ᴛʜᴇ ᴏᴘᴘᴏʀᴛᴜɴɪsᴛɪᴄ ɴᴀᴛᴜʀᴇ ᴏғ ᴀ ᴛʀᴀᴅᴇʀ.

It felt like just yesterday when I got involved in the crypto space, navigating my way and taking a step at a time. Learning about the basics of crypto felt like the most difficult aspect of it, in terms of understanding specific terminologies used in the crypto space but it is not. I got involved in the crypto space not because I was desperate to make money, I was just a guy that write all kinds of poems I felt comfortable with, it was who I'm. The thing about life is, there are some choices we make without realising where it will lead.

The journey began when I joined hive blog. I thought it was just a regular blog where I can just publish my written poems and get in touch with more readers e.t.c monetisation wasn't my primary focus but it is where it eventually leads. Along the line I realised, if I really want to take advantage of everything hive blockchain have to offer, I must know a thing or two about crypto. So it began, learning technical analysis of the market, candle stick patterns and trading strategies nearly melted my brain

There is one thing every crypto trader needs to learn on his/her own is, how to manage emotions, most especially fear and greed. People say liquidity is what drives the crypto market, well it is fear and greed that fuels it. Controlling emotions while dealing with crypto is not what you can learn from reading books or attending tutorials. The best teacher is experiencing continuous loss as a result of greed or fear, it will get to a time when you have to make two choices, either to give up on crypto trading or learn to control your emotions.

The crypto market is very volatile in nature, which means every decision you make is a risk. For those that trade crypto would know that there are all kinds of trading categories in crypto but as time goes on, a trader becomes more comfortable with trading in a specific category. I only trade futures when the market condition seems to be in the direction of my analysis but you see buying and hodl-ing coins when it is bearish and selling when the market is bullish is what I enjoy doing the most. It is definitely a simple swing trade but this is where every trader learns patience is a virtue.

The most recent risk I took? The major rule before investing in any coin is to do your own research {DYOR}. But then, most crypto trader look up to someone, someone you believe to have a very deep knowledge about crypto compared to yours. It is not just based on words only, the person must have proven to be indeed knowledgeable, so whenever the person says anything about any coin, it is like the voice of an angel.

I also have such a person, we have never met before but I got to know him through the website he created for black market trading of PI. So if you have traded any coin with him, he has a WhatsApp group he created for his customers. In this groups, occasionally he drops names of coins with bullish signs and every time he does this, the coin always performs as expected in a very short time frame. I have benefited from his prediction on PI, ICE, Trump and vine.

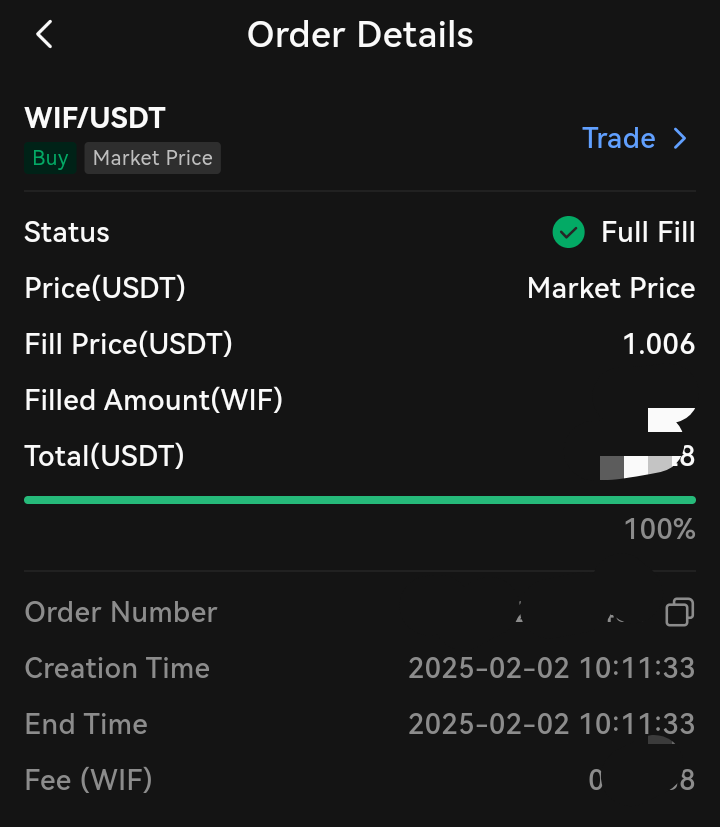

Early February, he dropped another prediction of a coin named wif. Normally, anytime he drops his prediction, I will just note it down and do my own research before taking any actions on the coin but this time I didn't. I just went ahead and purchase the coin.

Another rule is, do not use funds you can't afford to lose or wait till it appreciates to hodl a coin. The money I used to purchase this coin was the money have been saving for awhile to use for somethings immediately I get to Lagos. Since my service year ends was about to end in March and it was still February, I felt I still had more time. This wasn't about just taking risk, It was just recklessness.

For a coin I bought at the rate of $1, for the first 2 weeks, it went as low as $0.9 - $0.8 and it just kept going down till got to around $0.6. To cut the long story short, after I did my passing out parade {P.O.P} in March, I had to save up another funds to use for what I had in mind but it wasn't enough.

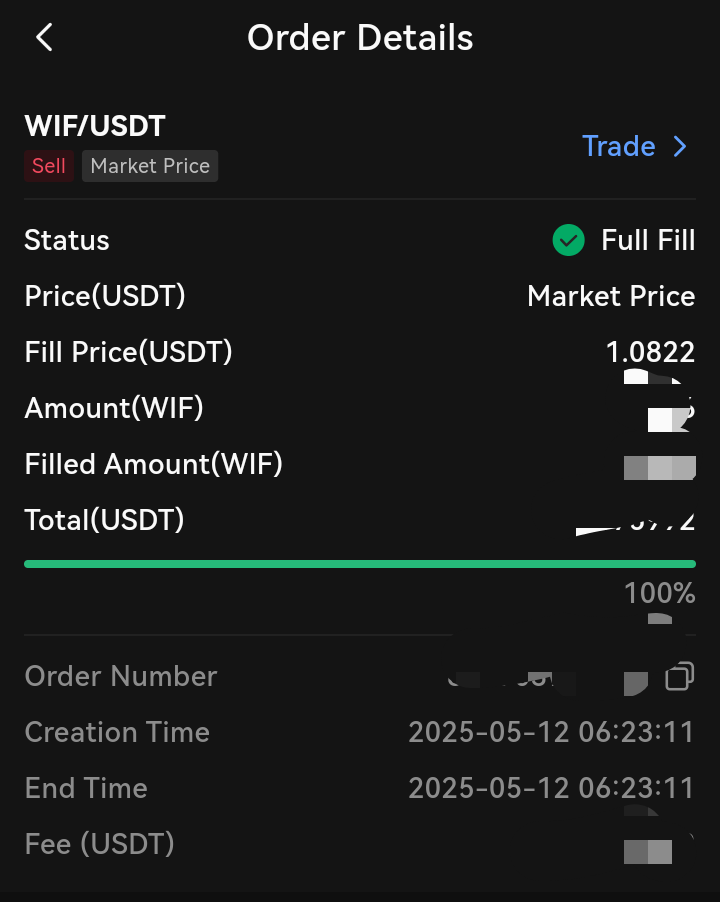

It was until May before the coin was bullish and I didn't wait for it to add more profit to the amount I invested, the moment it reached my initial capital, I sold it immediately. At that point, I was just interested in getting my money back so I could use it for what I wanted.

This write-up was inspired by weekly featured content titled The risk we take in hive learners community.

Cover image - 𝖣𝖾𝗌𝗂𝗀𝗇𝖾𝖽 𝗎𝗌𝗂𝗇𝗀 𝖼𝖺𝗇𝗏𝖺

Image 1 - Source

Image 2 - Image is mine

Image 3 - Image is mine