Day 4

“shocked” is an understatement to what I am actually feeling right now.

‘BRICS! BRICS!! BRICS!!!’ is what I’ve been hearing for the past few weeks now. Like its everywhere; the news, online (Social Media; Facebook, Twitter. Youtube), newspapers, tongues – everywhere. And at first I thought it was too dramatic to be true.

Like; how do you plan in carrying out the creation of a new currency backed by gold – real GOLD?! Hold on, I’ll make my point. But first let’s talk about this BRICS and what it truly means.

BRICS, originally named BRIC (Brazil, Russia, India, China), is an acronym for the world economies of Brazil, Russia, India and China, which in 2010 had included the letter S for South Africa. The original acronym "BRIC" (or "the BRICs") was coined in 2001 by Goldman Sachs economist Jim O'Neill, who created the term to describe fast-growing economies that would collectively dominate the global economy by 2050.

The foreign ministers of the initial four BRIC General states (Brazil, Russia, India, and China) met in New York City in September 2006 at the margins of the General Debate of the UN Assembly, beginning a series of high-level meetings. A full-scale diplomatic meeting was held in Yekaterinburg, Russia, on 16 June 2009.

The BRIC grouping's 1st formal summit, also held in Yekaterinburg, commenced on 16 June 2009,with Luiz Inácio Lula da Silva, Dmitry Medvedev, Manmohan Singh, and Hu Jintao, the respective leaders of Brazil, Russia, India, and China, all attending.The summit's focus was on improving the global economic situation and reforming financial institutions, and discussed how the four countries could better co-operate in the future. There was further discussion of ways that developing countries, such as 3/4 of the BRIC members, could become more involved in global affairs.

In the aftermath of the Yekaterinburg summit, the BRIC nations announced the need for a new global reserve currency, which would have to be "diverse, stable and predictable." Although the statement that was released did not directly criticize the perceived "dominance" of the US dollar – something that Russia had criticized in the past.

Fast forward:

Since South Africa joined the BRIC grouping (now BRICS) in 2010, numerous other countries have expressed interest in joining the bloc, including Argentina and Iran. Both signaled their intent to join BRICS during meetings with senior Chinese officials, the current BRICS chair, over the course of the summer of 2022. Beijing backed Argentina's potential accession following a meeting between Argentine Foreign Minister Santiago Cafiero and Chinese State Councilor and Foreign Minister Wang Yi on the margins of the G20 Summit in Indonesia. China once again reiterated support for Argentina's potential application during a subsequent meeting between Cafiero and Yi on the margins of the 77th UN General Assembly. Likewise, it is understood that Russia, India, and Brazil all support Argentina's application. Iran also submitted an application in June 2022 to Chinese authorities to join the economic association of emerging markets. Relations between Iran, China and Russia have warmed in recent months as all three governments seek new allies against increasing Western opposition. There is no formal application process as such to join BRICS, but any hopeful government must receive unanimous backing from all existing BRICS members—Brazil, Russia, India, China, and South Africa—to receive an invitation.

Ahead of the BRICS summit, South Africa's Foreign Minister Naledi Pandor said that there are 12 countries interested in joining the initiative. Of the 12, she mentioned 7 countries specifically, namely Saudi Arabia, United Arab Emirates, Egypt, Algeria, Argentina, Mexico and Nigeria. On June 14, 2023 Russia’s ambassador to Egypt announced that Egypt had applied to join BRICS.

Pandor also said that membership discussions will be dealt with at the upcoming summit. In spite of South Africa's membership, British politician Jim O'Neill said that new members should have populations of at least 100 million in order to counter the US dollar's dominance.

But why do they want to overthrone the us Dollar?

Well, The United States dollar was established as the world's foremost reserve currency by the Bretton Woods Agreement of 1944. It claimed this status from sterling after the devastation of two world wars and the massive spending of the United Kingdom's gold reserves. Despite all links to gold being severed in 1971, the dollar continues to be the world's foremost reserve currency. Furthermore, the Bretton Woods Agreement also set up the global post-war monetary system by setting up rules, institutions and procedures for conducting international trade and accessing the global capital markets using the US dollar.

The US dollar is widely held by central banks, foreign companies and private individuals worldwide, in the form of eurodollar foreign deposit accounts (not to be confused with the euro), as well as in the form of US$100 notes, an estimated 75% of which are held overseas.[1] The US dollar is predominantly the standard currency unit in which goods are quoted and traded, and with which payments are settled in, in the global commodity markets.[2]The US dollar is also the official currency in several countries and the de facto currency in many others, with Federal Reserve Notes (and, in a few cases, US coins) used in circulation.

The monetary policy of the United States is conducted by the Federal Reserve System, which acts as the nation's central bank.

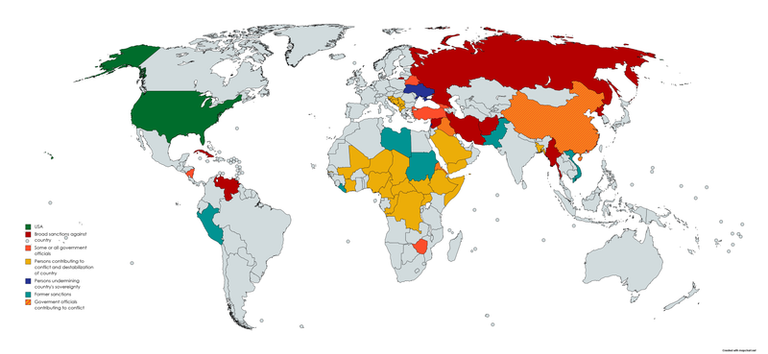

With this much power, the United States is able to exert their influence on the world and suppressed their rivals with sanctions (damaging another country's economy and preventing them from participating in global trades); with Russia topping the list, of course.

Truth be told; after the sever of the US Dollar from Gold's safe haven in 1971, leading to what we know as the Fiat currency, things have been pretty rough on a global scale. Giving birth to Inflation, debt-ceiling crisis , 'Over' taxation and massive unemployment - even in USA too, which has raised concern about the dependability on the US Dollar And that is the motion behind this new Alliance.

In 2014, with $50 billion (around €46 billion) in seed money, the BRICS nations launched the New Development Bank as an alternative to the World Bank and the International Monetary Fund. In addition, they created a liquidity mechanism called the Contingent Reserve Arrangement to support members struggling with payments.

These offers were not only attractive to the BRICS nations themselves, but also to many other developing and emerging economies that had had painful experiences with the IMF's structural adjustment programs and austerity measures. This is why many countries said they might be interested in joining the BRICS group.

The BRICS bank is open to new members. In 2021, Egypt, the United Arab Emirates, Uruguay and Bangladesh took up shares. However, these were much lower than the respective $10 billion investments made by the bank's founding members.

And with that comes the mighty 'BRICs currency' everyone is speculating.

It's all easier said than done. Even after 1941 when The Euro was overthroned by the US Dollar, it took a very, very long time to actually replace it. and the case is not different here for the BRICS. IF (and it's a big 'IF') the BRICS Countries successfully launch this new currency, the USD will still remain dominant for a very, very, VERY looong time since it has been widely implemented and engraved into the global financial system and a lot of countries rely greatly on it.

Moreover, to actually back the currency with Gold will pose a significant challenge. Like; Who is ready to give up their precious local currency for the not-so-sure BRICS currency? How would the BRICS Country actually inter-trade since they are key exporters in a dollar dominated world without disrupting their Economy? Will the BRICS Currency actually be conversable to Gold? If yes, How will they pull it off without hurting themselves greatly? In the long run, the whole gold will have to be kept somewhere. Like; on whose soil will that be? - See, not as easy as ABC when power is in play. (you will only understand a dent of the great risk this poses if you put yourself in their shoes with lives of your people at stake on your shoulders.)

and then again India's External Affairs Minister, S. Jaishankar in a press conference held on Monday, 3rd July, 2023 said that India has no plans for a BRICS currency. He declared a month before the summit that India might back out from creating the new currency.

(face-palm) 'I saw this coming.' seriously, i did see it coming. (LOL) IDIA and CHINA?, No way. Considering their not-so-lovey-dovey past.

I really don't blame them. In fact; I would consider it too risky to share a currency with someone I had clashes with in the past.

To be honest, The differences between this BRICS Country is just too great, laced with dictatorships.

We do not want to conclude yet. for the fact that this strong alliance has awed the word before, There are possibilities they might pull it off again. Well, all fogs will be clear in the upcoming summit on August, 2023 in Johannesburg, South Africa. and surprise, surprise there are going to be over 41 nations present. woah!. A lot, lot of nations are really showing interest.

Then again, let's be honest. There are many advantages which comes with this BRICS Currency. And one thing that stands out greatly is the possibility of economic stability and financial security. This will significantly return power the people.

Reference:

https://en.wikipedia.org/wiki/BRICS

https://guardian.ng/opinion/brics-an-alliance-for-new-world-order/

https://en.wikipedia.org/wiki/History_of_the_United_States_dollar

Congratulations @youngladpaul365! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 800 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: