Stake HBD for 20% APR OR stake it on Polycub for 3x More!

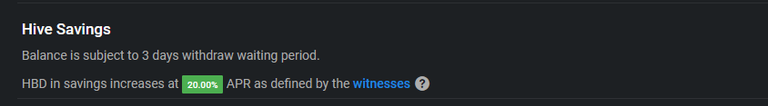

The major news about the Hive ecosystem, and everybody heard about it, is the increase of interest on HBD in savings from 12% to 20%.

As usual, the Leofinance team didn't fail to surprise us with an even more interesting news: The launch of pHBD/USDC Liquidity Pool on polycub!

What is the new stable pair pool? What's it's aim and why we should invest in? Will this pool sustain a higher APR on the long run?

.png)

HBD Saving

Putting HBD into Saving is a safe solution for an investor who wants to put his money to sleep and collect passive income monthly with no risks involved.

- 20% APR sound lacking in the DEFI era but a Big Deal when it comes to Stable Coins. Just to name an example: Curve.fi known for the largest TVL in term of stable coins, offers only 2% APR on stable coins pools (DAI/USDC/USDT Pool)

- Security: staking on Hive chain is safer than staking on another chain. Moreover, in case of a hack, saved HBD can't be withdrawn instantly and your funds will remain safe in case your account is recovered within 3 days of unlocking.

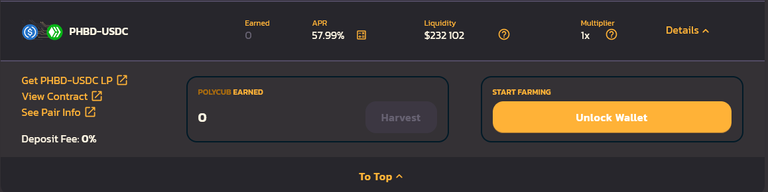

pHBD/USDC: more than just a higher APR

NB: pHBD is the Polygon wrapped version of HBD on hive ecosystem. Here's a guide on how to Wrap HBD to pHBD from Leofinance: How to wrap HBD to pHBD

As the title says, this pool provides 3x more APR than HBD saving, currently on 58% APR with $230,000 in liquidity provided in less than a day from the pool launch!

Regarding the rewards, here are some specifics regarding this pair:

- Rewards are paid in PolyCub, in the likehood of pCub going up, the APR will follow up (assuming liquidity stays the same)

- 50% Penalty if rewards are claimed before 90 days. A fan of hypercompounding? Pay the penalty and you still get more than 20% (29%) but with the price so low ATM, if the price recovers to it's opening price at $1, you'll be 3x your profits turning it into around 180% APR

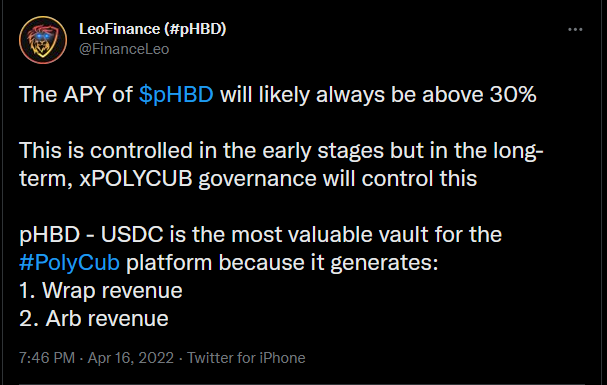

- The team assuring that the APY will be maintained above 30%:

HBD isn't totally stable as it's price can vary from $0.90 to $1.10, with the pool and the influx of an ever growing liquidity:

- HBD will be more stable, the very point of opening a pool is to stabilize the token's price

- More arbitrage opportunities:

- If HBD at $0.90, you can exchange USDC to HBD and vice versa

- Great arbitrage example can be found on Edicted post

- With a tightly $1 pegged USDC and arbitrage, HBD will quickly recover to it's original value that if there is enough liquidity to support it!

- No more Impermanent Loss

Keeping HBD stable is one of the reasons why LeoFinance wants to create a $5,000,000 liquidity Pool

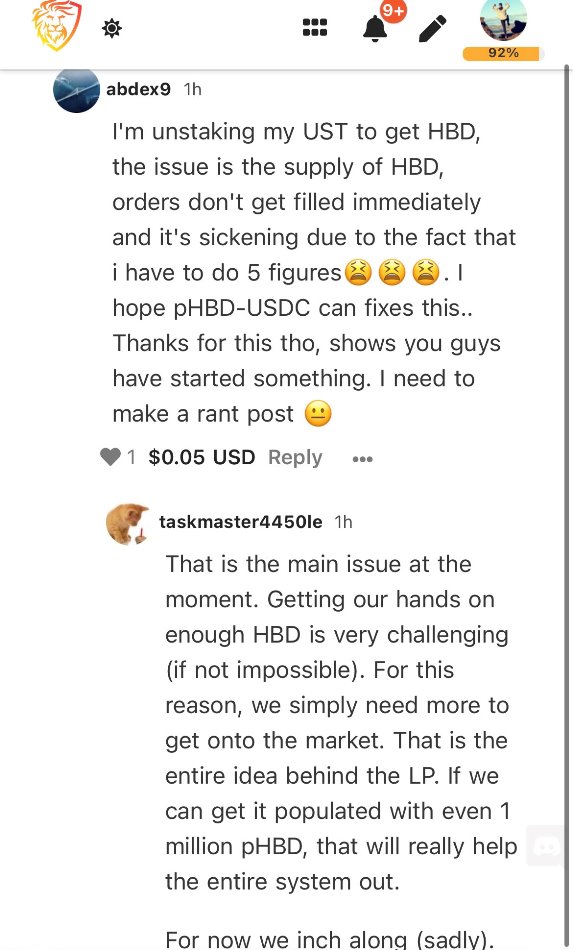

and to solve HBD illiquidity, if we want LeoFinance and Hive to reach outside and DEFI whales, this problem must be solved:

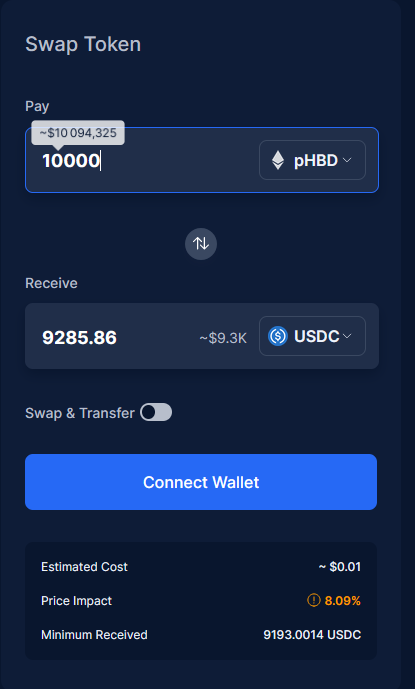

The problem is slippage, whales make $10k worth in a single transaction and will be extremely turned off when facing a 8% slippage:

Conclusion

If everything goes as planned, will PolyCub be a leading platform on Stable Coins? Will HBD gain mass adoption and become a major stable coin like USDC, UST or DAI? Can PolyCub reach $5M in liquidity? Only the future (and our efforts) will answer those questions.

Also, take part in LeoFinance contest by using the #phbd tag for a chance to win 100 HBD!

Posted Using LeoFinance Beta