Is There a "Lack of Hype Disinterest Curve" in the Cryptosphere?

Stepping out into speculative territory here, for a moment...

What Is the Trend?

In much of legacy investing — meaning primarily investing in stocks, in my personal experience — it seems that you buy some asset you believe to be a "good investment," and as long as the company/investment in question is following through and doing well with whatever it's doing, you end up with a fairly consistent and steady asset price development. It might be up and it might be sideways, but as long as the company keeps "performing," it's rarely down, except in the shorter term.

The Cryptosphere doesn't seem to behave like that.

In most cases, the ongoing activity and/or performance of the underlying blockchain project seems to have relatively little connection to the price of the token associated with that project.

As far as I can see, the Crypto field is far more "hype driven" than "performance driven."

Let's even consider our own LeoFinance community, and the LEO token.

In the time I have been tracking $LEO on a daily basis (since March 2021) the token price has been as high as $1.22, and as low as $0.028.

During the same time period, the LeoFinance team has worked on and released a steady stream of innovation and new "products."

The token price pattern has been very predictable: A new announcement leads to a momentary bounce upwards followed by a gradual decline; a release date announcement leads to a bigger upwards bounce followed by a lat/declining period; an actual product release leads to a substantial rise... "euphoria" for 10-14 days... and then back to the gradual decline.

Here's a screen shot of $LEO's performance over the past 90 days, screen shot from Hive-Engine:

Each up movement represent an announcement (or a challenge, with prizes) or a major product release. The high point before the almost inevitable gradual decline is represented by the June 15th HPUD following the new interface release.

Now we're slowly drifting back down again.

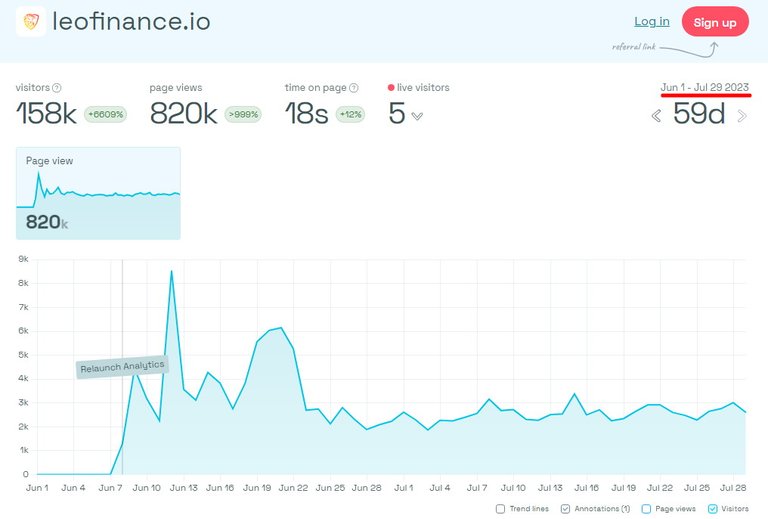

Let's nab a different chart; this one showing LeoFinance site traffic for the past 60 days or so:

Source

It shows lots of activity around the new threads/interface release and subsequent June LPUD... and then everything just falls back to "normal."

So why am I even writing about this?

What I find slightly alarming — and let's keep in mind this doesn't just apply to LeoFinance and $LEO — is that the "steady state" (i.e. no hype or new announcements/products) doesn't seem to be flat, but instead a slow decline.

How to interpret this?

Purely speculation, of course, but I'd say that the Cryptosphere remains far more oriented towards Profit Loyalty than Product/Community Loyalty. Hence this thing I call the "disinterest curve" which sets in the moment the hype dies down.

Sure, there are some of us who are the exception, but we're the exception, rather than the majority.

Hopefully, it will still all pan out in the long run...

=^..^=

Curator Cat; July 30th, 2023