.2024: 0.21 (though now it no longer matters)

Formula

[HBD balance]*PLN exchange rate

| Date | PLN Value | Result PLN |

|---|---|---|

| 24.10.2023 | 3189.93 | -110.07 |

| 24.11.2023 | 3119.64 | -180.35 |

| 24.12.2023 | 3145.49 | -154.51 |

| 22.01.2024 | 3187.60 | -112.40 |

| 22.02.2024 | 3238.63 | -61.36 |

| 22.03.2024 | 3321.58 | +21.58 |

| 22.04.2024 | 3414.71 | +114.71 |

| 22.05.2024 | 3378.53 | +78.53 |

| 21.06.2024 | 3552.47 | +252.47 |

| 21.07.2024 | 3510.29 | +210.29 |

Summary

Double exchange rate risk, how can one not love you? It's gratifying that despite the increase in the value of the zloty against the dollar, which falls within standard fluctuations, I have definitively (within reason) embarked on a path of stable growth.

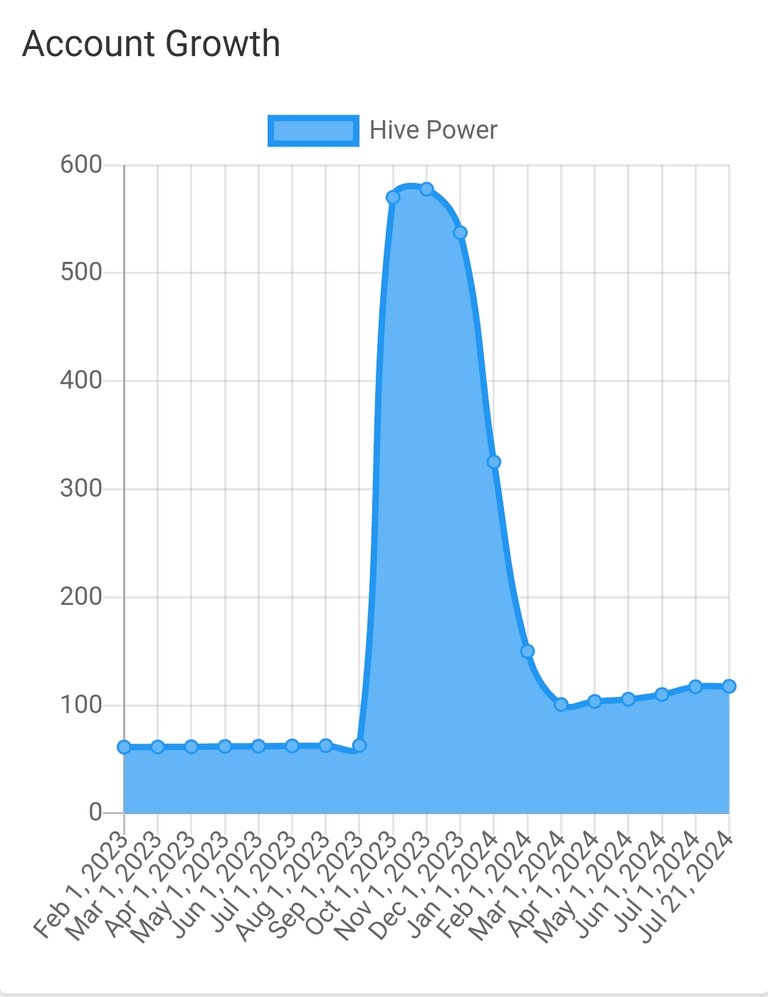

The account also grows slightly in HivePower.

Predictions?

The AI generated predictions for the value of the investment are as follows:

- End of October 2024: PLN 3680.87

- End of 2024: PLN 3777.27

These values are based on the trends observed in the provided historical data.

Results against the inflation

Unfortunately the nominal results beed to be verified due to high inflation of fiat currencies that we use. To evaluate whether the investment was profitable, we need to consider the impact of inflation. The annual average inflation rate in Poland is 11.2%, so the value of the investment needs to be adjusted accordingly.

- End of October 2024 (adjusted for inflation): PLN 3310.83

- End of 2024 (adjusted for inflation): PLN 3397.64

Compare these adjusted values with the initial investment value (PLN 3300)

Conclusion

The investment yielded a small real profit after adjusting for inflation. Therefore, it can be considered profitable, although the profit is not significant.