SEED Transparency Update

I've been feeling uneasy regarding something with SEED for a few months already (which intensified the last few days) with the overall crashing of all the markets.

Something which, if not addressed, could severely damage the project in the short to medium term (not to mention my reputation here). Obviously I don't want any of this to happen.

This post is a transparency report to let users know where we are standing in overall terms.

¿First, What's the Problem?

I've mentioned it probably dozens of times, but what's driving me worried is the illiquidity of the project overall (not a small thing).

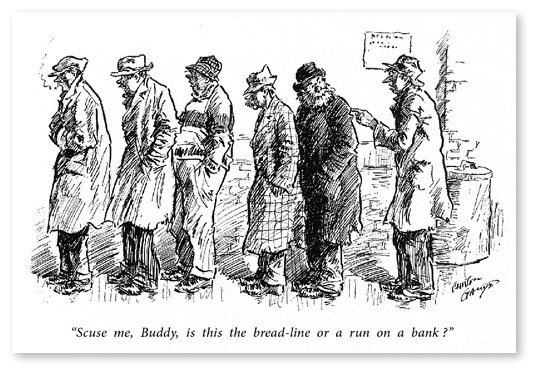

If a 'bank-run' scenario for SEED had to happen, There's not enough liquid available to cover everyone's funds at the last reported price of 1,1$.

We kept dipping the day after so the number is much more closer to 1$ now.

The main plan for a while has been to use the excess of funds coming from presales to build up a buffer of stablecoins, but this has proven to be a slow solution, which lately isn't working out as it should (bear market things).

In the last months, most presales had a hard time just to cover it's own ROI, and they're much less frequent; so we can conclude that they're just useful in a neutral/bull market environment, since in bear there's not enough hype/excitement around to bring huge multiples early.

This is the current problem, let's address the other two relevant variables; SEED Supply and Available liquidity.

A look at the SEED Supply distribution:

Not all the SEED is the same from my eyes, (well, not exactly, let me explain). All the SEED is treated in the same way but...

From my side, there are 2 types of SEED tokens.

- Tokens ''not likely to be redeemed for liquid cash soon''

- The remaining or 'SEED which can be exchanged at any given time'. Or in other words, SEED being held by the overall public.

in the first category (the one that will remain untouched for the foreesable future) we have:

- My own stack or 50% of the total supply.

- SEED held by what I consider Private Investors. They hold 13% of the total supply.

They're (from larger to smaller) @trasto, @vibora, @j1984 and @resiliencia.

'Private Investors' are people which I know IRL, so I already know what are their preferences. They're here for the long-term and are OK holding SEED for a few years more.

Then we have all the rest, which is ~37% of the overall supply or 37K SEED. Let's save this figure for later.

A look at the (available) SEED Liquidity:

As you already know for the biweekly reports, we have 3 main ways of classifying the funds in the reports: Core, Liquid and Locked.

Core is our main DAO position, HBD savings and HIVE Power. Currently we don't hold HBD, and only 5K HIVE, so it's mainly DAO. I'm not counting any of these as available liquidity currently.

Locked is formed by all of our locked assets in long term vesting withdrawals. AKA DAO Maker presales. We can't count with any of these as available. Check this post for a more detailed overview.

- Liquid is composed by all of our available assets NOW. The figure reported a few days ago was 29,500$.

If we take the 37K SEED as the maximum withdrawable figure and we divide the liquid available (~29500$) between this amount we can conclude that:

29,5/37 = 0,797$ /SEED , which maybe is still somewhat optimistic since It still would require people to accept illiquid assets like Splinterland License Nodes, cards and LARYNX as payment for his SEED.

Not ideal, right? Taking the last reference price of 1,1$ then 0,797$ is ~30% short. This of course is a worst case scenario as I'm counting with basically all the SEED holders running for getting whatever cash is available.

Proposed Solution: Make 'Locked Liquidity' as not withdrawable (or 1/3 as hypothetical maximum).

This is a idea which I briefly touched as a provisional measure in the beginning of the project, when the Locked Value could represent at times a very big % of the portfolio (and it kept happening over time, honestly I don't remember why I stopped using it).

Now, I'm thinking about recovering it. Because why people should be allowed to cash out something which isn't really available? If it's not available for sell, then it's a mirage, doesn't matter the number, it's just a floating random number in dollars.

1/3 could still be counted but... I guess It would be better to scrap this figure completely.

I prefer a smaller number, but fairer for everyone.

Then, from now on:

- Locked Value will no longer count as a 'redeemable value'

So SEED will have 2 values:

- Backed Value (the exact same figure which we had until now). Total value of all assets divided between the total SEED supply.

and

- Redeemable Value (Which is the Backed Value from before minus the Locked Value).

What would be the actual Redeemable Value of SEED if we exclude the 'Locked Value'?

Pulling approximated numbers:

- Core: 43,7K$

- Liquid: 27,7K$

TOTAL: 71,4K$

/100K (Total Supply) = 0,714$ /SEED

The value counting with 1/3 of the locked would be a bit more, (like 0,8$). But as i said I'm all in about the idea of excluding this number completely.

TL;DR

In order to equal the playing field for everyone and avoid the possibility of someone cashing out more than it should, from now on I'm excluding the 'Locked Value' when calculating the redeemable value /seed.

Although I understand that this decision could trigger some hard feelings, I believe it's the better for the long-term viability of the project.

I try to keep things plain simple and fair for all the parts (including myself). Being accountable with everyone's funds is part of this transparency exercise.

It would be nice to hear about your plans and/or future desires with SEED. Since this is a 'for profit' initiative, what are your plans/expectations for SEED long-term?

For example, I know that @resiliencia wants to buy a van, and @trumpman wants 100K HIVE for his 1K SEED.

My plans for SEED is to be able to live off dividends once they're ready... and maybe I'll be selling 1/5 to buy myself a house. All of this while doing my part to help HIVE succeed.

50% of blogging rewards paid to @seed-treasury.

Have a good week everyone.

Posted Using LeoFinance Beta

Blah blah blah.

All I read is gay

not waiting for rug? :D

F*ck lmao, I just told u that u cannpt cash out as much as yesterday and you keep calling me gay.

wen upgrade? I'm not feeling anything anymore

Posted Using LeoFinance Beta

it's hard to go with the flow when you have a liquidity problem :P ( lame joke I know but I work with what you give me )

No probs, love ya

Posted Using LeoFinance Beta

I think it does make sense and it's a similar issue for the exchanges. They probably don't have all the funds ready if everyone withdraws because some of the things are illiquid.

Thanks for the update.

Posted Using LeoFinance Beta

You're welcome, thanks.

Posted Using LeoFinance Beta

Thanks for update. Hope everything recover soon.

Posted Using LeoFinance Beta

I know I repeat myself a lot... but the bear market will end sooner than later. Most of the damage has already been done IMHO.

Posted Using LeoFinance Beta

Mine is locked so no worries on my side as you only have the pressure of doing your magic when you can. If anyone wanted to sell their SEED for 80 c there will be enough takers so no stress as that would be a bargain.

It's great to know, thx mr coffee.

Understand that I have to plan for the worst, and although sucks to be under the initial price, it's after a -75% on absolutely everything on the market, so not THAT bad.

Thanks again for the support :)

Posted Using LeoFinance Beta

You can count my small amount as "not likely to be redeemed for liquid cash soon". If that helps any. lol

Posted Using LeoFinance Beta

Trust me, it helps much more than you believe.

Thanks for sharing that, highly appreciated :)

Posted Using LeoFinance Beta

I plan to buy the dip on SEED!!!

Me too!

Gracias compañero :)

Posted Using LeoFinance Beta

You can consider my small portion "locked". I'm in it for the long-haul. My plan is to get my money back through dividends down the road before I ever plan on selling any. I'm also with a previous commenter: if someone needs to sell, I'd be willing to help pick it up at a discount. :-)

Posted Using LeoFinance Beta

This is great to know, and a very good reason to rush dividends (which will be the next logical step after the liquidity problem gets somewhat solved).

Most holders already had a great degree of patience. So it's only logical to start paying back some.

Posted Using LeoFinance Beta

No hard feelings here. I know you've been talking about this and understand.

I think it's the sensible thing to do. Thanks for the endless support :)

Posted Using LeoFinance Beta

If bankrun, hit me up, i make a buy order for 0,3$ on 1$ :D

So, 0,3$ SEED lol

Posted Using LeoFinance Beta

na current price *30% :)

So even lower :D, but that's how to make good deals right? :P And then the bull can come back :D

My plan is to buy a little more next year. :) Certainly not sell.

Glad to know that bud. Thx

Posted Using LeoFinance Beta