Anyone looking to buy LEOM? - 'OTC' offer available

Hello,

I'm tired of dumping LEO. Ever since I bought 6,66% of the supply of LEOM (10K LEOM out of 150K) I've been dumping at least part of my rewards (and entirely for months), especially after the release of PolyCub.

I believe it's time to look for a more decent owner for these sweeties.

Thing is, I can't sell the miner tokens for a reasonable price as there's no liquidity out there. But I would like to...

I wonder, is there anyone among my readers willing to buy a large stack of LEOM?

Some LEOM numbers

LEOM (also LEOMM) is a type of miner token released at the beginning of Leofinance (formerly SteemLeo). The main advantage is it has a fixed supply of 150K and it receives a fixed percentage of the total LEO inflation (15% if I remember well).

It's a much longer-term investment and more passive compared with 'simple' LEO, as it's highly illiquid, but you don't need to curate to receive your rewards. You just stake & forget.

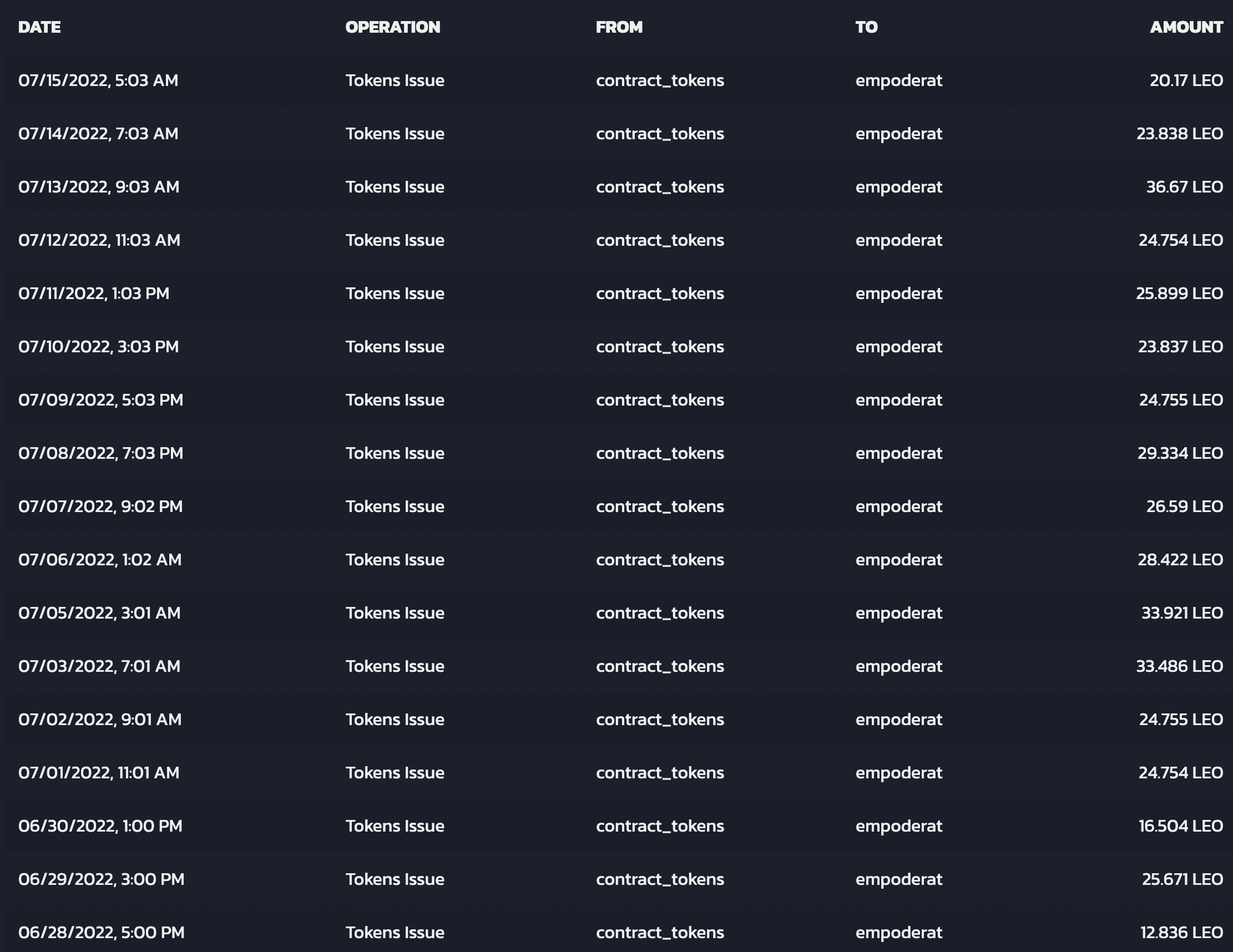

At the time of writing, this amount adds up to 25-35 LEO/day (for 10K LEOM) with 95% of the total supply of LEOM staked. So theoretically this number never should go down unless Khal makes changes to the core of the LEO token (which in that case would come with some type of refund for LEOM/LEOMM holders though).

LEOM provides you with a constant inflow of LEO tokens. Every day.

I bought all of them at 2 HIVE each when every HIVE was worth 0,2$ around September 2020, so 0,4$ /LEOM. I paid 4000$ back in time if we make the hive to dollar conversion.

Since that date, 660 days have passed, which means that my miners have produced 16500 LEO (assuming 25 LEO/day).

Assuming an average price of LEO around 0,1$ (although historically has been much more, maybe an avg between 0,2 - 0,4 conservatively speaking) then we're talking about 1650$ or a 41,25% ROI or a bit less than a 20% APR.

Numbers soar rapidly if the price of LEO grows up to 0,2-0,3$ or more. And that was my case, my investment is fully recovered since I sold the remaining of my LEO's at 0,2-0,25$ a few months ago.

How to get the most from LEOM?

If you're a long-term Leofinance supporter not willing to sell anytime soon and without a problem locking a decent chunk of liquidity, then LEOM could be suitable for you as an investment.

You can think about selling your mined LEO on future pumps, which increases drastically its profitability, or stake them to keep compounding with curation rewards. It's entirely up to you but both strategies are valid.

It's also recommended to own at least a decent bunch of 500-1000 minimum, to 'notice' the slow flow of tokens into your account. With smaller numbers maybe you feel you're not receiving rewards, since they're allocated in a lottery style.

On a side note, and since Project blank is coming since ages, I feel worth it to mention that (only maybe), LEOM holders will get a airdrop of the future blank token. Take this with a grain of salt as this is pure speculation. Real value of LEOM only should be derived from the LEO mined/farmed and no airdrops should be counted when valuing the asset.

And what's the price?

According to the previous numbers, I'm offering an asset (10K LEOM), which produces an average of 25 LEO/day which translates into 1,75$ (with a 0,07$ LEO token price). This yearly adds up to 638,75$ (assuming all things remain equal).

The highest bid in HE is 1,31 HIVE or 0,55$ /LEOM. While the lowest ask is 4 HIVE or 1,68$/LEOM. No liquidity on any of the sides.

At 0,55$ /LEOM, 10K LEOM would equal to 5500$ , the 638,75$ from before would equal to a 11,61% APR (fair?)

At 1,68$ /LEOM, 10K LEOM would equal to 16800$, '' '' would equal to a 3,8% APR. (vastly overpriced!).

With current market conditions, I would be happily taking an offer to buy up all my LEOM on the low end side of those prices... Dunno, still 3 weeks and a half of unstaking ahead to give it a few thoughts.

What about 5000$ for all the pack of 10K LEOM (0,5$ each)?

I would also be interested to accept Splinterland Validator Licenses... (yeah, I'm thinking about you @nealmcspadden).

TL;DR

- Everyone loves a good printer at home.

- Even more, if it prints dollars.

- Price of my machine is around 5000$ (but is negotiable).

- I'm accumulating Splinterlands License Nodes, so I would accept those as payment, but only if you're a trusted long-term user.

- Save your time and refuse to make very low-end offers. I'm not in a hurry to sell (but as I said before, I would like to be able to arrange a suitable and fair deal for both parts).

Good weekend!

You can join us on Telegram and follow me on Twitter.

Posted Using LeoFinance Beta

I just bought a bunch of LEOM. I'd need a sweetheart deal to buy more, like 1 sps node license

Posted Using LeoFinance Beta

Thx for the response, Definitely will take a thought on this

nah that would be insulting. I was thinking of asking if you were willing to give them out for free :)))))

That's a reasonable offer, upvote the post and that's it.

I always upvote your posts dear ser :P also reblogged for good mesure

help you with an reblog :)

Thaaaank you my bera

very nice offer. I wish I could get that from u. Tell crypto to 10x and then i could afford that one. :P

Sounds like a good idea! Not sure where I would get $5k from, so I have reblogged your post instead xD

thanks bud :)

where you're from, do you write amounts of money with commas instead of periods? It's a little confusing for me because I used periods.

$0.07 me

0,07$ you

this is confusing.

I'm from Spain, normally we use the dots '.' to separate thousands, while for decimals we use ','.

I know the feeling lol 😄, sometimes I don't know if it's me or the rest of the world

Regards !

Good investment if you have the funds. I am sure someone will scoop them up.

Posted Using LeoFinance Beta

It is if you believe in the future of the LEO token

Interesting, you switch from Leo deeper into SPL, could you comment on that? Why don’t you sit and wait for the bullS?

In my humble opinion it seems that the LEO token has been abandoned for quite a while while all the dev efforts focuses on polycub. I have the feeling that the previous tokens from the leofinance team are treated like 'experiments' (failed or not) while they keep searching for the perfect tokenomics.

On the other hand, the Splinterlands team have been releasing tokens with a lot of sense and all the ecosystem is receiving constant updates. SPL nodes have a big degree of utility, yield and liquidity, hence the price.

I (on a personal level) I also value liquidity an currently I have 5000$ in LEOM (virtual price) locked. I would prefer those 5000$ in HBD for example, and have it always available. (this is where the difference in price will happen, since a buyyer will want a discount to compensate the lack of liquidity).

There was a rising focus on DEFI Tools over extending the Blogging Web&App tools. Which I would not critique publicly because of credibility reasons, but it's interesting for you as a significant stakeholder to point that out.

It's good that you try to not crash the market but sell them packaged otc, my gut tells me that splitting them into 500$ bundles might be a good way. I'd be open to such a pack if that turns out to be a valid solution for you.

View more