DAO Maker Overview: One year of (profitable) presales for SEED holders.

The other day my beloved hiver and SEED holder @jfang003 asked in my regular Holdings report the following question:

And although I'm fully aware of the numbers (in gross terms), the question piqued my curiosity to know more about this information in detail. Neither short nor lazy, I picked up excel and started uploading numbers from my DAO Maker acc. interface.

In the last year (since late October 2021) we participated in 33 presales with our improved tier of 50K $DAO . Let's dive in and see how that went overall:

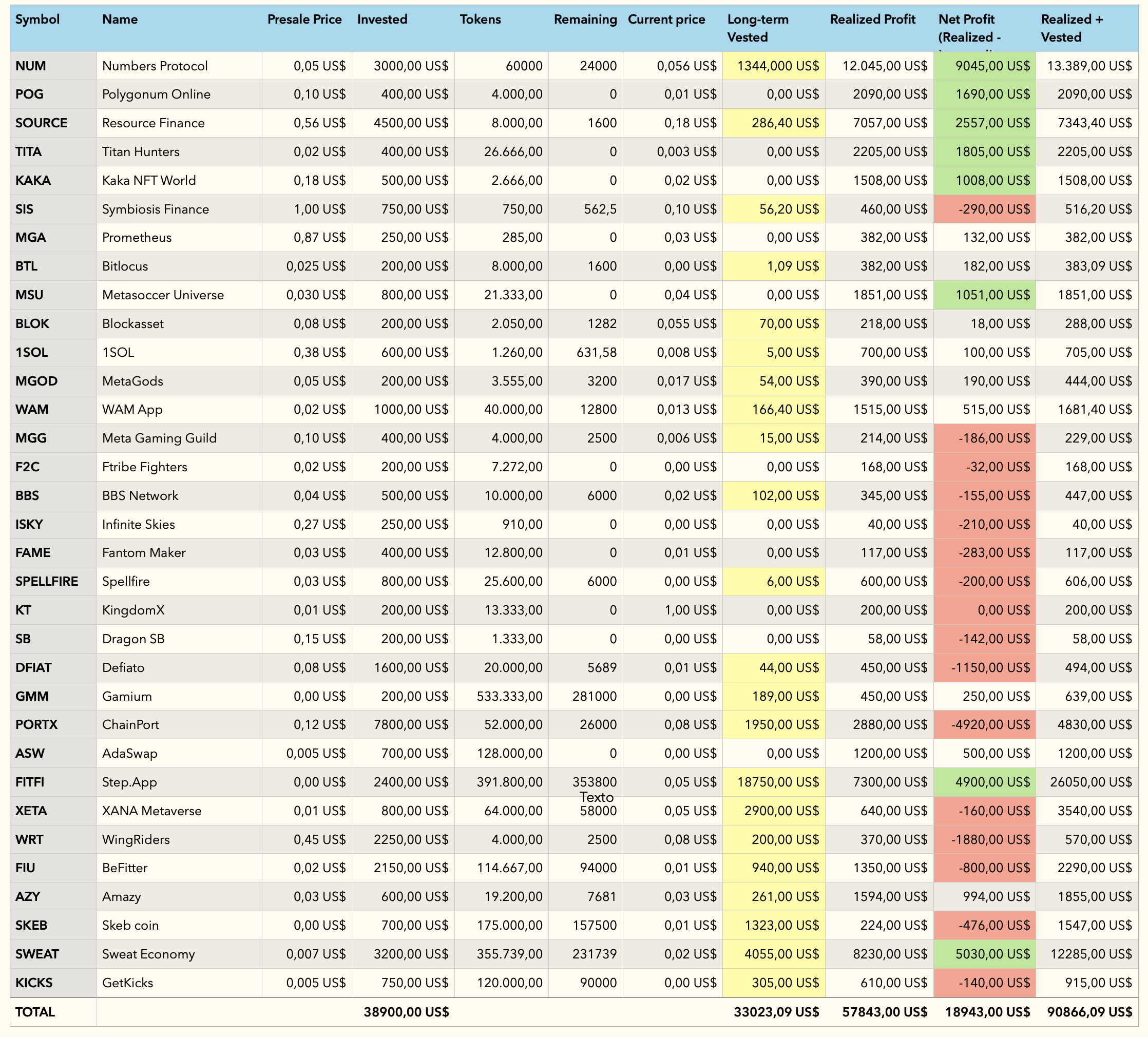

The presales are classified in descending order (older presales first), which means that the first ones on the list were carried out in October - November 2021.

The first values in the chart are pretty straightforward to understand (presale price, the amount invested, token ticker, etc) but there are a few highlighted that I believe are important to mention:

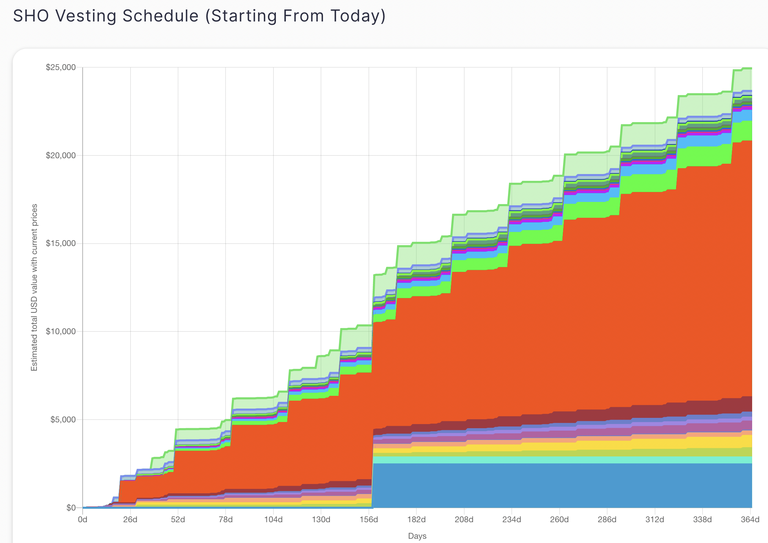

Long-term Vested: Tokens locked in long-term vesting release terms. P.e. 5% monthly or 10% quarterly. Every token has its own release schedule. All of them look like this:

The earliest one is in 3 days. The oldest one is in 897 days (almost 3 years!) and it isn't even shown in the previous chart. The remaining value in $ (if any) is represented in yellow. So, Yellow in the chart means that there's still value left to withdraw.

Realized Profit: Consists of the value in USD already extracted from unlocked batches of tokens. P.e. I invested 1000$ in Token ABC and I get 10% (100$ in the TGE). If I sold those 100$ worth of tokens for USDT/BUSD these are counted as 'realized profit').

Net Profit: It's just the realized profit but subtracting the amount invested. Green means that the amount invested has been recovered and that there's at least a +1000$ profit, Red means that there are still some dollars to recover before 100% ROI.

Note how early presales are already fully recovered and/or have a 0 'Long Term Vested' value. Newer ones (except for a few exceptions) are more in the red because of the bear market, but still, have plenty of value locked. Most presales in the first half of the year accumulated some losses (the red block in the middle of the chart).

For example, notice XETA. It's slightly in the red (-160$), but has 2900$ locked. Or FITFI, which was highly successful, with 4,9K$ in pure profit, but 18K$ vested over 16 months.

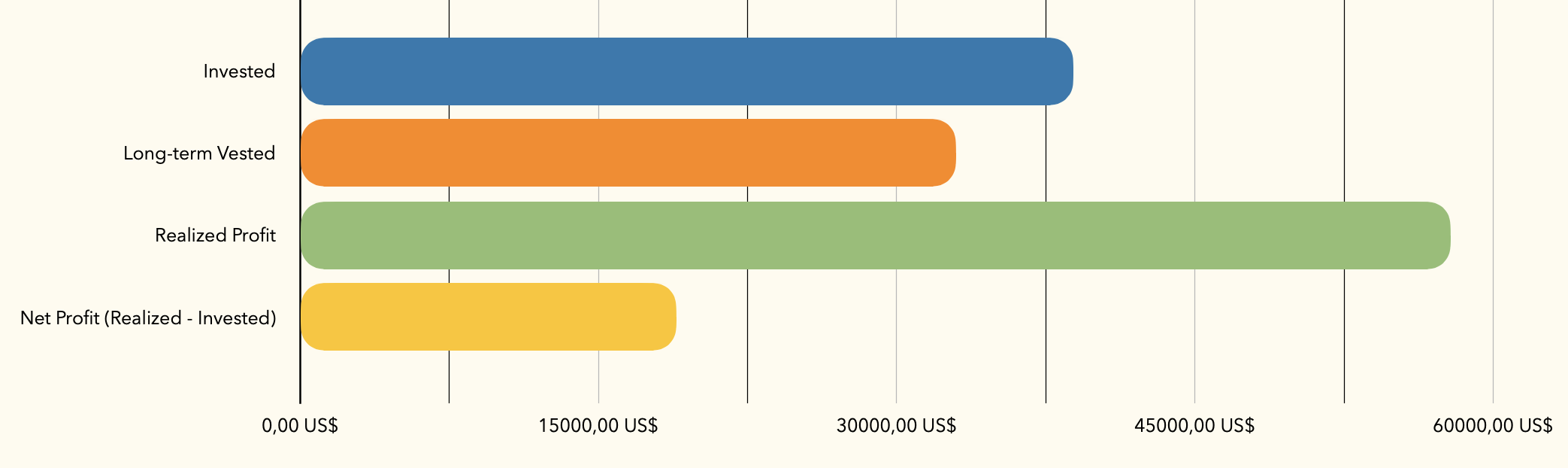

Overall the 4 most important values could be summarized as that:

Notice how the Log-term Vested is almost enough to cover our full investment... while the Realized profit in dollars keeps growing.

TL;DR

If you have the starting capital, DAO Maker is very profitable over extended periods of time (+2 years). But it needs time to manage every presale individually (and obviously be there to claim/participate/sell allocations).

The Presales model is proving to be highly lucrative for SEED, but it works much better for obvious reasons) on the bull market. Hopefully, by the next one, we'll have a very big stablecoin war chest (since this one has been faced with a tight budget). Mission was to survive without stopping the investment rounds. (After all the 38900$ initially invested has to come somewhere first). But this is my job. To keep the balance sheet healthy.

That's all for today, hope you enjoyed the read, I'll keep accumulating that kind of data.

Enjoy your weekend!

Remember you can follow the portfolio in real-time here:

https://cointracking.info/portfolio/seedtreasury

You can join us on Telegram and follow me on Twitter.

Vote for My Witness!

If you like what I do consider voting for my witness:

Witness account: @empo.witness

https://vote.hive.uno/@empo.witness

Posted Using LeoFinance Beta

https://twitter.com/1331330355513745413/status/1588895598010597376

The rewards earned on this comment will go directly to the people( @taskmaster4450le ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Yawn

So if I look at at cointracking, Do it consider the coin that will be released in later date for total value?

Posted Using LeoFinance Beta

Yep, all of those are locked (but they're being counted for obvious tracking purposes). If I'm not getting rid of most of these shitcoins is because they're locked :)

Great explanation and why we are so confident in your ability to just make profits out of thin air.

Well I'm just being transparent as I believe I have to.

Thanks for your confidence mate :)

😊😎🤙🌈

ENJOY your WEEKEND too!

Thanks for the in-depth explanation. It's proving to work out well and not every single token succeeded but the vetting process by DaoMaker seems to be doing quite well.

Posted Using LeoFinance Beta

Although some of them are technically in a loss, once more batches of tokens gets released they'll be easily in profit. So yes, as you said it's working pretyy well so far :)