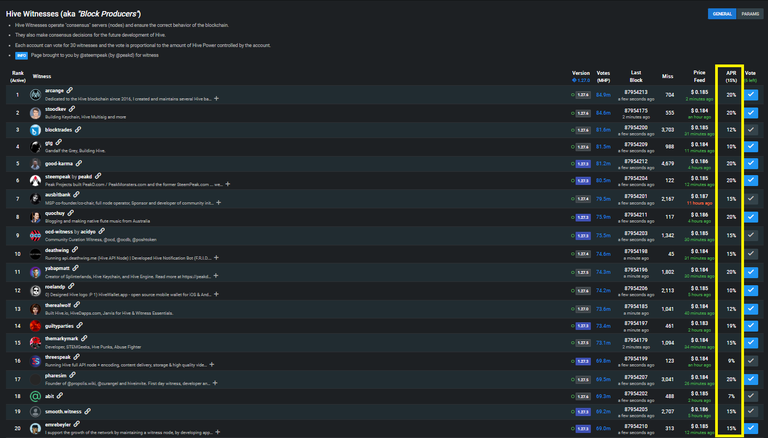

Hive Witnesses - HBD Savings voted to 15% APR

As an active participant in the Hive ecosystem, I've been closely following the developments around the HBD (Hive Backed Dollar) Savings interest rate, especially how the Top 20 witnesses are voting to set the APR (Annual Percentage Rate). As lately I've started preferring more passive revenue streams, HBD is way better than Hive Power were you need to do quite a bit of curation and engagement to get good returns. But recently, there was a significant change on HBD Savings returns, with the APR being adjusted from the previously generous 20% down to 15%. While some may view this reduction as a downside, I still see the 15% APR as a strong incentive to keep my HBD in Savings and enjoy 100% passive returns.

The decision to adjust the HBD APR is not made lightly by the witnesses. These top 20 witnesses, who are essentially the main network's guardians, take into account various factors such as the overall health of the Hive ecosystem, inflation, and the need to ensure sustainable growth. The recent reduction to 15% APR was likely influenced by these considerations, aiming to maintain the long-term stability of Hive while still offering an attractive return to HBD holders. Despite the decrease, a 15% return on a stablecoin like HBD remains highly competitive in the current financial landscape. Traditional savings accounts often offer interest rates below 5%, and even other stablecoin savings platforms rarely come close to matching Hive’s offering. This makes HBD Savings a compelling choice for those looking to earn a reliable passive income on their digital assets.

In my opinion I still think that 15% APR for the HBD held in Savings is a good deal and let me just present you some reasons for that.

Stability of HBD

HBD is pegged with $1 work of Hive, which means its value remains relatively stable compared to other cryptocurrencies. This stability ensured through the HBD Stabilizer which perform trades to recalibrate the value, combined with a 15% APR, offers a low-risk way to grow your investment over time.

Decentralized governance

The APR rate is determined by the community's top witnesses, ensuring that it reflects the broader interest of the Hive ecosystem. This decentralized approach prevents sudden and arbitrary changes, providing more predictability for HBD savers. It also enable Hive user to vote for the witnesses representing their interests. Here I am not referring to just fast high returns, but to keeping a healthier ecosystem on Hive.

Compound interest

Even at 15%, the power of compound interest should not be underestimated. By keeping HBD in Savings, you’re not just earning interest on your initial deposit but also on the interest that accumulates, leading to exponential growth over time. Double this with HBD earning from blogging and commenting and you will see that things start to add up pretty fast.

Fast liquidity

Unlike staking or other forms of investment, HBD in savings can be withdrawn relatively quickly. This liquidity means you can access your funds when needed, without having to worry about lengthy lock-up periods. You only need 3 days to get your hands on liquid HBD and you can trade easily to Hive and than on any other crypto(currency).

While I perceived the reduction from 20% to 15% APR as a loss at first glance, I must recognize that 15% is still a robust return, especially in today’s financial environment. The Top 20 witnesses have likely made this adjustment to safeguard the long-term sustainability of Hive, ensuring that the network remains healthy and that HBD Savings continues to be a safe and rewarding option for investors like me. Pushing Hive price higher, will have a positive impact also on HBD and ensure a healthy symbiosis with mutual growth.

Posted Using InLeo Alpha

Totally agree with you, 15% is still a very good return for a 3-day lock up period for stablecoin.

Which is why I will be converting some of my $Hive to $HBD on the coming bull season or when the Hive’s price go above $1 in preparation for the next cycle of bear season. It’s a good thing that I don’t have to go to exchanges in order to make it happen.

Good to read your insight about this as I know that you have a good judgement on things related to Hive.

15% is still a robust return like you've actually put it.. I think I still prefer Hive and that's because in a bull market cycle you can make a lot of gains on your curation reward which is amazing. Overall Hive is a full of compounding gems

Having a 15% APR on HBD is not bad but the 20% would have been better😁😁

The 15% annual profit is cool but I will rather buy Hive. I’d sell and buy and it will continue like that

Sell when it is high and buy when it is low

That’s the goal