Zero To Hero Challenge Ep7: First Lucky Break

Patience and persistence paid off finally with a huge score after-hours on BBIG, also known as Vinco Ventures, Inc.

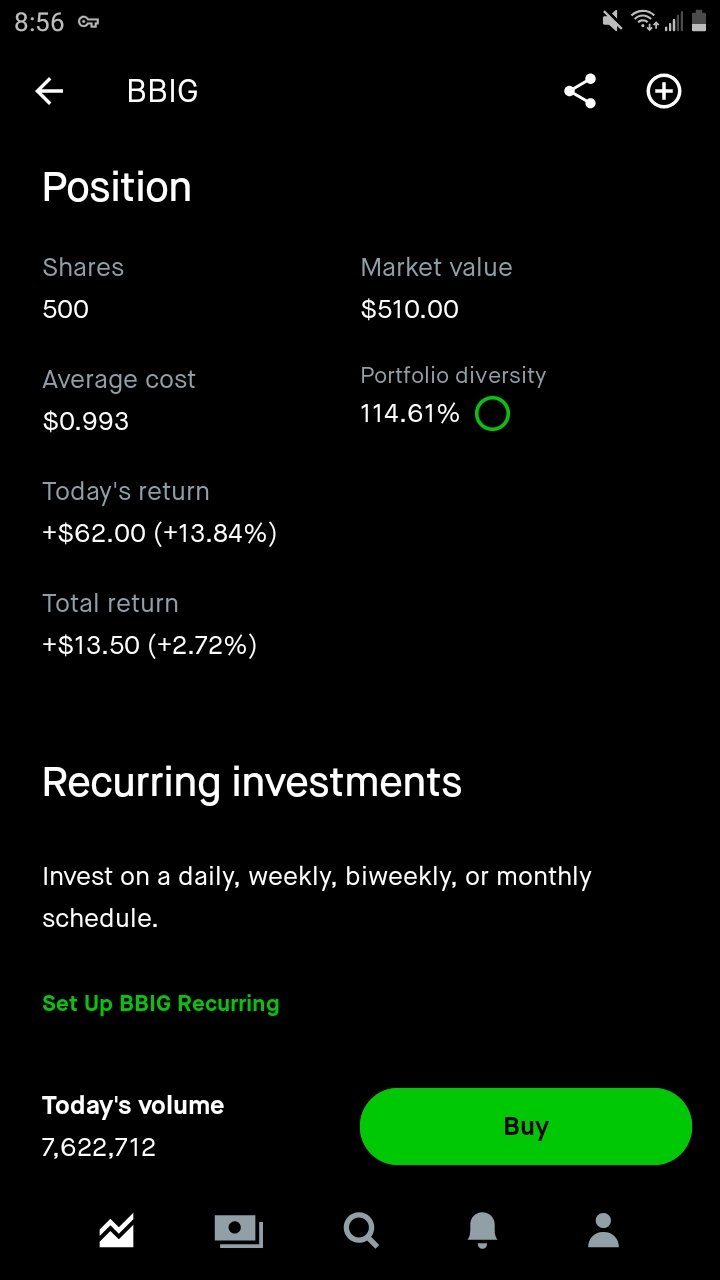

I had decided to consolidate my portfolio down to 500 shares of BBIG since it was showing the most potential profit. Not necessarily from price speculation but from the volatility and options premiums it was generating from covered calls.

A covered call is technically a short position for the equity holder. Meaning if I am holding a stock, but have a neutral to bearish outlook short term I can "write a covered call" contract using my shares as collateral. This allows me to profit while still holding my position in a company that may be trading sideways or down.

This past week I sold off my 100 shares of Bakkt Holdings, which had been tanking since I bought it and was not offering decent premiums for calls. Also AVAX had been dropping or chopping sideways from the time I got it so I cut my losses on both.

Using this cash I loaded up on more shares of BBIG which I had used to write $1 calls. Friday before markets wrapped up I closed out my contracts and rolled them over to a further date.

Current portfolio:

It may seem like a completely random choice of a penny stock, but BBIG was picked specifically for several reasons.

It is optionable and offers weekly contracts

The volatility it high enough to give decent premiums on covered calls

It is a meme stock which is heavily shorted at about 18% short float

It is an innovation and growth stock that pivots when and where necessary. Plus also has revenues

The price is at a sweet spot hovering near the $1 strike price

The reason why it pumped after hours on Friday was the announcement of the change in leadership. The new CEO was instated and restructured the company somewhat. Traders were excited to hear the news after market and bought into low liquidity, so I expect the price to drop back this week.

My $1 covered calls will be worth more Monday at open, which is bad for me since I wanted the price to decay. Being called away at the $1 strike wouldnt be terrible since I would flip my strategy into writing cash covered puts to collect higher premiums on a red day.

The Wheel Strategy is going to play out perfectly with BBIG with this kind of trading action!

@ecosaint Please curate this post sir 😎

https://twitter.com/CannaCollectiv2/status/1574079394913452032

The rewards earned on this comment will go directly to the people sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.